The crypto markets kept on mounting a recuperation this week, ignoring fears of a conceivable respite in front of the Chinese New Year occasion.

At the end of the seven-day session, the aggregate estimation of all digital currencies is being accounted for at $471 billion by information source CoinMarketCap, up 22.65 percent from $384 billion seen last Friday. Amid this period, the market capitalization was up 39 percent from the Feb. 6 low of $276 billion.

However, while features might be commanded by bitcoin's turn above $10,000 once more, the world's first cryptographic money isn't really the greatest gainer of the week.

Notwithstanding its 13.54 percent ascend in costs, other extensive top digital currencies (characterized as those with over $1 billion in showcase top), are maybe most adding to what could wind up being a recuperation from the market's powerless January execution.

Top entertainers

Litecoin

Week after week execution: +33.58 percent

Untouched high: $375.29

Shutting cost on Feb. 9: $163.95

Current market cost: $219

Rank according to advertise capitalization: 5

Litecoin (LTC) has been on a tear this week, however the reason might involve point of view.

While some refered to its two-year high against bitcoin (something that possible impelled some purchasing among conferred bulls), there was likewise the bait of free supports from a coming fork.

As profiled by CoinDesk, the declaration of an unaffiliated venture called "litecoin money" has supported interest for the digital currency, however specialists say those anticipating that the subsequent tokens should be as significant as bitcoin money might need to reconsider.

Ethereum Exemplary

Week by week execution: +26.92 percent

Unsurpassed high: $47

Shutting cost on Feb. 9: $26

Current market cost: $33

Rank according to advertise capitalization: 15

The cost of And so on, the local cash of the ethereum exemplary blockchain, likewise bounced for the current week, to $35.90 on Bitfinex - its most elevated amount since Jan. 21.

Likewise important is that And so on has increased 135 percent from Feb. 6 low of $14.00. All things considered, And so on has bounty space to broaden increases, as indicated by the relative quality list (RSI).

VeChain

Week after week Execution: +24.89 percent

Untouched high: $9.45

Shutting cost on Feb. 9: $4.66

Current market cost: $5.82

Rank according to showcase capitalization: 17

January's best performing money had another great run for the current week.

The VEN/BTC conversion standard saw a bull hail breakout this week, recommending holders of the digital money will probably have a decent time sooner rather than later.

The blockchain will be rebranding VeChain (VEN) into VeChain Thor (VET/THOR) this month, and that appears to have created enthusiasm for the digital money.

Base entertainers

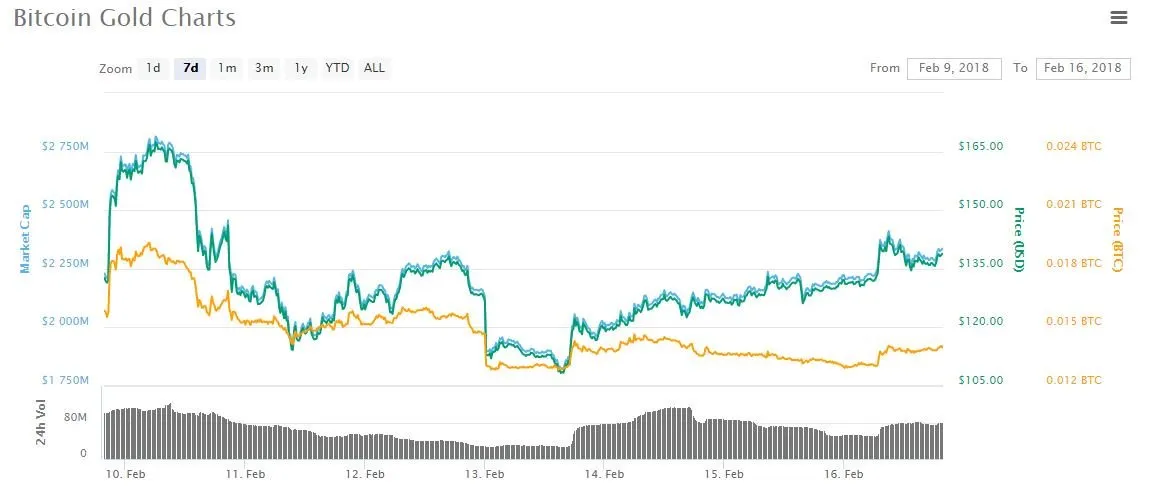

Bitcoin Gold

Week by week Execution: - 17.88 percent

Record-breaking high: $484.7

Shutting cost on Feb. 9: $166.09

Current market cost: $136.4

Rank according to showcase capitalization: 19

There's no affection lost between financial specialist group and bitcoin gold, as the digital money made through a fork of bitcoin in mid-November fell 40 percent in January.

Costs energized (potentially due to oversold conditions) 12.98 percent a week ago, yet the additions were transient.

As of composing, bitcoin gold is down 70 percent from the record highs above $480.

NEM

Week after week Execution: - 5.64 percent

Untouched high: $2.09

Shutting cost on Feb. 9: $0.590486

Current market cost: $0.557157

Rank according to advertise capitalization: 12

NEM's XEM token wasn't possessed the capacity to put on a decent demonstrate this week, however it' up 40 percent from the Feb. 6 low of $0.397361.

On Hitbtc, XEM is debilitating to dip under $0.51327 - 78.6 percent Fibonacci retracement of the rally from the July low to January high. Such a move could open entryways for a further decrease in costs.

Nano (Raiblocks)

Week after week execution: - 3.98 percent

Unequaled high: $34.43

Shutting cost on Feb. 9: $10.05

Current market cost: $9.65

Rank according to showcase capitalization: 24

Raiblocks, rebranded as Nano this year, fell in the midst of the more extensive market recuperation. The drop shows its Binance posting has gone unnoticed.