A standout amongst the most mainstream images on the digital money subreddit r/bitcoin, ostensibly the biggest grouping of Bitcoin aficionados on the web, portrays a toon coin riding a crazy ride with its hands waving fiercely noticeable all around. On days when Bitcoin is soaring in value, the image demonstrates the rollercoaster propelling straight upward, and on days when Bitcoin is smashing, the entertaining copy is seen bearing a close vertical drop. This double sided web joke has went with about each critical development in Bitcoin's cost as of late and is telling in its recurrence.

Bitcoin is interminably rising and falling in relative fiat esteem, and even mid 2018's 70% decay isn't amazing, nor is it the most noticeably awful at any point saw. Indeed, even in the midst of the most sickening of freefalls, experienced dealers remain undaunted, on the grounds that they've been there previously. Holding through a remedy is just about a transitional experience for cryptographic money financial specialists, and the gathering's most experienced veterans have persevered through more than what's coming to them throughout the years.

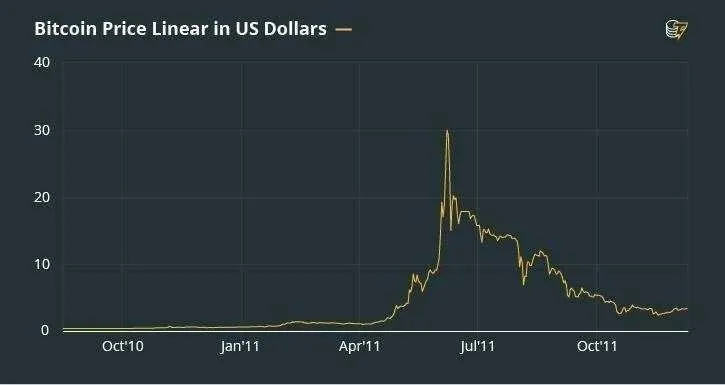

June 2011

The beginning of Bitcoin were its 'Wild West'— a period when not very many trades made exchanging conceivable, and when just the most daring of the overcome dunked their toes in. Such conditions were everything except kept from liquidity, thus when the cost started ascending from around $0.95, the slope and the accompanying drop were a portion of the steepest at any point recorded.

In mid-June 2011, Bitcoin's cost come to as high as $32.00 per coin before tumbling the distance to $2.00 in November. At a 94% decay, this crash still keeps up its record and holds agonizing recollections for early speculators, however the individuals who held solid are presently checking their fortunate stars (and wads of bills). Thinking back, this twofold digit record-breaking high appears to be low, yet one must recollect that there was a small amount of the present volume and intrigue. Bitcoin was as yet a to a great extent obscure idea test, and nobody had any sign of its future. As needs be, $32 appeared like a decent time to take benefit, particularly after such a spike, and different dealers started to cede.

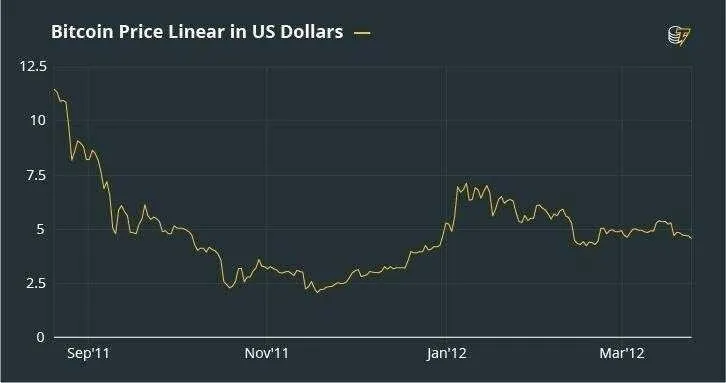

January 2012

The second critical crash happened a very long time after Bitcoin bottomed out at $2.00 per coin. In spite of the fact that the cost had dramatically increased from lows before the finish of 2011, the market was as yet dreadful, as it had viewed the digital currency tumble from $32.00 just as of late.

Beginning the year at a hopeful $4.50, Bitcoin expanded in January to over $7.00. Be that as it may, plunge purchasers today should look to this time and observe, as it embodies an imperative certainty: Bitcoin isn't ensured to achieve its past unequaled high before amending yet again. From around $7.40, it took a startling 49% decay to only $3.80 in late January, shaking out a few financial specialists who had held through November's fiasco.

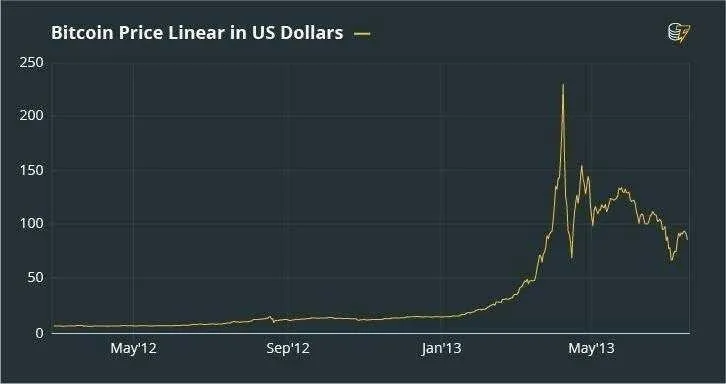

April 2013

The period between mid 2012 and 2013 was uneventful. Bitcoin picked up relentlessly and started 2013 at a cost of around $13.00, coming to as high as $17.00 in 2012. Mid 2013 was a bullish stage for the digital money, as it pushed past its unequaled high of $32.00, achieving $49.00 before a one-day minor amendment back to $33.00.

Numerous new trades and dealers, notwithstanding extended media scope helped Bitcoin recoup rapidly, and it put on picks up at a hot pace until April, where bulls at long last gave in at a cost of $260.00, breaking admirably into the triple digits. A blackout at the then most well known trade, Mt. Gox, was likewise credited as driving force for the decrease. Benefit bringing transformed into an all out freefall down to $40.00, for an aggregate loss of 83%.

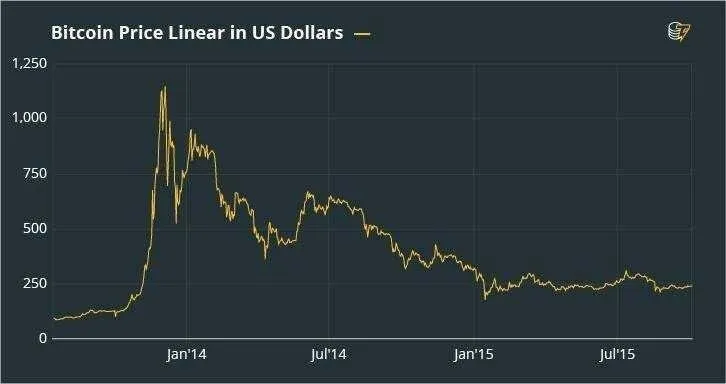

November 2013

Known as the greatest and most model of Bitcoin crashes, it's nothing unexpected that the notorious 87% decrease occurred in November 2013. As the most recent development to $20,000.00 demonstrated, Bitcoin bull runs tend to turn into a free for all late in the year. The same number of anticipated, November to January 2014 is a close identical representation of the most recent four months, with a colossal flood of new brokers and media consideration helping bitcoin achieve incomprehensible highs.

In late 2013, the cost was nearing $1,200.00—a mentally huge value that helped the resulting rot keep going for quite a long time. With a sum of 411 days in rectification, helped to some degree by the epic implosion of Mt. Gox and deletion of nearly $500 million, the post-November low was just come to in January 2015 at about $150.00.

November 2017

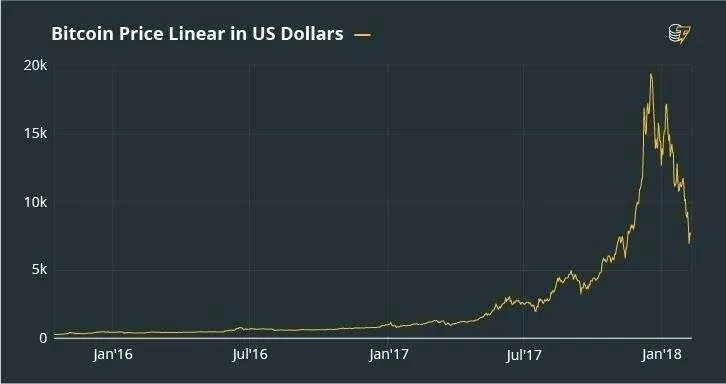

Five years on the spot after Bitcoin's four-figure make a big appearance, the ruler cryptographic money soar past the five-figure stamp at $10,000.00 and drove the distance to $20,000.00 before losing steam. The two years' earlier would turn out to be a portion of the best chances to purchase, and even the individuals who bought bitcoin at the year's opening cost of $750.00 picked up altogether.

In December, a little revision down to $14,000.00 wasn't sufficient to stop force, which rapidly took it back to $17,000.00 before separating. Worries about Bitcoin's maintainability, particularly with a plenty of noteworthy elective arrangements being discharged, just made the selloff more outrageous. Support rose close $5,900.00—the mid-to-late 2017 level when the digital money estimating started showing a close exponential ascent. An aggregate decay of more than 70% could go lower, if 2013 is anything to pass by, however advertises are idealistic for 2018.

Looking Forward

In the event that anything, this long history of rehashed blast and bust is an idealistic flag. When Bitcoin entered the features, it never left, and it keeps on snowballing in prominence with retail financial specialists and media consideration the more it remains significant. All through administrative weights, specialized challenges, and numerous a greater number of adjustments than the ones featured over, the cryptographic money has stayed at the bleeding edge of the Blockchain upset.

Bitcoin's destiny is attached to more than its devotees, be that as it may, and the multi-year battle that happened post-2013 exhibits that the way back upwards isn't generally straight. With its whales making waves at whatever point they like, excavators hunting down different approaches to benefit, and another prospects showcase, Bitcoin's viewpoint remains anything other than straightforward.