I don’t like drinking whisky. It tastes like gasoline with a complex vanilla aroma, which does nothing for me. The last time I tried whisky may have been 15-20 years ago. On the not-so-common occasions when I drink alcohol, it’s beer or wine.

As an alternative investment, a well-chosen bottle of whisky has beaten the stock market in recent years. It has beaten real estate in many areas. An investment in good whisky has beaten everything but cryptocurrency. I’ll keep my cryptos, but you can keep your gold. My alternative physical investment is buying bottles of whisky that continue to appreciate over time. Like cryptocurrencies, you can think of it as liquid gold.

Expensive whiskies. Moneyconnexion.com

As with cryptocurrency and as with wine, people in new markets continue to discover good whisky. The price of high quality aged whisky continues to climb as people in Asian countries and elsewhere have discovered it. In the first half of 2017 in the United Kingdom alone, the value of rare bottles of Scotch whisky sold at auction reached $14.34 million (11.18 million British pounds), which was a 94% increase over that same period one year earlier in 2016.

New buyers are discovering more and more undervalued labels, which makes it much like cryptocurrency investing. The good news is that the price has continued to appreciate (across the board, but concentrated in certain areas) and this price movement is much less volatile than cryptocurrencies. As ‘undiscovered’ countries and distilleries become better known, the prices of their products, in particular, can increase dramatically. But as soon as that happens, it becomes harder to find any bargains in that particular space.

Source: Macallan Distillery.

As with cryptocurrency investing, you have to keep an eye on those trends and stay just ahead of them. For steady returns, you can invest in a basket (or a shelf) of good-quality selections that are likely to go higher over time. For the biggest potential rewards, you take a risk on picking an unknown and hoping it will hit the moon as buyers discover its quality. If you fail badly in cryptocurrency, your junkcoin devalues to nothing. If you fail with a whisky, then you have a bottle on your shelf of something that’s presumably good quality. So you’re left with something tangible and you can either drink it, give it as a gift, or sell it.

Let’s take Scotch whiskey and compare it to cryptocurrencies. Bitcoin might be analogous to something like Dewar’s or Chivas Regal, which are mass-produced and have more buyer acceptance than whisky from smaller distilleries. There’s nothing wrong with these whiskies, which have more of a market share because they’ve had it for a longer time. They are blended whiskies produced by some mega-company, so their value might increase, but it’s like buying Coca-Cola rather than some more interesting craft soda. Nothing special and they’ll keep being produced in large quantities.

For Ripple’s doppelganger, I’ll go with Johnnie Walker Red, since it’s produced by Diageo, one of the world’s largest alcoholic beverage companies. Bailey’s, Guinness, and Smirnoff are some of its other brands. I love me some Guinness, but that gets us close enough to being centralized like Ripple, which really isn’t a cryptocurrency any more than Johnnie Walker Red is a true Scotch Whisky. Both are for noobs that don’t know better; they’re for banks (Ripple) or bars and restaurants (Johnnie Walker) that don’t have the imagination to discover some real stuff with better value.

When the price of Ethereum shot up from $9 to $13 per token, I started shaking my head. Months later, it was $1300. There, we might look for parallels to some of the single malt Scotch whiskies such as Dalmore or Macallan. Dalmore is more famous (and some would say greedier), perhaps, because they have released a number of very limited edition bottles such as the 64 and 62. In 2005, several limited editions Dalmores sold for 32,000 British pounds. In 2010, some others came on the market and sold for 100,000 pounds. In 2013, they created and sold another set for 987,000 pounds per bottle. You get the idea.

Dalmore's liquid gold. Source: Dalmore Distillery.

And so, just as Ethereum showed a new use case, that of the cryptocurrency ICO, distilleries like Dalmore firmly established single malt Highland Scotch whisky. It became the height of luxury quality for a whole new set of young, well-to-do buyers and investors.

So where do you put money now if you are looking at cryptocurrencies or whiskies? Maybe you see what Ethereum accomplished with an early-generation technology that has been improved upon since then by others. Maybe you realize that cryptocurrency platform for ICOs is just beginning and that, when there are better alternatives to the expense and overload of Ethereum’s chain, some of those better built ones like EOS and NEO may be in very high demand in the near future.

Macallan whiskies and prices. Source: sgdgmagazine.com

So, too, might whiskies from distilleries like Balvenie, Bowmore, or the aforementioned Macallan. None of these are bargain picks, just as you’ll pay a Top 15 price for any crypto platform like NEO or EOS that has a reasonable chance of succeeding Ethereum. They won’t increase by 1000%, but as the markets continue to mature and buyers look for high quality bottles from respectable distilleries in this proven region, they are safe bets to experience healthy increases in value. For that matter, if you prefer less of an active risk, you can buy shares in a whisky investment fund or ETF, which have shown some good returns so far.

On the other extreme, maybe you take a chance on something new and unproven. The good news is that it’s cheap. The bad news is that there are something like 900 new cryptocurrency projects per day now and you’re trying to pick a winner; you won’t know for a while since development can take many months.

Lots of junk coins out there and market cap doesn't mean a thing. Source: thegadgetflow.com.

It’s like picking a penny stock, the success of which has less to do with its technology than of its marketing team. In the world of Scotch whisky, I’ll use Kilchoman as an example in this category, since it has a recently established (since 2005) distillery on the island of Islay in the Inner Herbrides. It’s not unknown, as it’s already been producing some good Scotch, but buying a case of it is taking more of a risk.

Looking further afield now, Irish whiskey is probably a better bet for investing than Scotch, as it has not been fully discovered yet by the investor set. There are good bargains to be had in Irish whiskey, but no certainties that investors will move to that sphere. When you buy a case of something like that and hold onto it in the hopes that trends will move that direction, it’s somewhat similar to buying cheap on a promising crypto that is not yet firmly established.

To be bold, you need to predict the next frontier. Throngs of connoisseurs and investors have been all over Scotch whisky for a number of years. They moved onto Japanese distilleries, which are fewer in number and probably simpler to pump in price (just like your favorite crypto!). And perhaps Irish whiskey will be the next investment frontier. But let me turn back the clock just a bit to show you what you could have had if you were staying ahead of the curve; the timeline doesn’t quite overlap with cryptocurrencies, but that’s okay.

You could have noticed the cryptocurrency Steem sitting around the # 25 – 30 position on Coinmarketcap (as it is now at the time of this writing). Just like with American bourbon whiskey, it requires one to think a little differently than the obvious Ethereum successors like EOS and NEO. While whisky connoisseurs and investors were busy buying up aged single malt Scotch whiskies, no one was paying much attention to the other world hot spot with a history of high quality production from craft distilleries, which was American bourbon whisky.

Sitting on a gold mine. Source: Blanton's Bourbon.

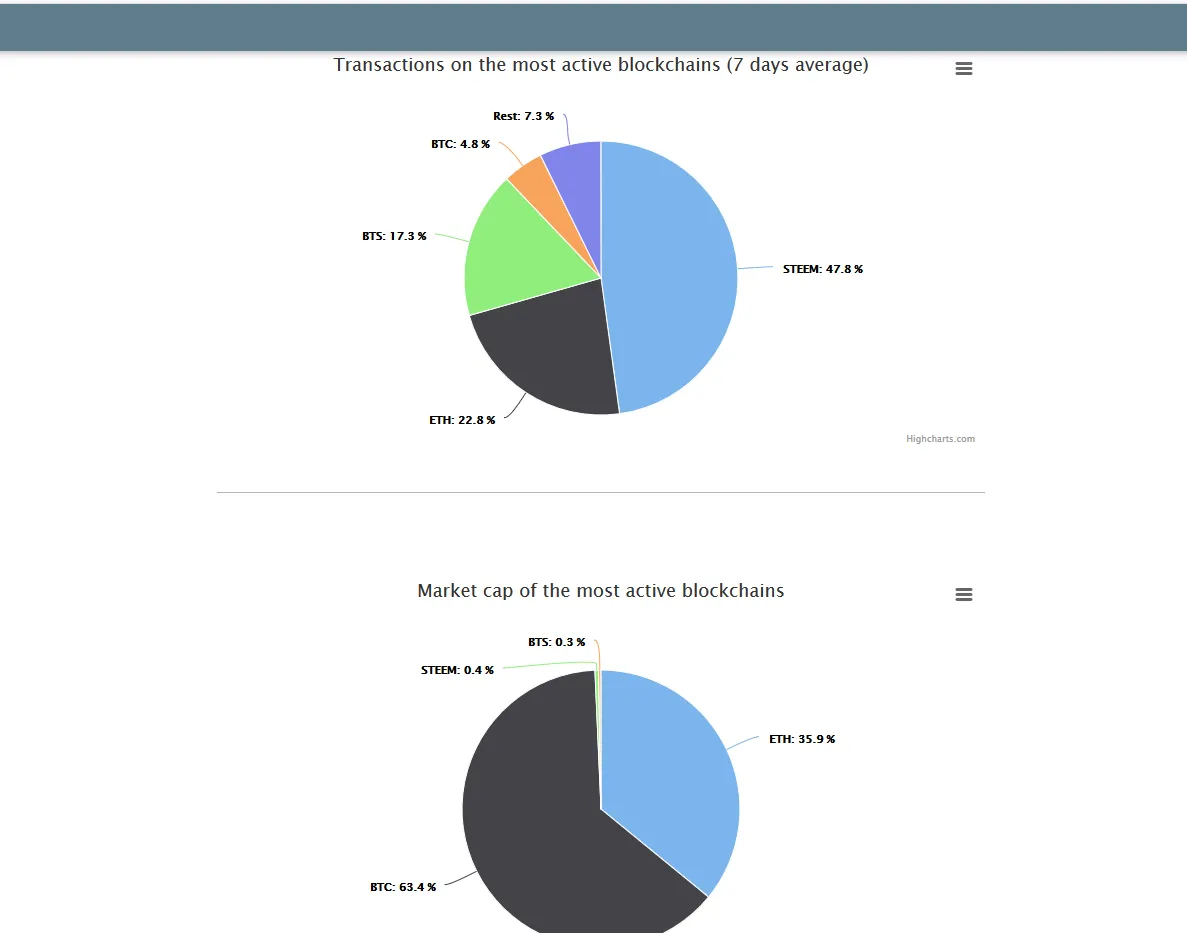

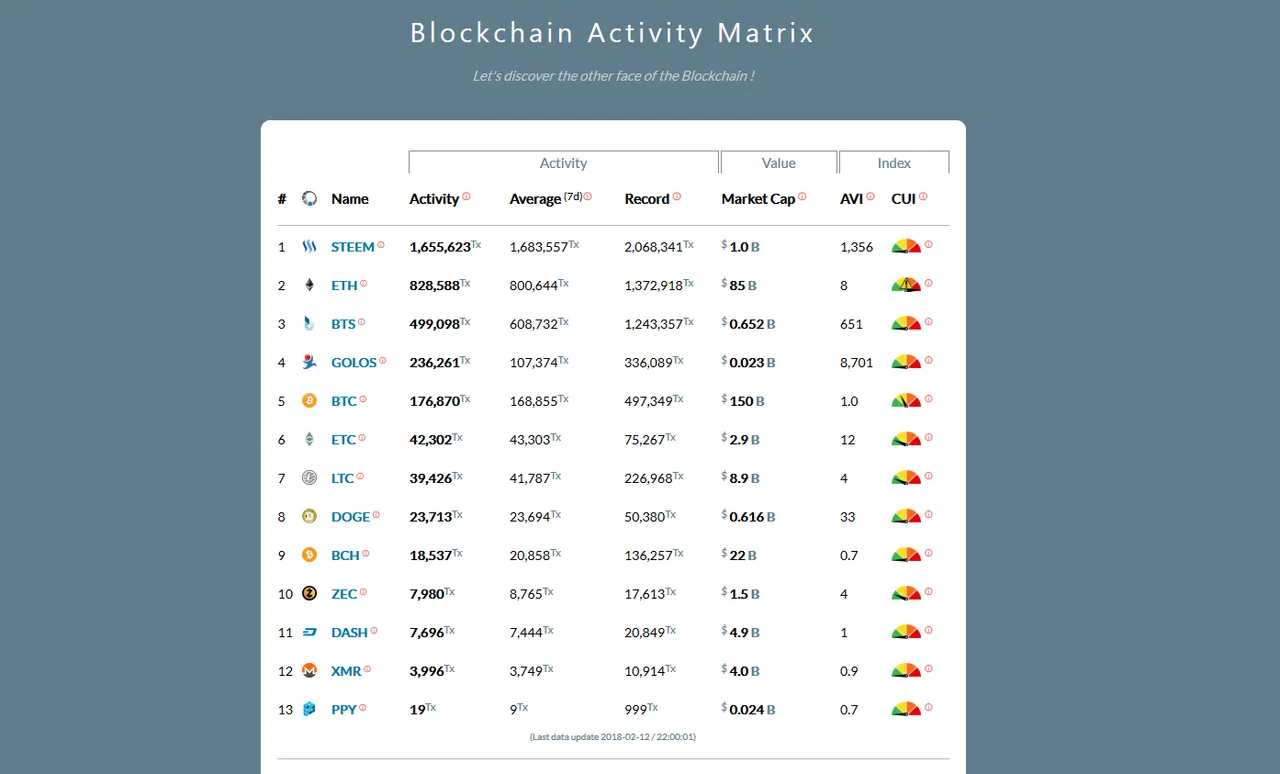

Similarly, with Steem, you are looking at something just as well proven, but just as undervalued as those bourbons were before whiskey investors found them. With Steemit.com and other sites like Busy.org, eSteem, Steepshot, and Dtube, Steem has proven one of the best use cases for cryptocurrency. Over a period of almost two years and with hundreds of thousands of active users, it has shown that good content can be rewarded by user upvotes. Steem is handling nearly half of the transactions in crypto now with a far more robust use case than nearly any cryptocurrency that has a higher market cap (hint: most of them have no real use).

And in the coming months, as Steem’s Smart Media Tokens (SMTs) become available, it is set to tokenize content on many other sites across the Internet. From Reddit to the New York Times to YouTube, almost any content site could monetize its content with a Steem SMT. While platforms like EOS and NEO are busy recruiting partners for ICOs on their platforms, Steem has a different niche: content sites that want to monetize their content.

Anyone interested in SMTs can look at the site buildwithsteem.com to learn more.

Similarly, there’s a distillery that’s been making the highest quality Kentucky bourbon in limited batches for many years. This distillery is called Pappy van Winkle. Because production is limited, you know that buying a bottle of Pappy gives you a stake in a batch that is capped, rare, and in demand. When international buyers and investors looked beyond Scotch and recognized a similar promise in American bourbon whiskey, they discovered Pappy van Winkle’s 23-year old Family Reserve. A bottle of that stuff on the shelf has increased 972.5% since 2010.

Of course, with Steem now processing nearly HALF of all transactions in crypto and with a market cap that represents only 0.4% of the total cryptocurrency market capitalizations, Pappy van Winkle may not be the best parallel. Owning Steem is more like owning shares in all American bourbon whiskey distilleries before investors discovered them. You get the idea.

Steem is now processing nearly HALF of all cryptocurrency transactions with a market cap of just 0.4% of the total cryptocurrency market capitalization. Source: Blocktivity.info. Daily active users from https://steemit.com/steemit/@penguinpablo/weekly-steem-stats-report-february-12-45-899-new-accounts .

Look just outside the hype box for something that’s proven its quality, has an important niche with committed followers, and deserves a bigger audience. If investors are as smart as you are, the hype will shift and they will find it also.

Disclaimer: This post is not intended as investment advice.

Sources:

CNBC: https://www.cnbc.com/2017/08/25/why-alternative-investment-in-rare-whisky-is-booming.html

WealthSimple: https://www.wealthsimple.com/en-us/magazine/whiskey-how-to

Financial Times: https://www.ft.com/content/a066332c-5acb-11e5-9846-de406ccb37f2#ixzz435EGpoKC

Atlas Obscura: https://www.atlasobscura.com/articles/worlds-first-whiskey-investment-fund-sweden

Dalmore Distillery: https://en.wikipedia.org/wiki/Dalmore_distillery

Maxim: https://www.maxim.com/entertainment/10-single-malt-scotches-2017-6

Coinmarketcap: https://coinmarketcap.com/

Build with Steem: https://buildwithsteem.com/