But although the benefits are so obvious, traditional banks are still very hesitant about the concept of digital currency - and not only hesitant, some are even fighting it completely.

And of course this behaviour is no surprise because the decentralized cryptocurrencies would effectively disrupt the banking system as we know it.

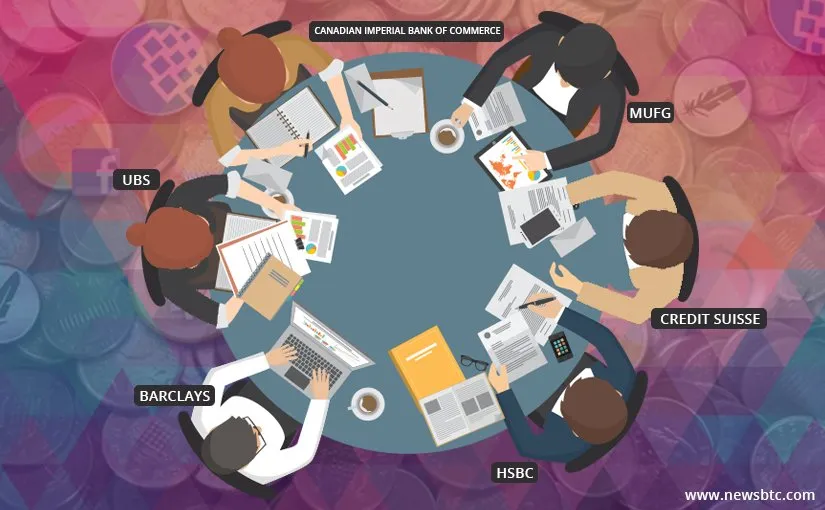

Since then, major banking institutions like Barclays, Deutsche Bank, Credit Suisse, Canadian Imperial Bank of Commerce, Santander, BNY Mellon, HSBC, MUFG, State Street and more have joined.

"Digital cash is a core component of a future financial market fabric based on blockchain technologies. There are several digital cash models being explored across the Street. The Utility Settlement Coin is focussed on facilitating a new model for digital central bank cash. It may well inform the way central banks choose to move things forward. We see it as a stepping stone to a future where central banks issue their own [cryptocurrency] at some point."-Hyder Jaffrey, head of Strategic Investment & FinTech Innovation at UBS Investment Bank

First of all: this will not be a regular cryptocurrency like Bitcoin or Ethereum.

The currency doesn't hold value itself - it's a digital representation of cash, meant to simplify the banking process by allowing transactions to be credited in a matter of minutes/hours, instead of a matter of days.

'So what's the point then?!' you might think. But the point is that the banks need to create this digital token as a tool to integrate blockchain technology into their current system.

This way, they can conduct a wide variety of transactions with each other using collateralized assets on a custom-built blockchain.

Financial groups would be enabled to pay each other, for example to buy bonds and equities, without having to wait for regular money transfers.

The digital tokens would be directly convertible into cash at central banks, therefore reducing the cost and time required for traditional post-trade settlement and clearing.

“The USC is an essential step towards a future financial market on distributed ledger technologies. It provides an exciting opportunity to work closely with other industry thought leaders and the regulatory community to explore the possibilities of this technology.”-Saket Sharma, head of Treasury Services Technology at BNY Mellon

The USC initiative is still in development.

Right now, the project has started the 3rd phase in which they begin to test a formal transfer of ownership and an accurate cash equivalents definition for the transfer. This way, they can imitate what the real process for transactions between members would be like.

During these tests, the collateralized token will be given directly to the asset owner, and does not have to go through the traditional process of banking transactions.

This 3rd phase is expected to go on for about a year.

According to Jaffrey from USB, this could also be the point where the first live collateralized token exchange using the platform launches.

From then on, he could see banks using the utility settlement coin to pay other banks in different currencies and conduct transfers almost instantly.

Before the USC tokens could also be used to settle securities trades, the securities themselves need to be transferred to a system based on blockchain technology as well. Otherwise, the gained benefits of speed and reduced capital requirements will be lost.

The USC is the first steps for banks to finally recognize and implement the power of blockchain technology.

It will first be a means for financial institutions to transfer funds without having to wait several days, and will launch in about 1 year.

We'll see how this project develops and if more banks will join in the future!

© Sirwinchester