Most of us around the world remember's the deploring financial crises that hit the global economy hard. Governments and masses struggled to recuperate and the disruptive waves of economic stagnation still threaten the welfare of the world’s population.

Adding to this an astonishing number more than 2 Billion Underserved & Underbanked across the planet do not have access to financial and banking services.

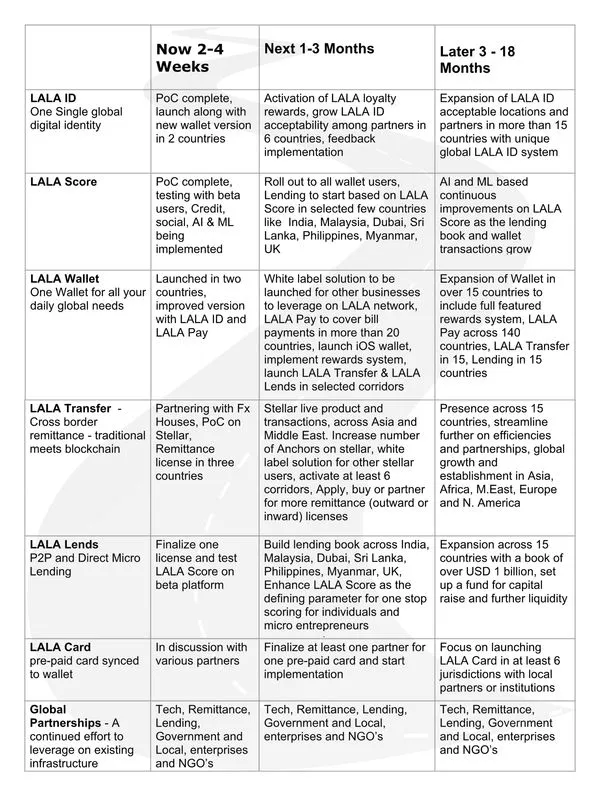

"The need of the hour is to provide a Single Global Digital Id and Micro Loans which LALA World talks about in the new Roadmap and Milestones"

Is it surprising, then, that cryptocurrencies, blockchain technology and artificial intelligence in the banking sector are gaining traction worldwide?

In this post, let’s put some light and a closer look at LALA WORLD, one of the blockchain startups that aims to become the new generation financial system.

How does LALA WORLD work?

LaLa World has created an Ethereum-based wallet that offers facilities like peer-to-peer transfer of local and global remittance, local and international bill pay and a globally acceptable LaLa Card. The most exciting feature of this system is its facility to promote peer-to-peer lending and borrowing via EMIs. This will greatly impact small and micro businesses which do not have the wherewithal to apply for loans from banks and non-banking financial institutions. This can be a major boost for entrepreneurial projects by passionate and talented individuals wanting to bring about a positive change within their communities.

Key principles & objectives of LALA World

D – Decentralized – No one should control the system. System should benefit the users and reward them for the growth and success of the system

D – Democratic – Everyone should have a voice on how the system should run. This will not happen overnight, but something we are aiming for a longer term vision.

O – Open Source peer to peer – No middlemen in true spirit of Blockchain. However systems need to be put in place such that there is no abuse

S – Social Impact – What good is technology, be it Blockchain or be it hash graph, if that does not benefit humanity, especially the needy and underserved.

Micro lending platform is based on direct lending to individuals and micro entrepreneurs/Micro SMEs starting with India by Q2 2018. We will also establish micro lending in Sri Lanka, Dubai, Malaysia, Philippines, Myanmar, UK in Q2 18, either directly or via our multiple B2B partners.

Other LALA Products of future shall include a crypto as well as fiat LALA Card, LALA insurance, LALA care. The foundation of this is being laid down now but would only start as we get some real partners and some more resources, so as not to spread ourselves too thinly. Also the focus is not just expansion, but profitable expansion so that we can give back to our early supporters and give back to the society.

Tasks