Wednesday - The BitShares blockchain and Committee announced BitShares BitAssets1.0 'Reloaded'.

BitShares will once again have committee owned, market-pegged, collateral-backed assets - this time, operating 'as nature intended'. The idea of these new fixed price assets re-establishes the rules for the truest of stablecoins on BitShares.

(See this BitShares Talk thread to apply as an oracle)

The Asset List

The blockchain was instructed by committee account to create the following new committee assets:

- 1.3.5839 CNY1.0

- 1.3.5840 USD1.0

- 1.3.5841 EUR1.0

- 1.3.5866 RUB1.0

- 1.3.5842 BTC1.0

- 1.3.5843 SILVER1.0

- 1.3.5844 GOLD1.0

The objective of the assets is to be pegged 24/7/365 to the corresponding real-world assets outside of BitShares. This presents a brand new opportunity and restart based upon experience and evolution of the first and original BitAssets.

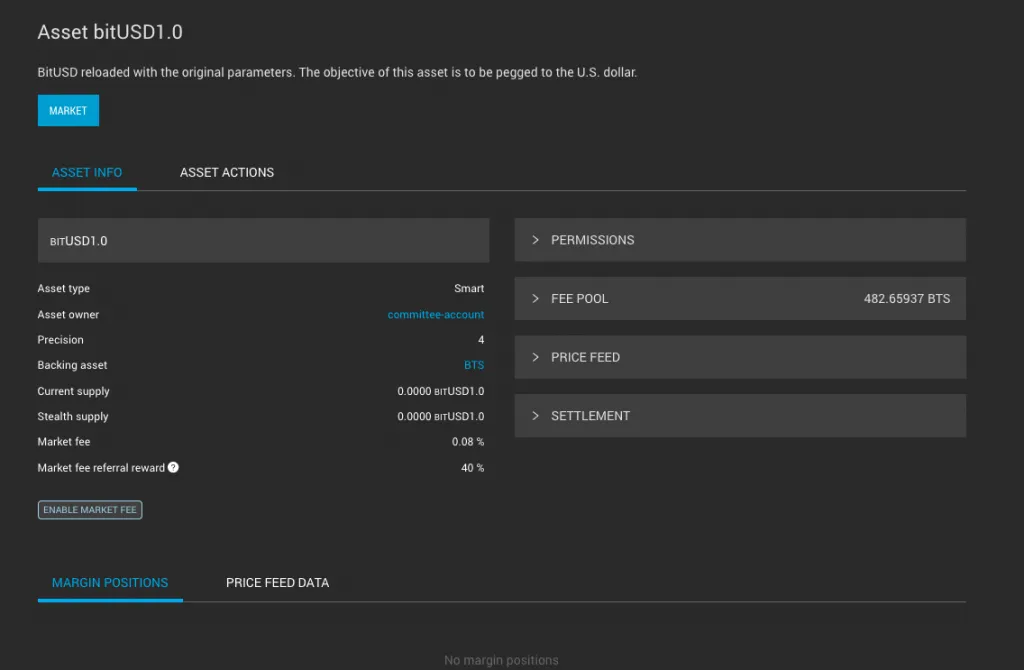

bitUSD1.0 on wallet UI explorer

BitShares BitAssets1.0 Reloaded - Parameters

The assets came with the original parameters which will not change in the future:

- ICR 175%

- MCR 175%

- MSSR 110%

- Force settlement offset 0%

- Force settlement delay 24 hours

- Backed by BTS

Fee structure

Fees go to the asset owner - in this case committee reserves. These can change in future:

- Margin call fee 1%

- Force settlement fee 1%

- Maker fee 0.08%

- Taker fee 0.12%

- Market fee sharing percent (to referral program) 40%

BitShares BitAssets 1.0 Reloaded will use DeFi-style oracles to feed the prices. This presents a new dynamic, whereby the price-feed job (economics) are separated from the block production (consensus core). That will certainly improve protection levels in maintaining smart assets as a contract on chain. Stability in terms of tracking their fiat currency counterparts 1-1 at all times is crucial.

Conclusion

The past flaw was simply that BTS in locked collateral would retain voting power. So when those holders found the market against them, were easily corrupted to vote against the common good. In other words, give everyone a free vote, and a majority will always form to use it for 'themselves'.

The result of a group of holders doubling power through collateral, then locking price feeds through block producers, held the blockchain 'hostage' since 2019 - destroying the standing reputation of a product with highest demand in 2020.

Stake-locking introduced in 5.0.0 means those who are responsible and wish to have a say, need to do so with a long term strategy - without ability to damage the blockchain. It removes immediate needs, and gives incentive for long term management. Where the results can be blockchain growth only. No one ever said digital democracy would be easy, and fully decentralized ones have fully proven themselves to be little more than digital anarchy.

Even though we understand that "reloading" entire market pairs and assets that can only be issued through collateralized BTS ("borrowed into existence"), will be a long painful process. It is of utmost important to keep these solutions alive and healthy. A future world economy entering the DeFi age will be relying on on-chain collateralized smartcoins. Whereas we - the BitShares Blockchain, are probably some of the most experienced veterans innovating around it.

With this in mind, we see this as a potential to redefine stable coins for the long-term and become feasible in broader regulated business and industry, which never happened in the past 5 years..

Let's set sail again.

@abitmore

---

See the source post from BitShares Talk.

Posted from BitShares News using SteemPress, see: https://news.bitshares.org/bitshares-reloaded-bitassets1/