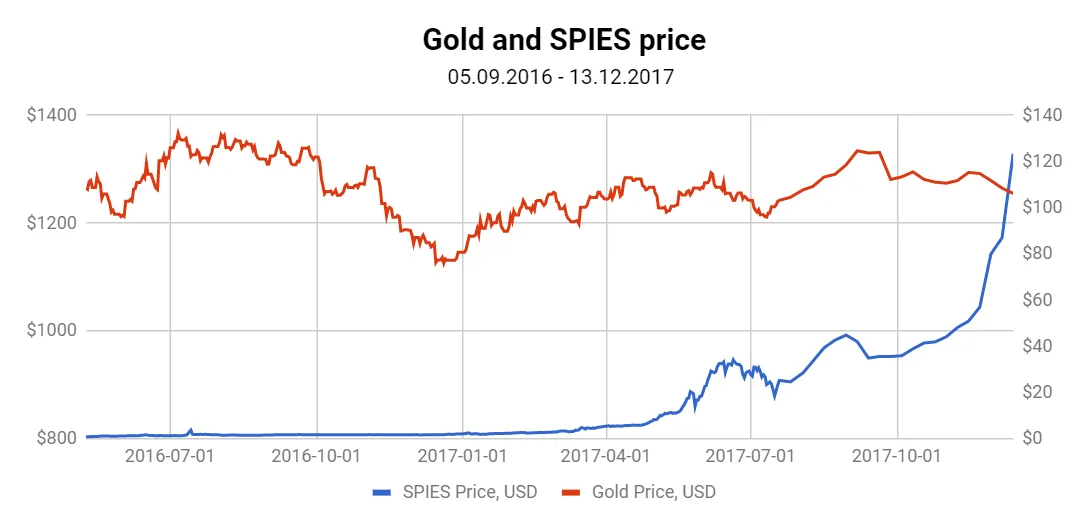

Satoshi•Pie token (SPIES), the token of the first investment fund traded on a blockchain, grew by 37.53% in the week from 06 December, 2017 to 13 December, 2017 reaching $123.3878.

Satoshi•Fund is the first company that has several blockchain investment products, including Satoshi•Pie, and according to its strategy, invests in blockchain assets mid- and longterm making investment decisions based on the analysis of fundamental factors such as compound monthly growth rate, adoption rate, development status, and team dynamics. Satoshi•Pie token, SPIES, is issued on the Bitshares blockchain and is tradable on the decentralized exchange Bitshares DEX.

You can get more information on Satoshi•Fund here.

On 13 December, the portfolio structure of Satoshi•Pie was as follows:

| Ethereum | 31.52% |

|---|---|

| Tezos | 17.41% |

| Bitcoin | 16.53% |

| EOS | 15.77% |

| Cosmos | 4.48% |

| Monero | 3.36% |

| Storj ERC20 | 2.30% |

| Dfinity | 1.74% |

| Byteball | 1.23% |

| Sia | 1.17% |

| Golos | 1.15% |

| Aira | 1.15% |

| Melonport | 0.97% |

| DAO.Casino | 0.67% |

| Bancor | 0.21% |

| Bitcoin Cash | 0.20% |

| Ethereum Classic | 0.13% |

| Other | <0.00% |

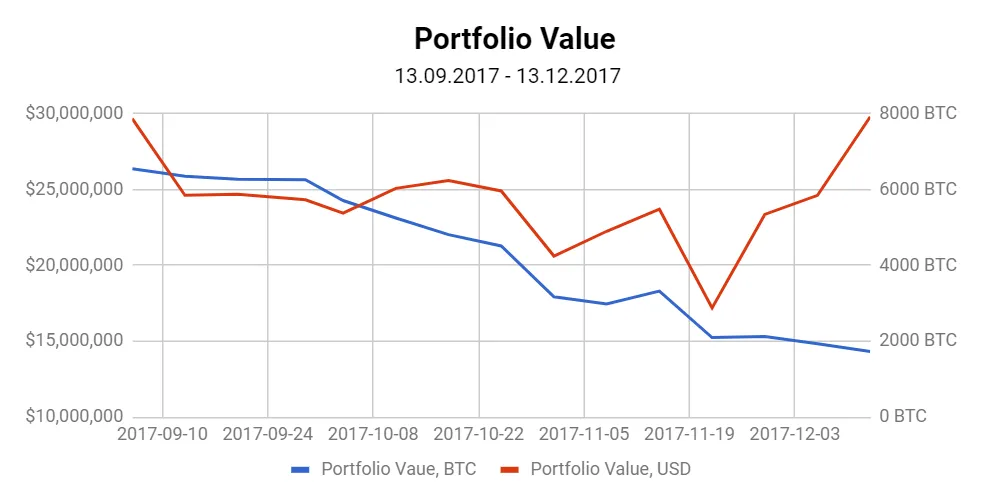

The total amount of assets under management is 17*. Stellar, Steem, bitCNY, Ripple and bitUSD left the portfolio. Over the past week, the portfolio value grew from $24,597,944 to $29,765,662. The supply of SPIES tokens decreased by 12.01%.

The growth of SPIES price since its inception on 9 May, 2016, is 12238.8% in US dollars and 229.7% in BTC. The portfolio grew from $47,382 to $29,765,662 during this period. The status of the portfolio in real time can be monitored in the fund’s profile on cyber•Fund.

The chart below shows the price of SPIES compared to the value of a troy ounce of gold. There is no correlation between the prices of SPIES and gold, the correlation coefficient is 0.02.

If you want to get more information about Satoshi•Pie or have any questions about the blockchain assets it invests into, please write to its cofounders: Konstantin Lomashuk (k@cyber.fund) or Marina Guryeva (m@cyber.fund).

You can also read this article on Medium