I believe Cryptocurrencies adoption particularly including Bitcoin, Ethereum and other DApps (Decentralized Applications) will soon skyrocket and come to the mainstream of financial markets which go through digital transformation.

I started following and trading cryptocurrencies in 2017 before the Bust. And although I quickly made and subsequently lost alot of money, I learned an insane amount about Digital Transformation, Web 3.0 and Fintech which was invaluable. A new digital economy was being born to challenge traditional financial markets and monetary thinking.

After the crash, many cryptocurrency developers and upstarts got back to working and a few years later, there is an entire emerging cryptocurrency ecosystem emerging with cryptocurrencies, exchanges and mobile wallets.

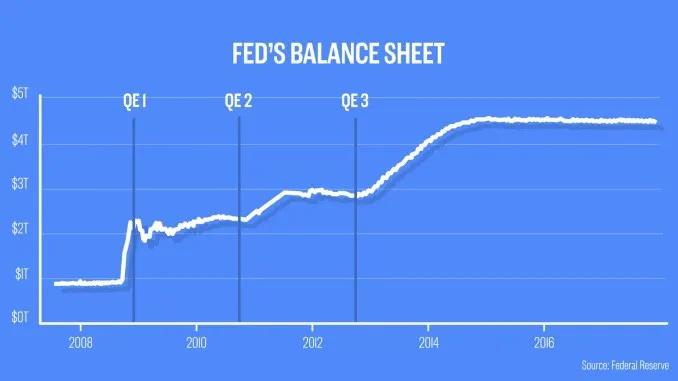

After the Financial Crisis of 2009, there was a lot of skepticism of the traditional banking system that is still inherent today. Many others including me believe that Quantitative Easing (QE) is becoming completely unsustainable.

Now I can’t guarantee which cryptocurrencies will ultimately win and lose. I have a feeling that network effects may prevail over the technology itself. But I think that the reason cryptocurrencies are highly intriguing is because they are not just a challenge to traditional financial markets and banking systems, but they are a challenge to traditional technology companies as well and I think capitalism as a system itself.

Capitalism like QE is unsustainable in it’s current form. It disproportionately rewards a few Market Winners and disproportionately punishes many Losers. The problem is that we are seeing soaring Income Inequality and concentrated monopolistic power in the hands of a few MegaCorporations (Particularly Silicon Valley Tech Goliaths) with Trillion Dollar Valuations as a result. Also a completely unsustainable paradigm.

Therefore cryptocurrencies and the DApps that they are birthing will give way to new paradigms and new revolutions in DeFi (Decentralized Finance), Multi-Stakeholder Capitalism and Sustainable Capitalism where more people and firms can win rather than have a few outsized moguls win massively at the cost of everyone else losing massively.

Right now, capitalism as it stands has and will continue to reward only a few outsized players in the market. We are seeing this with technology conglomerates that suck up rivaling startups as soon as they sprout also. This needs to change!

By challenging the notion of money and value itself and by tokenizing assets, I think more people will be able to partake in the digital economy and the GigTech Economy that is starting to emerge will become much stronger as a result of increasing optionality and microtransactions.