Another competitor to Golem?

Abstract

DeepCloud AI is building an AI driven decentralized cloud computing platform for running decentralized applications (IOT and Web 3.0). They are building their own blockchain with smart contract support which allows users to provide excess computational and storage resources in return for payment in DEEP (their native token). They are looking to

1) Disrupt the traditional cloud computing market dominated by AWS, Google and Azure, going after customers from the IOT sector and AI sector predominately.

2) Provide a fast and scalable blockchain to run Web 3.0 Dapps, something which Bitcoin and Ethereum cannot currently handle due to its low throughput

Who are they?

DeepCloud is owned and administered by DeepCloud Pte Ltd, a company incorporated in Singapore. They have a mix of seasoned cloud computing experts, developers and project managers. Their CEO is Max Rye (California, US).

Technology

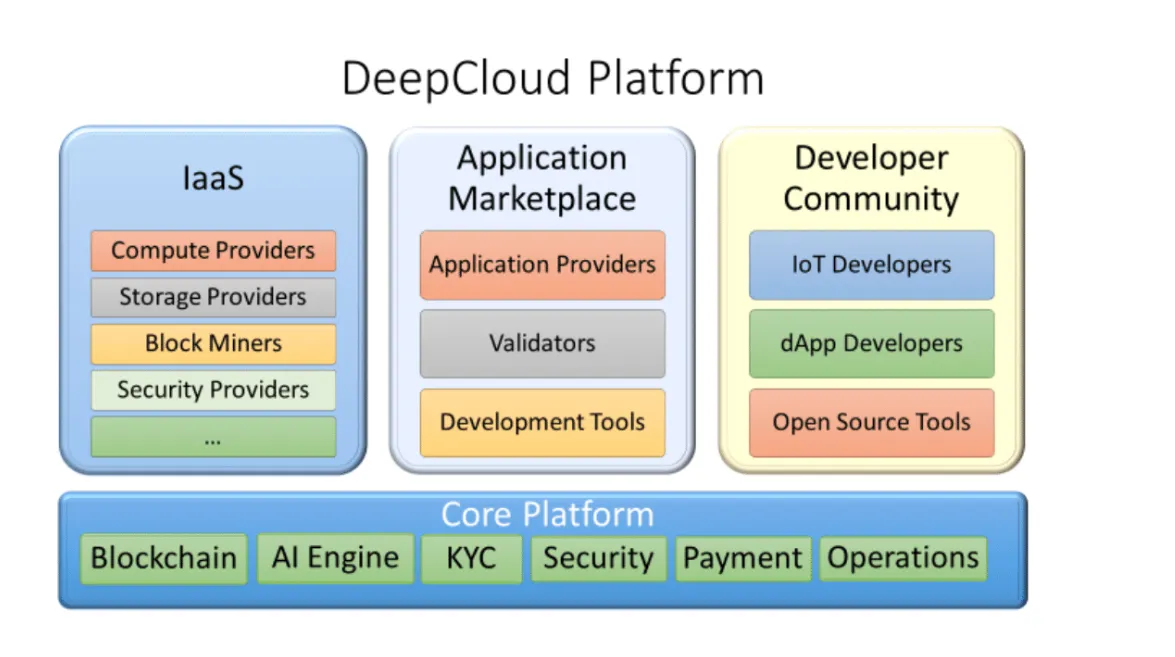

DeepCloud is a decentralized infrastructure as an service (IaaS)

DeepCloud is a decentralized infrastructure as an service (IaaS) which relies on network resource providers (me and you, businesses etc) to provide their computational power and storage resources for financial rewards, An application market place which allows developers to sell reusable components to build Dapps for financial incentives and a developer community providing open source tools for building IOT and Dapp applications for free to entice a strong community of developers (smart move).

So what makes this different from the rest?DeepCloud key differentiating feature is their AI Controller. Simple explanation of this would be it controls resources available from the network resource provider and allocates resources proportionally to consumers to avoid bottlenecks and ensure optimal performance.

Technical deep dive

Development

Currently they are developing their MVP

Road map

Test net launch August 2018

Main net launch Q1 2019(Iaas) with corporate testing

Application marketplace Q1/Q2 2019

Team

Advisors

Partnerships

Token metrics

Hard cap = $15 million

Total supply = fixed 200 million

1 DEEP = $0.25

Sold to investors = 40%

Private sale bonus locked for 3 months

Team tokens = 20% linearly vested over 2 years

Reserve = 12% linearly vested over 2 years

Marketing = 8%

Partnership = 15% For partner sales, it refers to them selling the tokens to enterprises who are coming onboard with them, using DeepCloud AI.

However partner sales will only take place AFTER the main net is up and running.Competition/RiskConclusion