While a purchase and hold methodology has ended up being useful to the early Bitcoin financial specialists, the late contestants have utilized the wild value swings to add to their Bitcoin numbers. We can see from the graphs in this article the whales have expanded their Bitcoin possessions over the recent years.

In these value swings, a normal merchant purchases at the highs and offers at the lows. We have been endeavoring to enable our perusers to stay away from this entanglement. From the beginning through this fall, we have avoided recommending forceful long positions. Be that as it may, do we locate a fleeting base at this point?

How about we see.

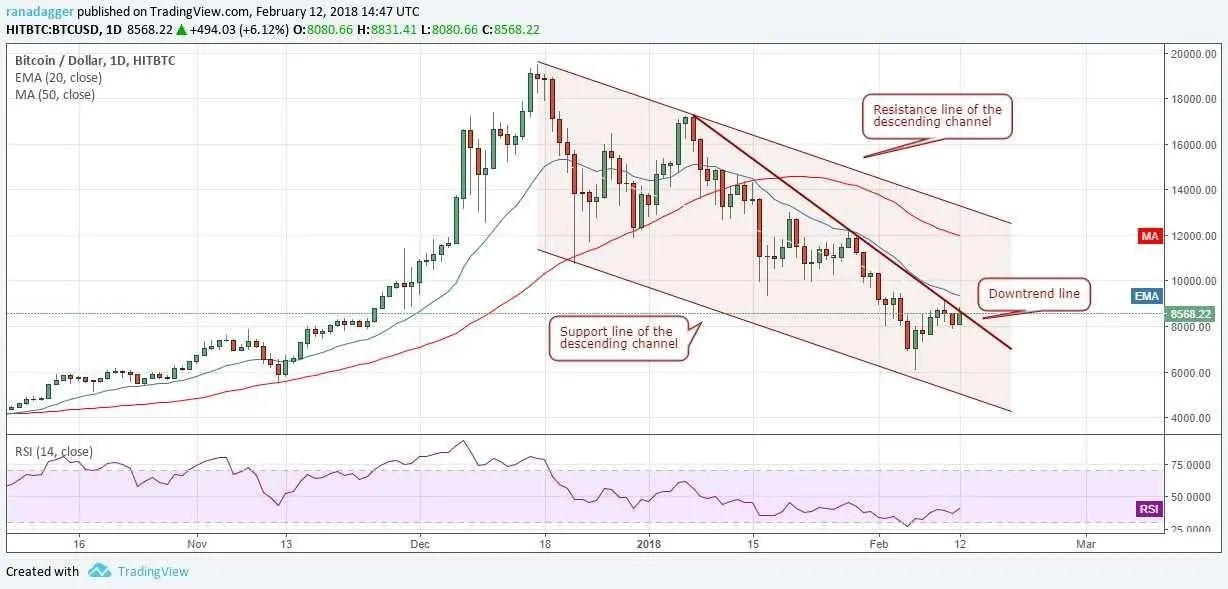

BTC/USD

We were anticipating that Bitcoin should retest the lows in the wake of diverting down from the trendline. In any case, the bears couldn't break beneath the $8,000 stamp.

On the off chance that they prevail with regards to breaking out of this zone, a brisk rally to $12,000 may happen, where it will again confront protection from the 50-day SMA and the protection line of the plunging channel.

Hence, the dealers can sit tight for a breakout above $9,500 to purchase. The stop misfortune for the exchange ought to be kept at $7,800. The benefit objective is a move to $12,000.

Also, consider the possibility that the BTC/USD match neglects to break out of $9,500 and turns down indeed.

For this situation, brokers should pause, fighting the temptation to purchase at bring down levels in light of the fact that if the value breaks underneath $7,800, we may see it go down to the $7,000 point.

We generally give both the bullish and bearish situations in light of the fact that the dealers ought to know about what's in store in the two cases. It is reckless to give levels just in one unforeseen development.

ETH/USD

Following a two-day plunge on Feb. 10 and Feb. 11, Ethereum is likewise endeavoring to climb.

On the drawback, $775 has solid help.

It doesn't give great hazard to remunerate proportion, so we are not recommending an exchange on it.

BCH/USD

Bitcoin Trade has been exchanging out a little range for as long as four days. It may resolve with a vast range day, either to the upside or drawback.

Be that as it may, if the BCH/USD combine breaks out of the downtrend line and the 20-day EMA, it will flag a fleeting base, which can be exchanged.

In this manner, we think a long position at $1,400 with a stop loss of $1,100 may be a brilliant move. The benefit target of this exchange is a rally to the $1,925 - $2,000 levels.

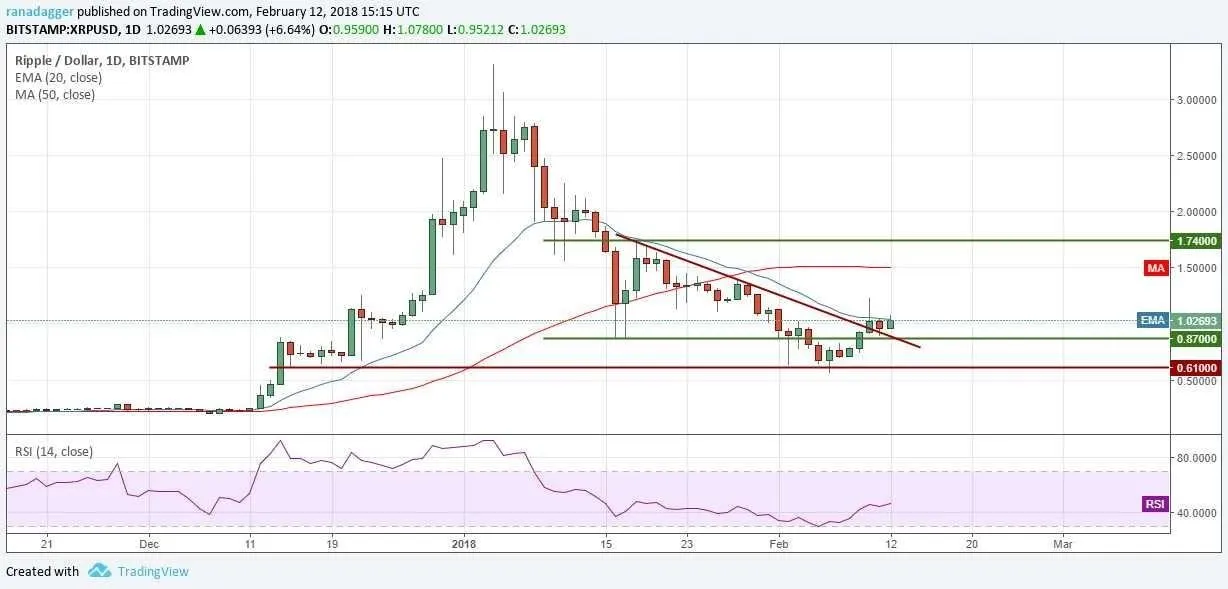

XRP/USD

We had expounded on the likelihood of a fleeting base in Swell. We have been sitting tight for a rally over the 20-day EMA to start long positions.

The merchants can keep a stop misfortune at the $0.86 levels, which is simply beneath the past help. Swell has been an underperformer in the present fall, henceforth, please exchange with just 50 percent of the typical position measure.

XLM/USD

Stellar has proceeded with its range-headed exchanging activity for as far back as few days. Endeavors to rally have been confronting solid protection at the $0.41 levels.

On the drawback, if the cryptographic money separates of $0.3 on an end premise (according to UTC), it can slide to the help line of the channel.

In this way, we would do well to sit tight for a breakout of the channel to start any long positions.

LTC/USD

We had exhorted on long positions in Litecoin if the breakout manages over the $175 levels. Be that as it may, for as far back as three days, the bulls have been attempting to clear the 20-day EMA jump.

We trust this is a critical improvement. That is we repeat our proposal to start long positions if the LTC/USD combine holds over the $178 levels for four hours.

The stop misfortune for the exchange can be kept at $130.

On the upside, $200 is protection. On the off chance that the digital currency battles at this level, we should close the position or fix the stops.

Once the bulls break out of $200, we may see a rally to $307.

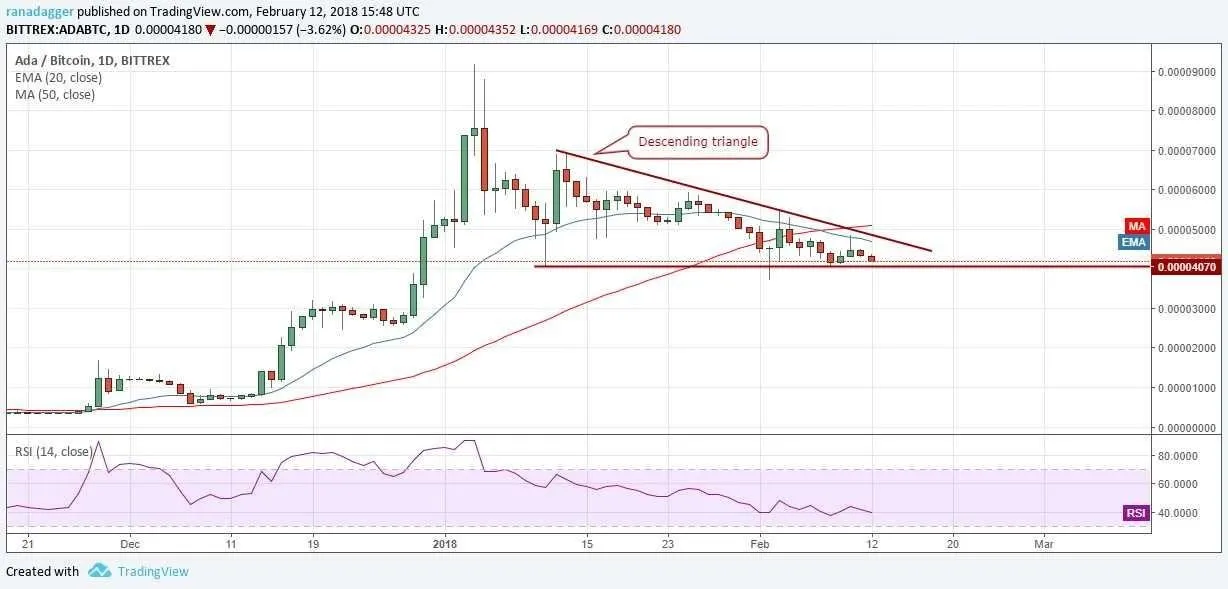

ADA/BTC

Cardano keeps on exchanging inside the diving triangle design. This is a bearish setup, and a breakdown of the help at 0.00004070 will finish the example.

Disappointment of a bearish example is a bullish sign. In this manner, if the digital money turns up and breaks out of the 20-day EMA, the downtrend line of the sliding channel and the 50-day SMA, we have to invert our position and go long.

Until at that point, consider avoiding it.

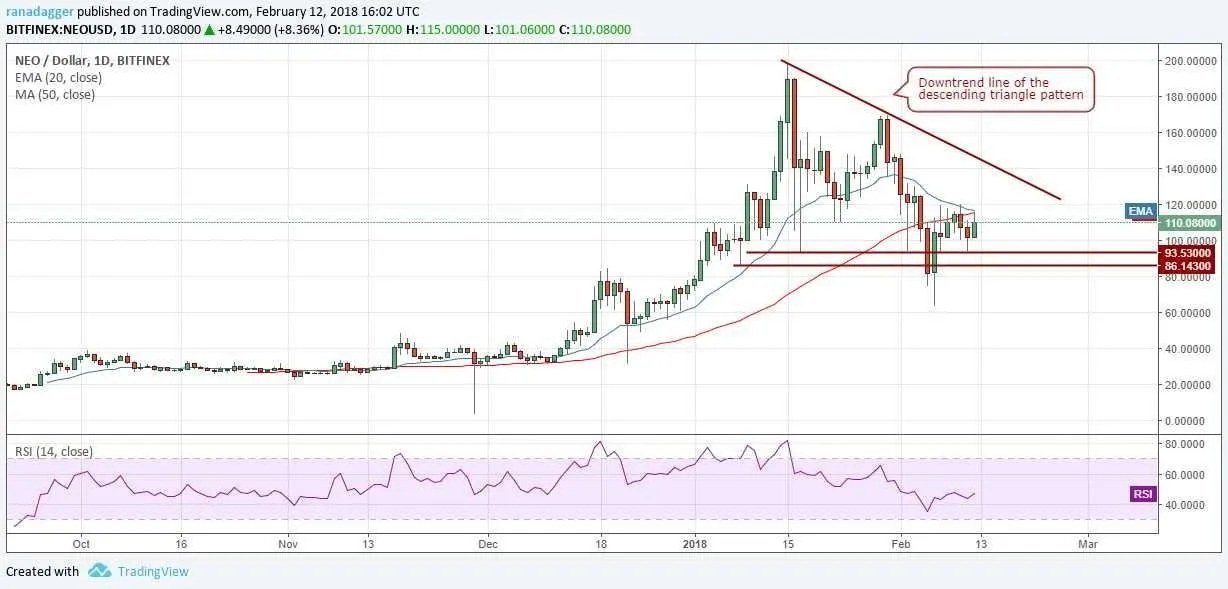

NEO/USD

In our past examination, we had suggested a long position on NEO above $120 levels with a stop loss of $100.

On the drawback, $93.53 again went about as solid help yesterday, Feb. 11.

The NEO/USD match is stuck in a scope of $93.5 on the drawback and $120 on the upside. A breakout of this range is probably going to move the digital currency towards the downtrend line of the dropping triangle.

Merchants can purchase on a breakout above $121 if the cost supports the level for no less than four hours. The underlying stop misfortune ought to be kept at $93, which ought to be trailed higher if the bulls neglect to break out of the triangle downtrend line.

However, in the event that, if the NEO diverts down from the moving midpoints and separates of the $93.53 levels, it may wind up plainly negative.

EOS/USD

We had prescribed a fleeting exchange on EOS at $9 with an objective target of $10 and $12. The digital money came near our objective as it bested out at $9.9 on Feb. 10. Expectation the merchants trailed their stops higher and finished off the exchange at any rate at breakeven costs.

On the drawback, the $7.5 to $6.5 levels will go about as solid help.

We don't locate any dependable exchange setups at the present levels, so no proposals on new exchanges with the EOS/USD match.