by euromoney

Learn the basics of blockchain technology and why it can enhance trust in both record keeping and financial transactions.

Blockchain is a system of recording information in a way that makes it difficult or impossible to change, hack, or cheat the system.

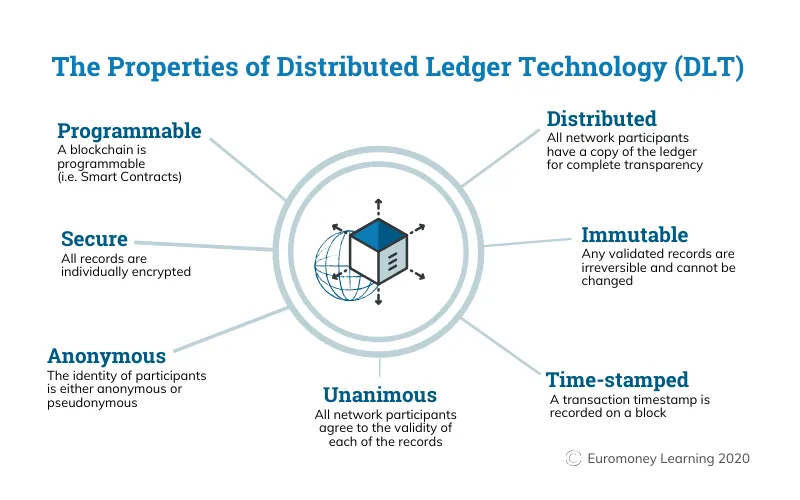

A blockchain is essentially a digital ledger of transactions that is duplicated and distributed across the entire network of computer systems on the blockchain. Each block in the chain contains a number of transactions, and every time a new transaction occurs on the blockchain, a record of that transaction is added to every participant’s ledger. The decentralised database managed by multiple participants is known as Distributed Ledger Technology (DLT).

Blockchain is a type of DLT in which transactions are recorded with an immutable cryptographic signature called a hash.

This means if one block in one chain was changed, it would be immediately apparent it had been tampered with. If hackers wanted to corrupt a blockchain system, they would have to change every block in the chain, across all of the distributed versions of the chain.

Blockchains such as Bitcoin and Ethereum are constantly and continually growing as blocks are being added to the chain, which significantly adds to the security of the ledger.

Why is there so much hype around blockchain technology?

There have been many attempts to create digital money in the past, but they have always failed.

The prevailing issue is trust. If someone creates a new currency called the X dollar, how can we trust that they won't give themselves a million X dollars, or steal your X dollars for themselves?

Bitcoin was designed to solve this problem by using a specific type of database called a blockchain. Most normal databases, such as an SQL database, have someone in charge who can change the entries (e.g. giving themselves a million X dollars). Blockchain is different because nobody is in charge; it’s run by the people who use it. What’s more, bitcoins can’t be faked, hacked or double spent – so people that own this money can trust that it has some value.

How does a transaction get into the blockchain?

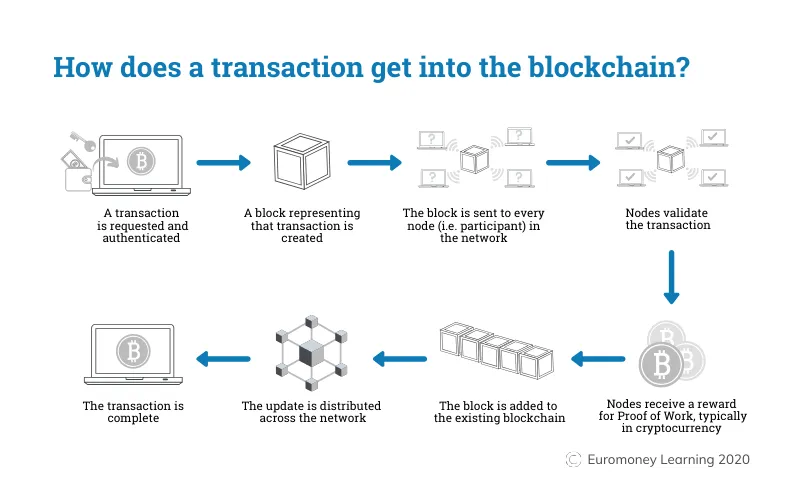

Before a transaction is added to the blockchain it must be authenticated and authorised.

There are several key steps a transaction must go through before it is added to the blockchain. Today, we’re going to focus on authentication using cryptographic keys, authorisation via proof of work, the role of mining, and the more recent adoption of proof of stake protocols in later blockchain networks.

Authentication

The original blockchain was designed to operate without a central authority (i.e. with no bank or regulator controlling who transacts), but transactions still have to be authenticated.

This is done using cryptographic keys, a string of data (like a password) that identifies a user and gives access to their “account” or “wallet” of value on the system.

Each user has their own private key and a public key that everyone can see. Using them both creates a secure digital identity to authenticate the user via digital signatures and to ‘unlock’ the transaction they want to perform.

Authorisation

Once the transaction is agreed between the users, it needs to be approved, or authorised, before it is added to a block in the chain.

For a public blockchain, the decision to add a transaction to the chain is made by consensus. This means that the majority of “nodes” (or computers in the network) must agree that the transaction is valid. The people who own the computers in the network are incentivised to verify transactions through rewards. This process is known as ‘proof of work’.

Proof of Work

Proof of Work requires the people who own the computers in the network to solve a complex mathematical problem to be able to add a block to the chain. Solving the problem is known as mining, and ‘miners’ are usually rewarded for their work in cryptocurrency.

But mining isn’t easy. The mathematical problem can only be solved by trial and error and the odds of solving the problem are about 1 in 5.9 trillion. It requires substantial computing power which uses considerable amounts of energy. This means the rewards for undertaking the mining must outweigh the cost of the computers and the electricity cost of running them, as one computer alone would take years to find a solution to the mathematical problem.

The Power of Mining

The Cambridge Bitcoin Electricity Consumption Index estimates the bitcoin mining network consumes almost 70 terawatt-hours (TWh) of electricity per year, ranking it the 40th largest consumer of electricity by ‘country’. By way of comparison, Ireland (ranked 68th) uses just over a third of Bitcoin’s consumption, or 25 TWh, and Austria at number 42 consumes 64.6 TWh of electricity per year, according to 2016 data compiled by the CIA.

The Problem with Proof of Work

To create economies of scale, miners often pool their resources together through companies that aggregate a large group of miners. These miners then share the rewards and fees offered by the blockchain network.

As a blockchain grows, more computers join to try and solve the problem, the problem gets harder and the network gets larger, theoretically distributing the chain further and making it ever more difficult to sabotage or hack. In practice though, mining power has become concentrated in the hands of a few mining pools. These large organisations have the vast computing and electrical power now needed to maintain and grow a blockchain network based around Proof of Work validation.

Proof of Stake

Later blockchain networks have adopted “Proof of Stake” validation consensus protocols, where participants must have a stake in the blockchain - usually by owning some of the cryptocurrency - to be in with a chance of selecting, verifying & validating transactions. This saves substantial computing power resources because no mining is required.

In addition, blockchain technologies have evolved to include “Smart Contracts” which automatically execute transactions when certain conditions have been met.

What's the difference between blockchain and Bitcoin?

Many people wrongly conflate the two. Do you know the difference?

Blockchain is the technology that underpins the cryptocurrency Bitcoin, but Bitcoin is not the only version of a blockchain distributed ledger system in the market. There are several other cryptocurrencies with their own blockchain and distributed ledger architectures.

Meanwhile, the decentralisation of the technology has also led to several schisms or forks within the Bitcoin network, creating offshoots of the ledger where some miners use a blockchain with one set of rules, and others use a blockchain with another set of rules.

Alongside the original Bitcoin, Bitcoin Cash, Bitcoin Gold and Bitcoin SV exist as their own cryptocurrency. With smaller networks, these cryptocurrency blockchains are more vulnerable to hacking attacks, one of which befell Bitcoin Gold in 2018.

The Bitcoin Origin Story

In late 2008, around the time of the financial crisis, a ground-breaking post appeared on a little-known internet forum entitled Bitcoin: A peer-to-peer electronic cash system. It was written by a mysterious person called Satoshi Nakamoto, a pseudonym used to disguise the author’s true identity.

Satoshi thought that the banks and governments had too much power that they used in their own self-interests. Satoshi envisaged a new type of money called Bitcoin that could change that: a cryptocurrency that wasn’t controlled or run by central banks or governments, that you could send anywhere around the world for free, with no person or institution in charge.

At first nobody paid attention to Satoshi’s wild ideas – but slowly more and more people started buying and using Bitcoin. Many believed it was the future of money, and the worse the big banks behaved the more popular it became.

Since it was formulated and launched in 2009, Bitcoin has grown to a network of around 10,000 “nodes” or participants which use the Proof of Work system to validate transactions and mine bitcoin.

This democracy prevailed until the development of specific mining computers called ASICs which overtook other less powerful machines, and companies began to profit from amassing miners and mining technology. It is still possible for an individual to take part in the Bitcoin process, but it is expensive to set up and the return on investment fluctuates with the highly volatile value of bitcoin itself.

Today, massive mining pools are owned or controlled by large corporations, and power is centralising again. This evolution has somewhat undermined Satoshi’s original vision for blockchain in which the "power” of participants was designed to be evenly distributed - but is now concentrated in the hands of half a dozen mining conglomerates.

What are the risks with public blockchains?

This blog post examines three risks with public blockchains: 51% attacks, Proof of Stake vulnerabilities, and double spending.

51% Attacks

Where blockchains have consensus rules based on a simple majority, there is a risk that malign actors will act together to influence the outcomes of the system. In the case of a cryptocurrency, this would mean a group of miners controlling more than 50% of the mining computing power can influence what transactions are validated and added (or omitted) from the chain. On a blockchain that uses the Proof of Work (PoW) consensus protocol system, a 51% attack can also take the form of a “rival” chain – including fraudulent transactions – being created by malicious parties.

Through their superior mining capacity, these fraudsters can build an alternative chain which ends up being longer than the “true” chain and therefore – because part of the Bitcoin Nakamoto consensus protocol is “the longest chain wins” – all participants must follow the fraudulent chain going forward.

In a large blockchain like Bitcoin this is increasingly difficult, but where a blockchain has ‘split’ and the pool of miners is smaller, as in the case of Bitcoin Gold, a 51% attack is possible.

A 51% double spend attack was successfully executed on the Bitcoin Gold and Ethereum Classic blockchains in 2018, where fraudsters misappropriated millions of dollars of value.

Proof of Work vs Proof of Stake

A 51% attack on a new blockchain called Ethereum Classic in January 2019 prompted a change in strategic direction from Proof-of-Work (PoW) mining to Proof-of-Stake (PoS) voting for the Ethereum blockchain.

However, Proof of Stake is more vulnerable to schisms or splits known as “forks”, where large stakeholders make different decisions about the transactions that should comprise blocks and end up creating yet another new currency. Ethereum briefly tried this validation method but, due to forking issues, reverted back to Proof of Work. It is expected to introduce a revised Proof of Stake validation system in 2020.

Double Spending

There is a risk that a participant with, for example, one bitcoin can spend it twice and fraudulently receive goods to the value of two bitcoins before one of the providers of goods or services realises that the money has already been spent. But this is, in fact, an issue with any system of electronic money, and is one of the principal reasons behind clearing and settlement systems in traditional currency systems.

How blockchain data is stored and secured?

Understand how blockchain data is kept manageable and secure to accommodate a constantly growing database

Blockchain works by including the identifier of the last block into the identifier in the following block to create an unbreakable and immutable chain. But as more and more blocks are added, how does the data remain manageable?

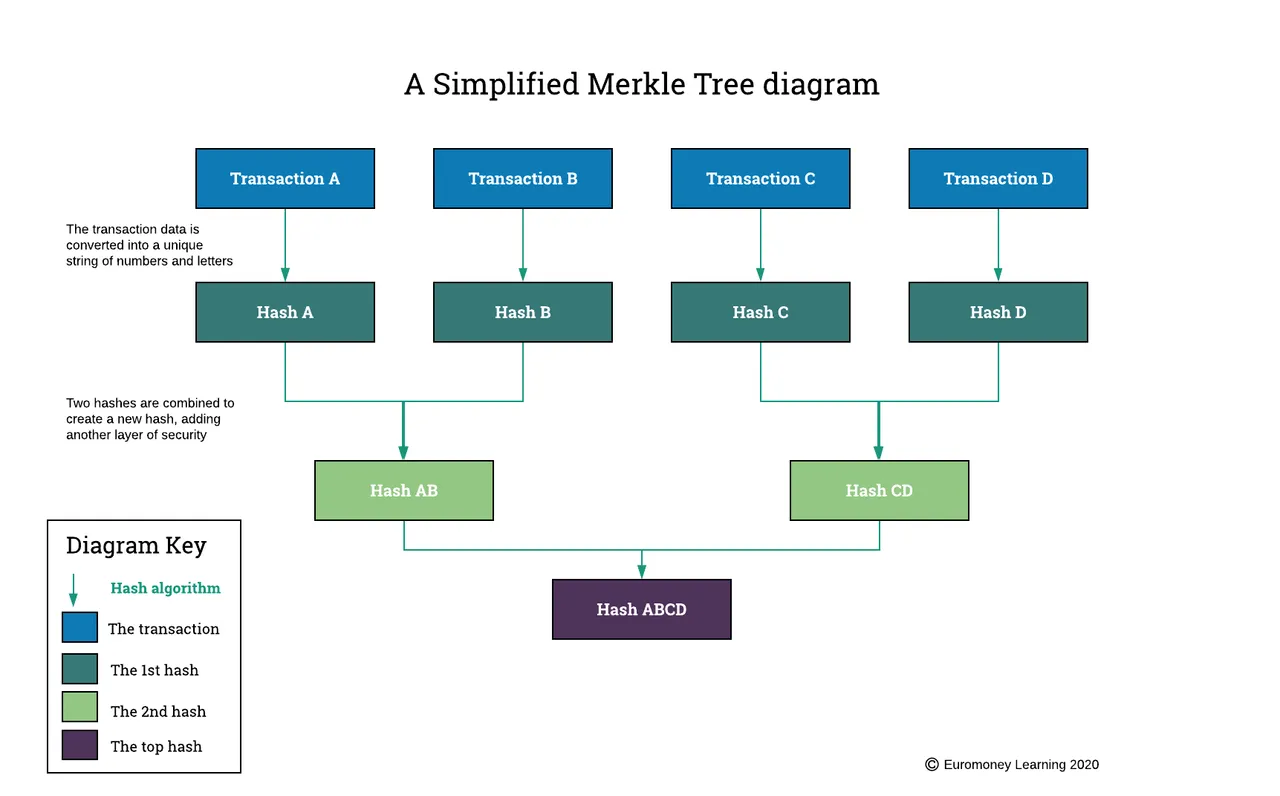

The key to keeping blockchain data manageable – and secure – is through an algorithm called hashing in combination with a consolidating data structure known as a Merkle Tree.

What is hashing?

When a transaction has been verified and needs to be added to a block in a chain, it will be put through a hash algorithm to convert it into set of unique numbers and letters, similar to what would be created by a random password generator. Then two transaction hashes will be combined, and put through the hash algorithm to produce another unique hash. This process of combining multiple transactions into new hashes continues until finally there remains just one hash – the ‘root’ hash of several transactions.

What makes hashes unique, and a key security feature for blockchains, is that they only work one way. While the same data will always produce the same hash of numbers and letters, it is impossible to ‘un-hash’, or reverse the process, using the numbers and letters to decipher the original data.

What is a Merkle Tree?

If the hashing process is repeated with exactly the same transactions, exactly the same hashes will be created. This allows anyone using the blockchain to check that the data has not been tampered with, because ANY change in any part of the data will result in a completely different hash, affecting every iteration of hashes all the way to the root. This is known as a Merkle Tree.

Merkle Trees serve the purpose of significantly reducing the amount of data required to be stored and transmitted or broadcast over the network by summarising sets of hashed transactions into a single root hash. As each transaction is hashed, then combined and hashed again, the final root hash will still be a standard size.

The rise of private blockchains

Discover how blockchain technology is impacting a variety of industry sectors due to its ability to improve transparency and fairness while saving businesses time and money.

Even though the original Bitcoin blockchain was designed to operate democratically without interference or influence from banks or central regulators, blockchain technology can still operate within closed parameters.

This means a bank or company could implement their own blockchain, and control which transactions are added to the chain. It will still be a secure system, but like the traditional banking system it will be based on trust of the decision-maker.

There are several major providers of digital platforms based on their own version of blockchain technologies, including Ripple, R3’s Corda and Hyperledger Fabric. These are permissioned systems which, in the case of Corda and Hyperledger, restrict access to transaction data to the parties involved in that transaction, rather than the data being made public in a public ledger like Bitcoin.

What companies are using private blockchains today and why?

Walmart has developed a blockchain system based on Hyperledger Fabric to trace the provenance of their products. The blockchain allows suppliers to upload certificates of authenticity to the ledger securely, bringing more trust to a system and enabling the company to trace products back to source within seconds rather than days.

After successful trials with two products, the company is looking to roll it out further. Like other private blockchains, Walmart’s traceability system does require its suppliers to participate in the system to ensure its veracity, but the company is large enough to impel them to comply.

De Beers has launched a ‘secure and immutable trail’ using a private blockchain called Tracr, to verify the authenticity and provenance of diamonds and ensure they are not “blood diamonds” from conflict zones.

Comcast has partnered with other industry leaders to launch Blockgraph, a blockchain-based system which allows advertisers to target viewers with specific adverts while maintaining viewers’ privacy.

BurstIQ's big data blockchain platform helps patients and doctors securely transfer sensitive medial information using smart contracts that establish the parameters of what data can be shared.

In April 2017, the streaming giant Spotify acquired blockchain startup Mediachain in an effort to create a fairer, more transparent, and rewarding music industry for musicians. Prior to its acquisition, Mediachain had developed several technologies that could aid in these efforts, including a decentralized, peer-to-peer database that connects applications to media and information about it, the Mediachain Attribution Engine, and a cryptocurrency that rewards artists for their work.

The all-in-one real estate transaction management software, Propy, leverages blockchain technology to streamline real estate transactions and mitigate the risk of fraud. Propy even offers properties that can be purchased using cryptocurrency.

Xage is the world’s first blockchain-enabled cybersecurity platform for IoT companies primarily in the transportation, energy and manufacturing industries. With the ability to self-diagnose and heal possible breaches, it leverages blockchain technology to manage billions of devices and protects industrial IoT operations against cyber attacks.

Shipping giant DHL is at the forefront of blockchain-powered logistics. One of the largest shipping companies to embrace blockchain, it uses the technology to maintain a digital ledger of shipments and protect the integrity of transactions.

And several banks and insurance companies, such as JP Morgan and MetLife, are using their own private blockchains to simplify, streamline and verify transactions and contracts that would previously have taken far longer and potentially been less secure.