There are many out there that consider the main issue with today’s cryptosphere is directly related to the fact that the large majority of transactions take place on centralized exchanges. The idea of compromising the monetary independence and sovereignty for which Satoshi Nakamoto arguably fought for by creating Bitcoin is indeed a thought-provoking one.

If you are new to the cryptosphere telling apart centralized from decentralized exchanges might seem a daunting and complex task which is exactly why we will provide a list of all the most relevant aspects for each particular case.

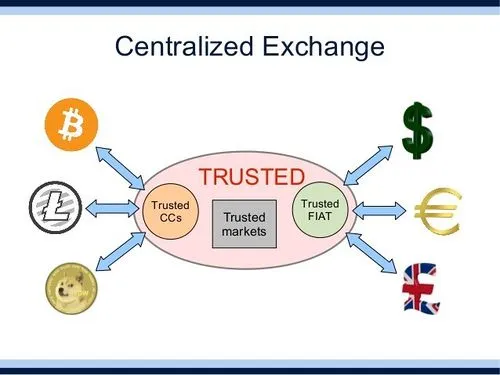

Centralized cryptocurrency exchanges

Centralized exchanges are trading platforms that can be compared to brokerage and stock markets regarding the way they operate. They have been responsible for maintaining the much-needed liquidity for the crypto markets, as they have made cryptocurrencies a lot more accessible to the masses.

Centralized exchanges are operated by various companies that maintain full control over all transactions, as well as to users’ private keys and their exchange account’s details and wallets. This leads us to the main criticism of centralized exchanges, namely the fact that users are required to undergo specific, company-approved methods for dealing with their funds and the implied transactions.

Over the past couple of years, tens of cryptocurrency exchanges have been hacked, resulting in millions of dollars lost (primary examples being Mt. Gox, BitGrail, and Coincheck, etc.). Not only that, but centralized exchanges are also prone to government bans, and they usually have unsatisfactory support sections (even though most exchanges are actively working on fixing this issue).

However, by far the biggest “problem” of centralized exchanges is the necessary KYC compliance and implied identity document submission. This opens the door to the possibility of identity theft and even personal identity information leaks.

Decentralized cryptocurrency exchanges

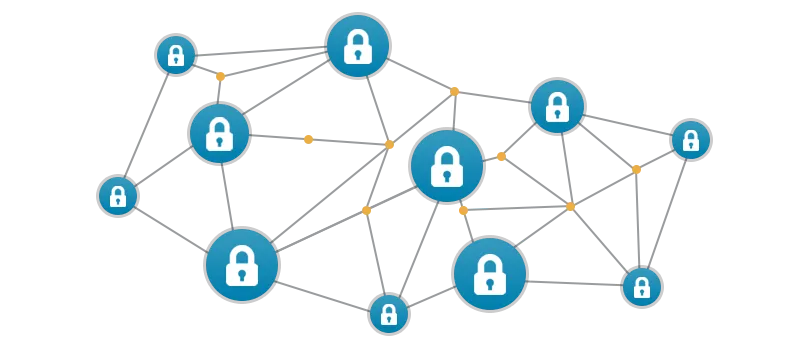

Decentralized exchanges are much more in tune with what Satoshi envisioned, as no companies operated these DEXs, as they are usually referred to. In fact, decentralized exchanges operate with the help of the same technology that powers most cryptocurrencies, the blockchain. These exchanges do not hold customers’ cryptos and don’t store sensitive information.

Since they’re fully based on the blockchain, it’s only natural that decentralized crypto exchanges suffer from most of the blockchain’s inherent drawbacks, the main one being scalability. Hence, most decentralized exchanges are slower than centralized exchanges. Not only that, but they’re also arguably less user-friendly when compared to their centralized counterparts.

However, as technology advances, decentralized exchanges will most likely improve. The liquidity levels will rise, and the user experience will improve mostly due to technologies such as smart contracts, off-chain atomic swaps, and on-chain atomic swaps.

Decentralized vs Centralized Exchange: Actual differences between CCEs and DEXs

The most obvious difference is the overall popularity levels. At the moment, DEXs are far less popular than their centralized peers. This means that regarding trading volume, the CCEs are also the leaders of the pack. CCEs also have better liquidity. Another big difference is the fact that DEXs only accept payments in cryptos and only exchange crypto, while CCEs also tend to allow fiat-to-crypto exchanges as well as accept direct bank wire transfers, and debit/credit card payments.

On the flipside, because their nodes are distributed, DEXs usually experience a lower risk of hacks. The same can be said about government actions, as DEXs are very much immune to government intervention. DEXs also have the upper hand when it comes to the provided level of privacy. All transactions are anonymous, while on CCEs, there’s an increased risk of identity theft and hacks. All exchanges of cryptocurrencies into fiat currencies are mostly done on centralized exchanges. This is mainly because EUR and USD (an all other fiat currencies) are also centralized.

Decentralized vs Centralized Exchange Conclusion

Choosing between a centralized or decentralized cryptocurrency exchange is not either black or white situation. Both types of exchanges have undeniable advantages, and both have noteworthy disadvantages. Nowadays, it’s clear that centralized crypto exchanges provide more utility and functionality for their users. The structure of the crypto ecosystem remains, at least for now, unchanged. Centralized exchanges are still kings regarding daily trading volumes.

However, decentralized exchanges will soon be able to hold their own against their centralized peers. As technology progresses, decentralized exchange UIs will continue to get better, trading pair options will grow, and shortly after, the differences between centralized and decentralized exchanges will become less apparent.

One thing is sure, security becomes a very strong focal point for most crypto-related exchanges. Hence, the improved security will certainly be a very good incentive for mass adoption purposes. In short, security will be a very compelling selling point for decentralized exchanges.