Hi, there 👋

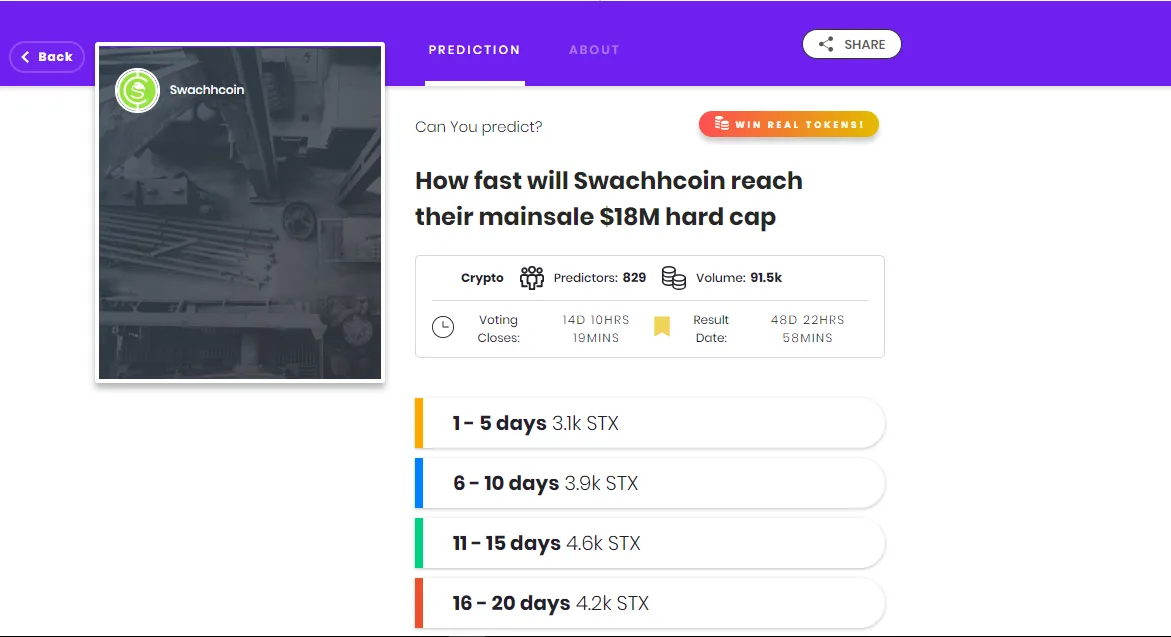

Almost everyday a new project is being launched as an ICO and people are investing in like crazy hoping to catch the holy grail of protocol or platform. All this seems interesting in the sense that people are participating in the developmental stage of the blockchain. But in the midst of all this, there is one major sector in blockchain which we think have gone under the radar of many for quite a time and most of us are kinda missing it out in the shine of Protocol and DAPPs. The sector we are talking about is 🔮Prediction Market on Blockchain, which many of us may not even consider but will be a major sector on the blockchain in the years to come. If you ask us personally, looking at the implications prediction market could have on our society we would say, it is a train not to be missed.😉

If we explain to you in simple terms Prediction markets are exchange trade markets that allow users to purchase and sell shares in the outcome of an event. This type of market is not a new concept at all and technically has been around for centuries. The current market price of the share is an estimate of the likelihood of an event actually occurring. This way it kinda acts like an engine for forecasting the future 🔮.

Prediction market relies on the scientific principle known as the wisdom of the crowd which states as below 👇

In order to tackle the above issues and bring more transparency to the prediction market we may want to use the blockchain. The use of blockchain would also allow any participants from anywhere around the world to create a market asking about anything and receive accurate odds of their occurrence at the fraction of the cost if we compared to centralized markets. How cool is that, isn't it?

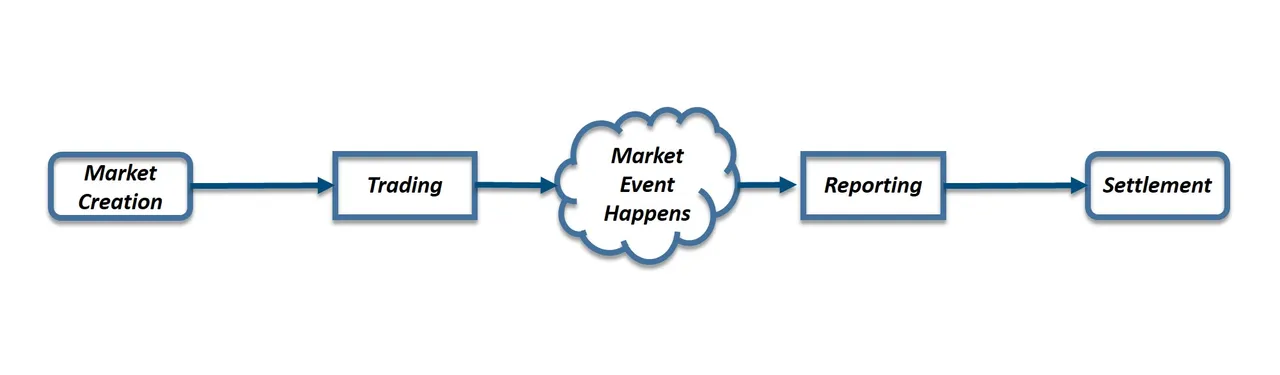

In general the entire Process in an over simplified form can be depicted as the diagram below 👇

Market Creation - This is the very first step of the process. In this step, a market creator creates a market based on some real-world event whose forecast he is interested in by submitting some tokens ( generally the platform's native token eg. REP in case of Augur platform ). The creator also selects the reporter and resolution source for verifying the outcome after the event has occurred. Apart from that the market creator also earns fees from participants who trade the event created by him/her. As soon an event market is created 2 or more outcome tokens are created.

If you are thinking, what are outcomes tokens? then let explain you in brief. Outcomes tokens correspond to the different outcome of an event. Eg. say in the event of a toss of a coin, there are 2 possibilities (Head and Tail) and so 2 outcome tokens will be created for this event, one for Head and the other for Tail.

Trading - In this step participants can start buying or selling the shares of outcome tokens in exchange for some other digital assets like ETH. Every time shares are bought or sold the price of the shares reflects the probability of the outcome.

Reporting - In this step the chosen reporter (who have put their assets on stake to participate as a reporter) report the outcome of the event after it has occurred. If the report's report the event correctly then he/ she is rewarded but if the report does not match with the majority then he loses his stakes.

Market settlement - This is the last step in the life cycle of the market. In this step, the participants settle their shares with the market and if they rightly predicted the outcome they are rewarded other they incur a loss as their shares now become worthless. This type of mechanism encourages only experts to enter and provide prediction which leads to more accuracy of the platform.

..................

Image being able to Google questions about things that haven't happened yet. That's the power of Prediction Markets on the Blockchain.