Speaking of which, Softbank is the best tech investor in the world. So why invest in a company that is at a loss? Surely the intelligent people around me would not have made such a big mistake. We want profit share from the first month, right? Let me give you a fun analogy. Getting a product from a farmer increases the price by almost 100%. Travel costs and labor 10%, merchants 15%, warehousing 10%, extortion 5% and van owners 60% - this is roughly the distribution. The question is, which vanwala will you ever see become rich? Didn't see. Because it's not about profit, it's about scale. This is what start-up investors see. The question is, this is so much loss, then who bears it? Many smart kids work at development. E-Valley could not pay such a salary, this is not the case here.

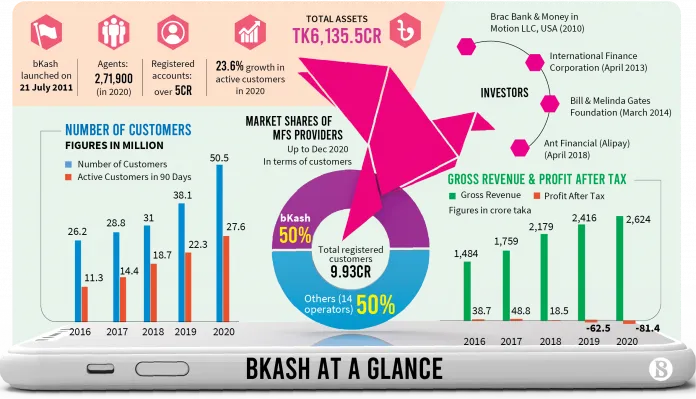

Is the customer satisfied with the development? Half of the mobile financial services market in Bangladesh is for bkash, the other half is for everyone. 2,100 crore daily transactions. There are complaints about cash out charges, but that is a strategy. bkash doesn't want you to withdraw more money, so he puts more cash out charge. He wants as much money as can be kept digitally, as much as bills, shopping, purchases - the more you do with development, the more profit they make. Ultimately, if someone is super up in Bangladesh, it will develop.

So what is the benefit of investor carrying so much loss? The answer to this question is in the stock market.

BRAC Bank owns 51% stake in bKash. BRAC Bank's own share price rose 9.93% after hearing the news of SoftBank's investment in bKash.

Those who were investors before the development, how to make a profit. When Ant Financials invested on behalf of the Chinese Alibaba Group in 2016, the valuation doubled in less than four years (60 million). As a result, the return of Ant Financials comes with 100% profit. Then those who have invested since 2011 are coming out with more profit.

Now the question is how will the share price of those who will invest in Last increase? When bKash becomes a public company, the price of this company will be 5-10 times more. That money will come from the stock market. 10-20% of public money will go to the company as operational cost, the rest will be spent on selling shares of private investors. In this way, the loss of development will not be borne by 5-6 investors, but will be borne by a few thousand investors. This means you are buying at a higher price, hoping for more profit in the future. Then once the cashless game is established in the development market, then everyone will start seeing the face of profit. This is the stock market and this is how the start-up game works.