I'm a little concerned with the DeFi (Decentralized Finance) craze in the cryptocurrency world right now. A lot of money is sloshing around and when that happens, some people are going to get rekt. Whether it's a founder dumping pre-mined coins or a code "bug" (that, from a scammer's perspective might have been a hidden feature all along) or an adjustment to the contract by a central actor to lock others out, front-run transactions, or change the rules in their favor.

This stuff is hard. At first it all just seems like a shell game, as I've talked about before:

Vigor, mentioned in that post, is providing real value through borrowing and lending which you can see here: https://app.vigor.ai/

Also keep in mind, this isn't exactly new as BitShares has been doing it for quite some time:

That said, the more I look into today's version, the more excited I get. At first it seems crazy to think value is being generated and distributed to participants seemingly out of nowhere. Then I realized just how much money centralized exchanges make every single moment of the day through trading fees providing liquidity. Being able to move from one token to another is a really valuable and people pay millions for that service! It's not just about borrowing and lending, but also providing liquidity.

DeFI services like https://defibox.io are creating very real value by providing a service people actually want.

So now that we have all that value, how do we protect it? Why would people send their hard earned tokens to a contract? Not your keys, not your coins, right? This is certainly true and there is risk with everything, but as I mentioned on this tweet thread, the security of these systems is actually decentralized at the core permissions level of the EOS chain.

For example, check out the permissions on the DeFiBox account:

This means they need 3 other community members besides themselves to update the contract code. The threshold is 23 and their account only has a weight of 20. The other accounts are trusted block producers in the EOS community with skin in the game through the value of their reptuation.

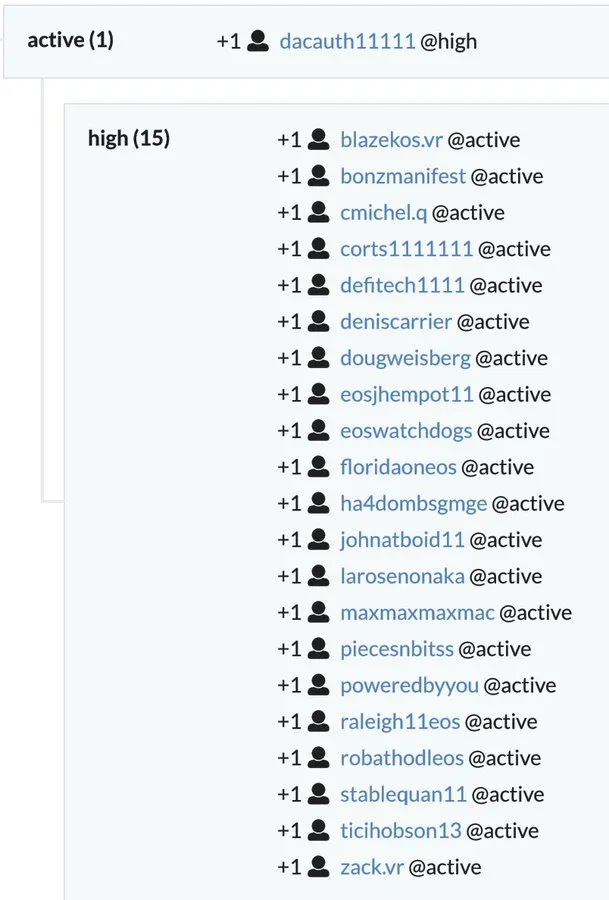

Here's another example with Vigor:

In this case they need 15 of 21 approvals and each custodian only has a weight of 1. This is truly decentralized! This, combined with well-written, professionally audited code, means we have replacements for banking through decentralized systems.

This stuff makes Ethereum based DeFi seem archaic. With ETH gas prices through the roof, the fact that EOS has zero transaction fees is even more important (including 500ms block times). Keep this in mind the next time you chase DeFi gains on some UniSwap clone. Check that the code is actually open source and audited by a reputable company and check that the permissions to update the code are decentralized with a decentralized decision making processes for how changes will be made over time.

There's a ton of risk in cryptocurrency and participating in DeFi only increases that risk. Your safest bet is always to just hold (and buy the dip when you can), but for those who want to put your money to work, please do your research before jumping in.

This is not financial advice, just me sharing some thoughts for educational and entertainment purposes. If you want to dive in deeper, learn about impermanent loss when providing liquidity and what systems like Bancor Version 2 are doing to mitigate it. Maybe someday the Hive internal market between HBD and HIVE will include some of these algorithms so people could easily swap between them. A stable coin is critical for a new economy we control. We need better systems and cryptocurrency can help. We have to get educated and make things easier (which we're working to do via @fioprotocol).

What do you think of all this DeFi stuff? How many of them are actually decentralized?