Here is my digital assets portfolio as of July 21st. Any critiques, insights, or comments are greatly appreciated. Steemit is a virtual library of knowledge, and I love interacting with people who are smarter than I am in this field.

Surprise, surprise, a digital assets portfolio with Bitcoin. The Bitcoin I hold is there for the long term. It is not that useful for payments like Dash, Steem, or Litecoin because of the processing speed. Segwit 2X is certainly going to help, but I think most people would agree that the future for Bitcoin looks to be geared towards a digital gold.

I do keep a decent amount of Bitcoin in a Jaxx wallet. This allows me to share it with my friends and family as they jump into the cryptoverse. It is the easiest coin to share with them because of name association.

I've been addding to my position since the price dropped below $200. Anywhere between $150-$175 is a deal to me.

I crossed into baby dolphin territory about a week ago with my Steem Power holdings. If you are reading this, chances are you know the market advantages and technical prowess of the Steemit coin economy so I won't discuss that in this section.

I continue to exchange my SBD for Steem and vice versa when the percentage is favorable (5% or more differential) utilizing tools like Blockfolio, and Changelly. I like the extra 15-20% leverage on post earnings it gives me in 1 weeks time.

Bitshares has recovered nicely after a rough go during the latest Bitcoin dip. The team is beginning to promote their product heavily and has hired a marketing team to garner attention as they roll out their Hero coin campaign. As more and more centralized exchanges experience problems, Openledger will look attractive to traders, but I don't see greater adoption of that platform until the UI is improved.

The upside for bitshares is massive and thus it is one of the main coins I am pouring resources into. I would not be surprised to see $200 bitshares in the next 5 years especially if the Hero campaign has moderate to good exposure.

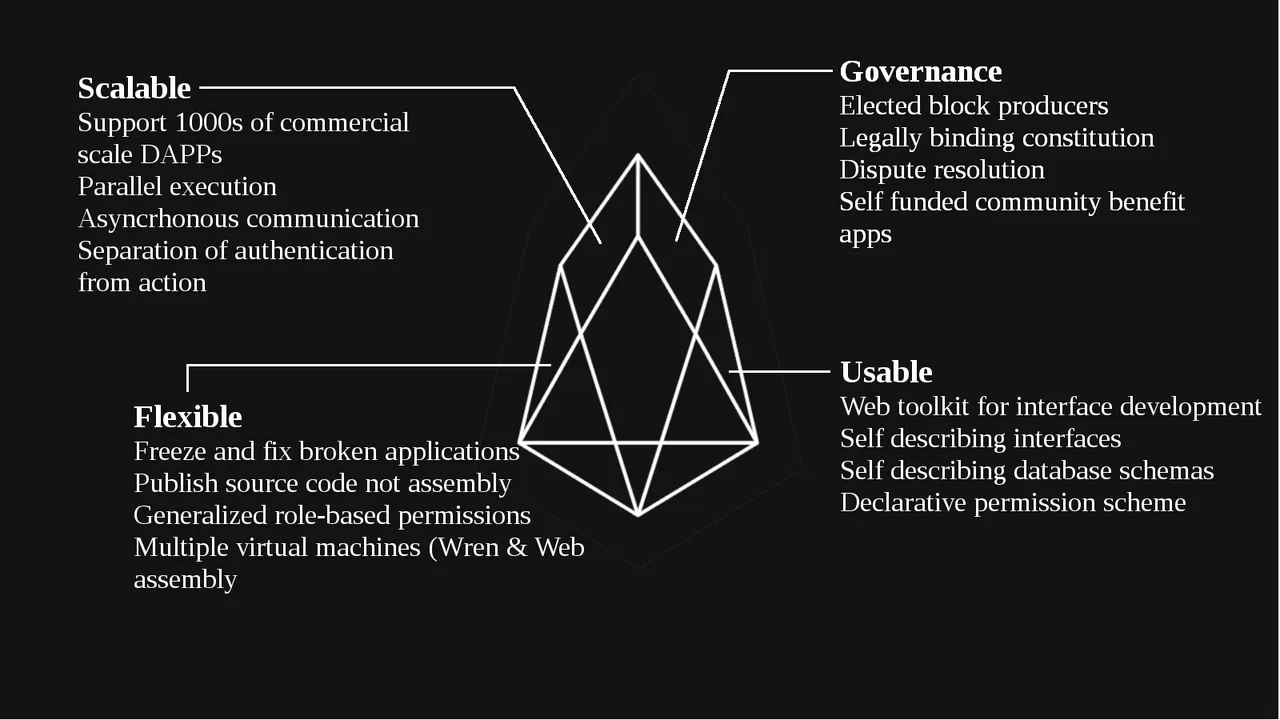

EOS is probably the coin I am most excited about for the moment. When you look at the current state of the Blockchain industry, everyone wants to build a DAO or smart business, and developers have wisely customized their computers to run decentralized applications. The problem is they are having to solve the same problems over and over again, ie account setups, recovery processes. To me, EOS looks to be the Microsoft Windows application for the DOS environment that Blockchain is working in right now. They are enabling the common features that decentralized apps need and shortening the set up time for developers.

While Ethereum is already struggling with scaling issues as ICO's join their network, EOS has the scalability to process millions of transactions per second. Yes, that still boggles my mind as well. That kind of speed will allow DAPP developers to earn profitable returns on their businesses as they utilize the EOS operating system.

Since @nepd is all over Peerplays, I found out it is trading on Openledger within minutes of launch. The dividend aspect of this coin appeals to me just as much as the sports connections. Dividends are a nice segue for the established financial world into the cryptosphere. I am just starting to trade this coin with a goal of 200.

Like Dash, Litecoin is quitely positioning itself to be a payment juggernaut. Founder Charlie Lee is working full time on the project now which bodes well for faster innovations and long-term planning.

If you follow Bix Weir or Clif High at all, you know that they are quite bullish on Litecoin. Clif's predictive lingustics has proven to be quite accurate when it comes to crypto, and he has Litecoin reaching a 4 to 1 ratio with Bitcoin when the latter reaches $15,000 per coin.

Since I am holding EOS, Ethereum has started to take a back seat as I liquidate some profits. The goal for now is to hold 100 coins and watch the mainstream adoption take effect. I believe Ethereum will be around for the long term but I am rooting for EOS to be the industrial grade blockchain that gains the most market share.

Image Sources: 1-2

Video Source: Dash Quarterly Report