Controllers around the globe are endeavoring to smother the prevalence of digital forms of money. Be that as it may, each time they do this, the crypto world skips back greater and more grounded than any time in recent memory.

Jesse Powell, author and Chief of Kraken, trusts that the market capitalization of digital forms of money will dramatically increase from the present levels and come to the $1 trillion USD breakthrough before the year's over.

Be that as it may, as the market develops, it will begin separating between digital forms of money. Swell's Chief, Brad Garlinghouse trusts that numerous will sink to zero since they don't have anything beneficial to offer.

Be that as it may, is there no real way to stop the pump and dump that is the standard component in a portion of the littler coins?

Lon Wong, leader of NEM, trusts that not a lot should be possible about value control until the point when the market develops.

As brokers, we generally keep a defensive stop misfortune to shield our capital and on the grounds that the crypto markets are open every minute of every day, the dangers of a hole down opening are nonexistent. Along these lines, our perusers require not stress regardless of whether costs of a couple of cryptographic forms of money drop to zero.

How about we check whether we find bullish setups on any of the main 9 coins.

BTC/USD

Bitcoin is endeavoring to expand its recuperation, however it is probably going to confront a solid protection from the present levels to the $9,500 check, from the downtrend line, the 20-day EMA and the flat protection.

There are two potential outcomes – the cost will either separate out or abandon here. Do we know for beyond any doubt which one will happen? No. In this way, we ought to be prepared for the two situations.

On the off chance that the BTC/USD combine breaks out of $9,500 and maintains for four hours, it affirms a breakout and we suggest long positions with a stop loss of $7,800. Our first target is a move to the 50-day SMA, which as of now is at about $11,780. Over this, we may see a move to the protection line of the diving channel.

Furthermore, if the value diverts down from $9,500 and breaks underneath $7,800, a slide to $7,000 is likely.

As we don't have an affirmation of a base yet, it is prescribed to keep the position estimate just 50 percent of normal.

ETH/USD

Ethereum framed an inside day candle design yesterday, February 13. Today, it is endeavoring to expand the pullback.

The recuperation looks solid as the ETH/USD match has not surrendered much ground since bottoming out on February 6, at $565.54.

Overhead protection is at the 20-day EMA at $902 and the 50-day SMA at $985, though bolster is at $775.

Forceful merchants can start long positions once the cost supports above $902 for four hours. The positions ought to be shut at the 50-day SMA, if the digital currency battles to break out of it, else a move to the protection line of the sliding channel, around the $1,050 to $1,100 stamp may happen.

BCH/USD

Since the vast range proceed onward February 8, Bitcoin Trade has been exchanging out a little range. As most digital currencies are hinting at a recuperation, we anticipate that this solidification will resolve on the upside.

The BCH/USD combine has a past filled with vertical energizes. Along these lines, we need to take this exchange. As of now, the cost has broken out of the downtrend line and the sliding channel, yet it is yet to clear the 20-day EMA, which is at $1,351.

We suggest a purchase at $1,400. The up move can stretch out to the 50-day SMA at $1,860 and from that point to $2,000. The stop misfortune for the exchange can be kept at $1,100.

XRP/USD

Swell has been exchanging a tight range for as far back as four days. It is at present confronting protection at the 20-day EMA. On the off chance that it breaks out of this, we anticipate that it will pick up force.

Accordingly, we had suggested a long position on the XRP/USD match in our past investigation.

We emphasize our purchase call on the grounds that with the greater part of the digital forms of money climbing, we trust that a rally to $1.50 and from that point to $1.74 is conceivable. Notwithstanding, we prescribe purchasing simply after the computerized cash maintains above $1.08 levels for four hours.

Our bullish view will be negated if the computerized money separates of $0.86.

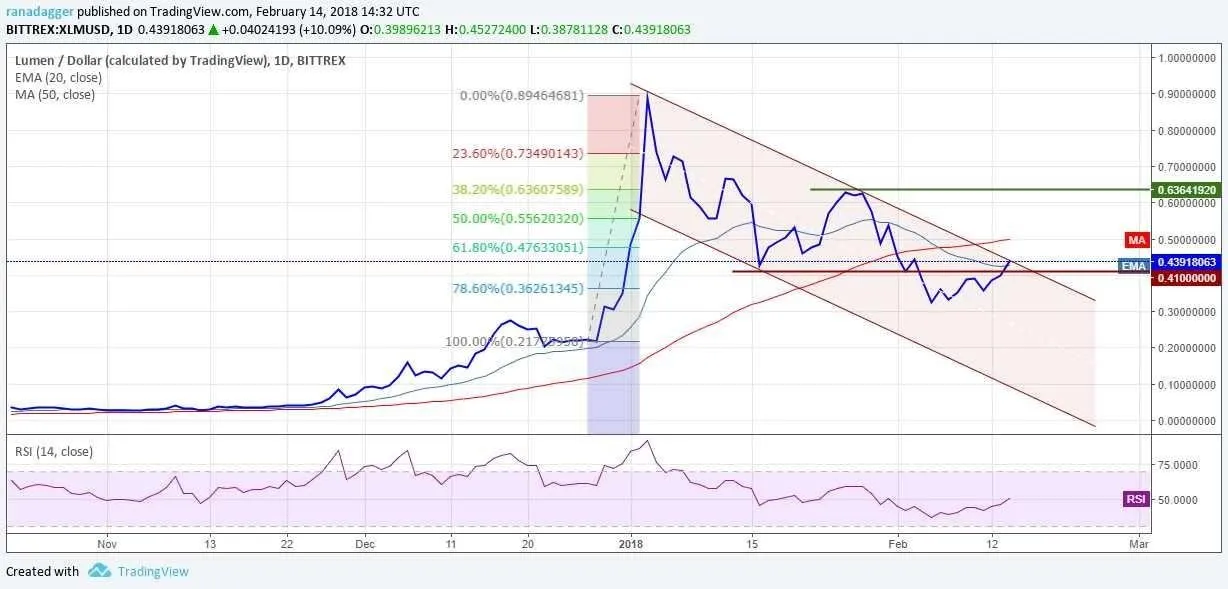

XLM/USD

Stellar is additionally hinting at an adjustment in slant. It has broken out of the overhead protection at $0.41 and is at present at the protection line of the plummeting channel.

Once the cost maintains over the channel, it will flag an adjustment in slant and a move to $0.63 is likely. We prescribe a long position on the XLM/USD match at $0.45 with a stop misfortune at $0.30 on day by day shutting premise (according to UTC time period).

We take note of that the protection at the 50-day SMA ought to be observed deliberately. In the event that the bulls battle to breakout of this, it is judicious to close the position.

LTC/USD

We have been bullish on Litecoin for as long as few days. We had suggested a long position in it in our past examination. Our exchange activated today and our perusers would have entered long positions at $180. The break out above $175 has finished a transient twofold base, which has a base target goal of $242.

The LTC/USD match has cleared the prompt overhead protection from the 50-day SMA; it is a bullish sign.

The cost should now rally to $242 and from that point to $307 levels. We had beforehand suggested a stop loss of $130. In any case, post the breakout, the stops ought to be raised to $140.

We would be wise to continue trailing the stops higher in light of the fact that we would prefer not to hold tight to the exchange in the event that it falls back beneath $175.

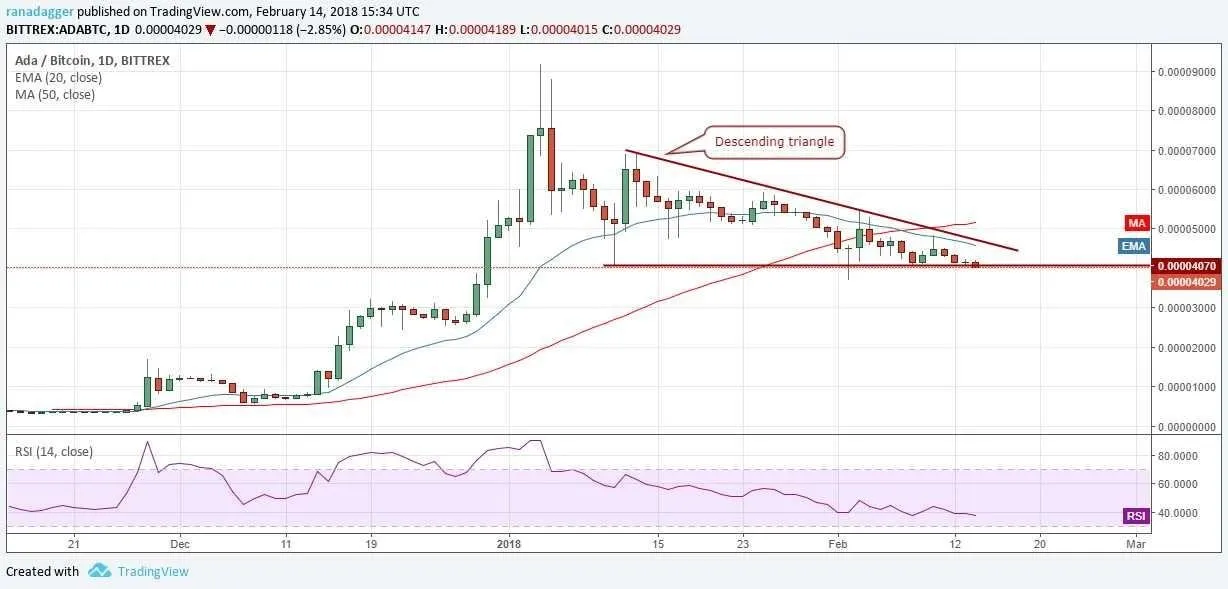

ADA/BTC

Cardano isn't finding any purchasers. It is looking powerless and a breakdown from the bearish diving triangle design looks conceivable.

The cost has separated of the basic help of 0.00004070. Unless the bulls rapidly move over this level, there may be a tumble to the following help level of 0.0000246.

Our bearish view on the ADA/BTC match will be refuted if the value breaks out of the downtrend line of the dropping triangle.

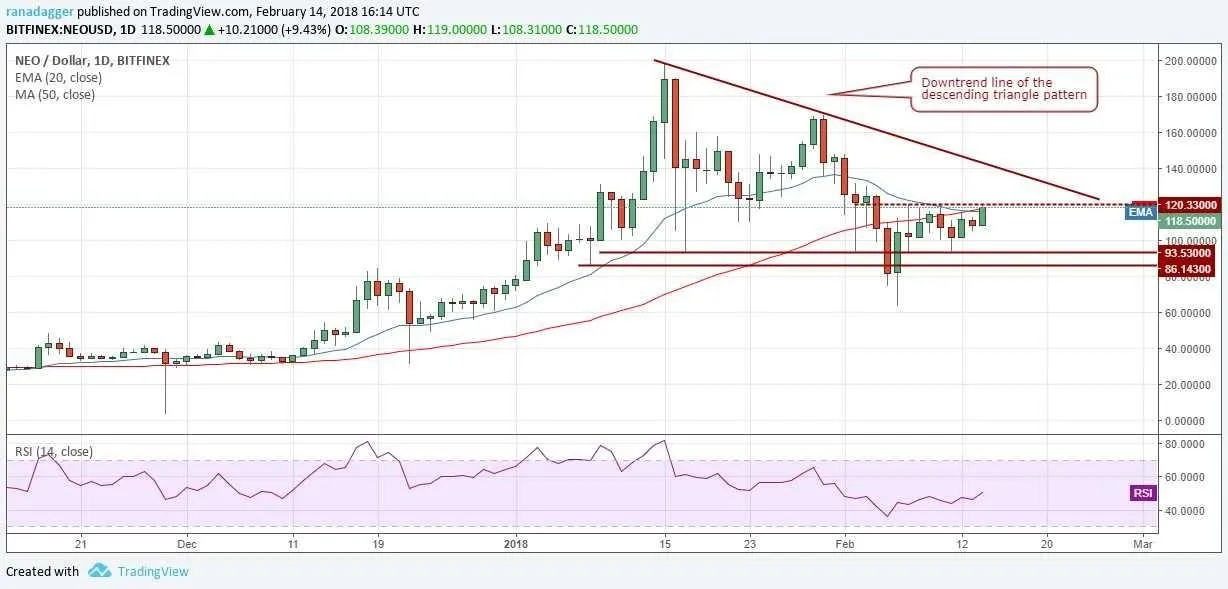

NEO/USD

NEO has achieved the basic overhead protection of $120 from where it has returned on three past events. Once the digital money breaks out of this level, we may see a move towards the downtrend line of the plummeting triangle design.

We hold our proposal for a purchase call given on the NEO/USD combine in our past examination. Merchants can go long once the cost maintains above $121 for four hours. The stop misfortune can be kept at $100. Target objective is a rally to $140.

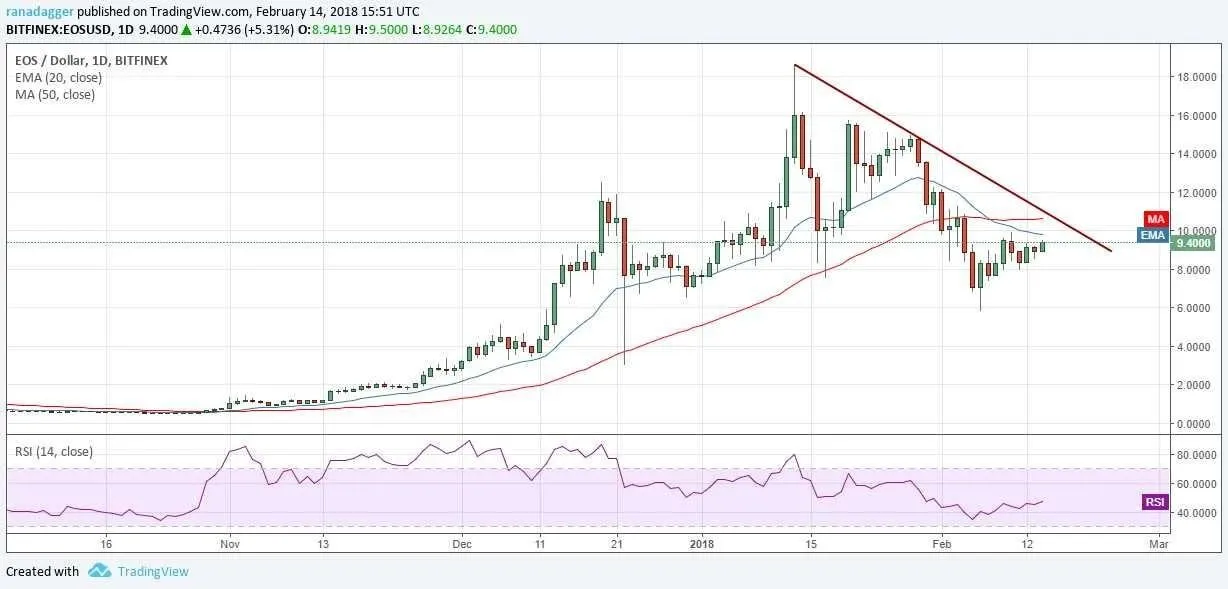

EOS/USD

EOS has achieved a basic protection zone of $9.8 to $10.6. In this zone, it has protection from the 20-day EMA, the 50-day SMA and the downtrend line.

The EOS/USD match will change its pattern once it breaks out of the downtrend line. Until at that point, we can't prescribe any solid exchanges it.