First, this method takes a bit of work. Low-marketcap coins are very risky, but the potential rewards are high. This strategy has worked well on multiple coins: PIE, AMS, LINDA, CXT, and CV2.

Research is King

Make sure to read everything published about the coin you are looking at. Go to the ANN page on bitcointalk. See if there is some fundamental event that could drive up the price. A coin swap, news of masternodes, adding to an exchange, etc. I will give you an example of a current one:

CV2 has been around a long time. It is supported by many established members on bitcointalk. Be wary of newbies. The coin count is quite insane, but they are doing a coin swap in a couple weeks. The swap is 2:1. And upcoming masternodes. I found this thread before the swap news and started following it. I joined the cv2 Slack.

News events in crypto have a way of driving price to stupid levels. You can take advantage of them. It is not my intention to hodl any of these coins. I am in and out quickly. Sometimes, I will hodl a few leading up to a swap . . but I do not hodl MN coins. The ROI is way too long when you can literally double or triple your money by flipping the coins in a few days or a week. It might take a year to get ROI on a MN. I'm sure others have different techniques, and that's perfectly fine, but it's not mine.

Look at Litecoin and Doge Coin Pairings

The coin, at the time I bought it, was selling for 1 satoshi in btc on exchanges. But, it could be purchased with LiteCoin for around 40-50 sats on Nova. I didn't market buy the cv2. On Nova, the spreads are quite large. Placing buy orders and waiting for a fill is the way to go. You really have to look at the order book. Check out where the sell walls are. I typically will place my sell 1 satoshi under the wall. Same on the buy side. I will place my order 1 satoshi higher than the wall. At the time, there were buy walls of 50 Litecoin for cv2. On an exchange like Nova, this is a large wall.

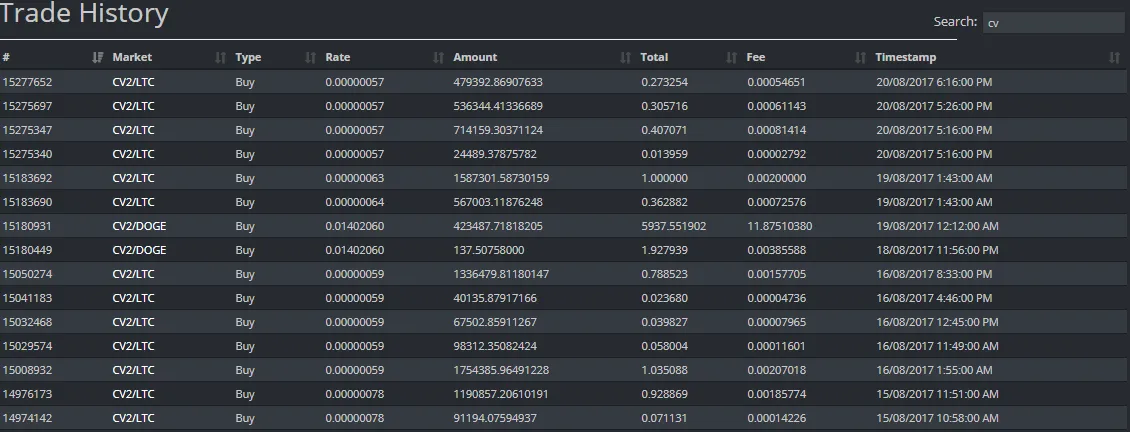

Some of My Trade History

You can see that all of my buys and sells were done with the ltc pairing not the btc pairing. I still have about 15 million cv2 left and have profited about 15 ltc from selling. Cryptopia has delisted cv2 now, so all of my trading will now be done on Nova. Is this risky? Yea, absolutely. But after getting some experience . . you will be able to see which of these coins have good short term profit potential.

In Summary

- Don't be afraid to utilize bitcointalk.org. That is a great resource.

- Follow the coins Twitter page. Turn on notifications so you don't miss the news as soon as it hits.

- Watch for fundamental news driver, such as coinswaps, MN's, adding to exchanges, website release, etc

- Join the Telegram, Discord, or Slack. I personally like Slack the best.

- Analyze the order book.

- Check out the Litecoin pairings.

- Watch for consistent increase in volume.

- Set a sell of half your purchase at double the price. The rest is a free position.

- Is the community active and growing? DAS coin dev abandoned and the community took over the project.

I understand that this isn't the typical way people trade, but it has worked out very well for me. I like this strategy, in addition to my charting techniques for more heavily traded coins on exchanges like Bittrex. Again, make sure you research these coins thoroughly and only risk what you can afford to lose.

Links:

This website shows you ROI on MN coins: http://masternodes.pro/

CV2 ANN for reference: https://bitcointalk.org/index.php?topic=941433.0

I have added hyperlinks to all the coins I flipped recently at the beginning of the article. I do not recommend buying them at this time. But there will always be more coins. Please, do your own research. Any questions? Drop them below and I'll do my best to answer them