For most service providers in the cryptocurrency space, the general advancement of the ecosystem rarely exceeds the importance of individual interest. This reality extends from fresh industry players all the way to major exchanges.

A recent event offered a rare public highlight of an exchange that went out of its way to cripple a fledging blockchain startup.

A few days ago, however, MXC reached out to DUO Network’s team. The exchange wanted the project to pay up for service fees that were never agreed upon at the time of the free listing. MXC threatened a delisting of DUO tokens if the team did not pay up.

The reason MXC exchange had waited so long to demand fees is because DUO Network’s private sale tokens are about to be unlocked soon. At such a critical stage for the project’s token metrics, a delisting can have an extreme negative shock on both liquidity and community confidence. Demanding payment at such a point would typically push most startup teams to give in to the exchange’s demand.

However, DUO Network’s team managed to gain incredible support from BitMax and so managed the confidence to rub aside MXC’s demands.

MXC exchange delisted DUO Network; the immediate result was a steep drop in the price of DUO tokens. However, in the day that followed, BitMax’s team took a strong supporting stance for DUO Network. Soon after, DUO Network’s team made a decisive move to buy 20% of the circulating DUO tokens from the secondary market and lock them up. The result of these two factors led to a sharp price recovery.

While DUO Network has had the support of a major exchange and has thus been able to withstand the threat of a delisting, most other startups listed on MXC cannot relate. The typical project receives a listing on just one major exchange; this means if MXC were to demand additional fees from the projects listed on it, most would likely comply as the alternative would be a sharp drop in token value with little sight of recovery options.

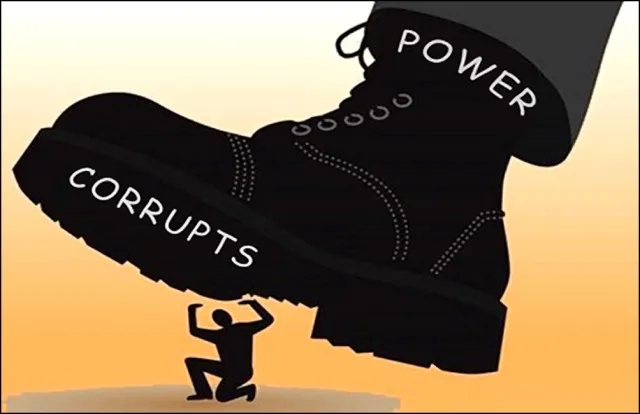

While there's nothing wrong with charging fees for a service, forcing a service upon a startup and then requesting a fee for it in a time of vulnerability is a horrible display of exploitation from a position of power. Such a mindset offers no value to the general productivity and improvement of the blockchain ecosystem; rather, it limits the growth of the space by impeding upon and thwarting the impact of others' positive efforts.

Connect with me:

Crypto News Blockchain Airdrops Best ICO List Ripple XRP News Ethereum News Cryptocurrency ICO Bounties Monero News Blockchain Lawyers Recover Lost or Stolen Crypto