One of the major concerns for Cryptocurrency investors nowadays is cashing out their crypto-assets. At times, investors need cash real quick but do not desire to sell their potential crypto and lose their future profits. Not only the profits but with selling Cryptocurrency originates taxes and fees which is a huge pain for them. Nexo has brought a perfect solution to their problems. Declaring to be world’s first crypto-backed loan providing platform, Nexo is a route which helps its users to get instant loans just by holding crypto in their nexo wallets. Without any of the credit checks or additional exchanges and hidden fees, the loan will be permitted.

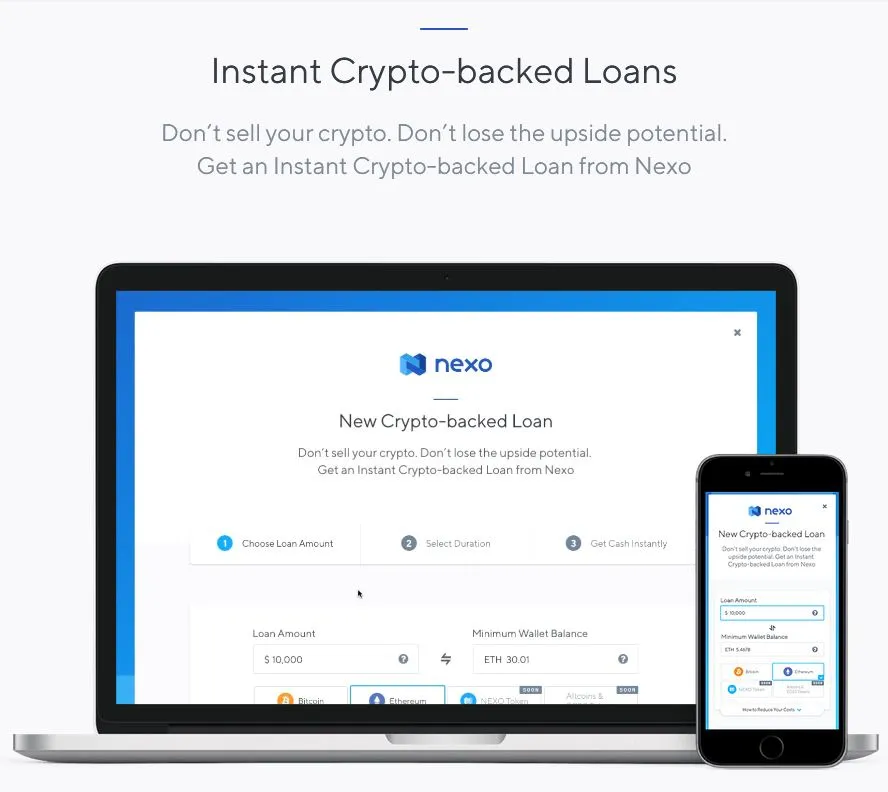

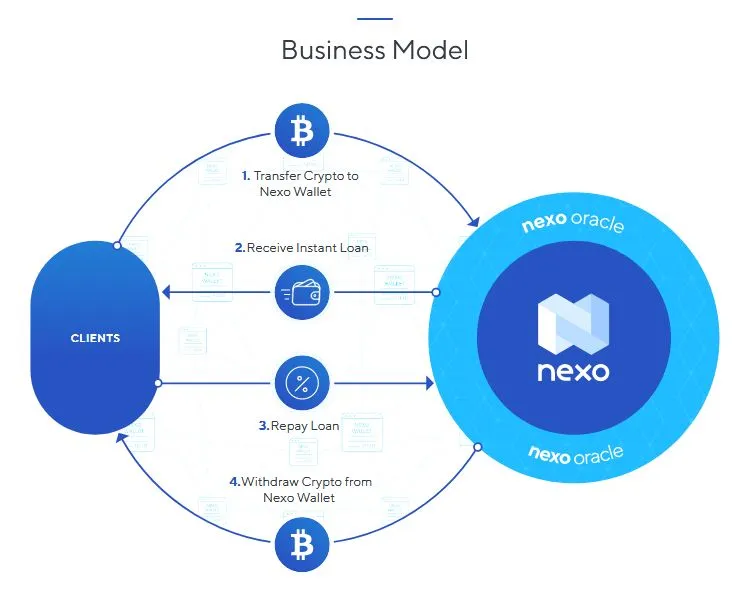

The platform is backed by Credissimo which itself has a good standing for providing online loans to its customers instantly. Co-Founder of Credissimo, Kosta Kantchev is one of the leading managing partners of Nexo. Company also has Michael Arrington, founder of Techcrunch on Board as an advisor. Loan procedures by the company are split into steps which makes sure that client is delivered with all services and the crypto linked to it is fully operative. When the Cryptocurrency is transferred in Nexo wallet, the customer is able to receive loan in fiat currency in any part of the world and at any time. Boundary of loan to be provided is dependent on value of crypto assets invested. None of the digital currency is owned by Nexo even while loan period is live. If the client profits out of his crypto assets based on which loan is received, the surplus value of currency can be withdrawn. In case of repaying the loan, platform provides various alternatives including bank transfers and Fiat to crypto transfers. If the loan is paid back in form of Nexo tokens, user can avail various rebates offered by the company.

The mechanism supported by the company is bonded together with assistance of Nexo Oracle. Oracle joins six main components of the Nexo environment including maintenance of Nexo wallet, analytics of data, time to time notification updates, analytics of repayments, distribution of funds and monitoring of real time assets. It is responsible for the calculation of value that assets hold. In case the value of assets fall during the loan period, Oracle notifies the owner about it and the outstanding amount can be paid through multiple methods. Some of it are adding more crypto to the Nexo wallet or repaying a partial amount. If the user does not respond to the call, Oracle automatically balances the loan amount by selling the assets. Users are notified even with an amount of assets that need to be added via Oracle.

Nexo organized its first successful Airdrop campaign in February and plans on having next one in the last quarter this year. First campaign was accompanied by its token sale a month later. Company plans on launching Nexo Credit card and Mobile wallet by the end of 2018. It also plans on increasing its loan limits throughout the working period. With an experience of 10 years in this crypto-sector, Nexo has entered the mainstream before the birth of most digital lending platforms and with its goals set for next decade, no doubts can be raised with its success rating.