Winklevoss ETF denied, SEC Commissioner Dissents, SolidX Likely to be Delayed, but inside SEC & CTFC Sources say a "Bitcoin ETF Will be Approved This Year."

Bitcoin and Cryptocurrency ETF applications are piling-up on the SEC’s desk, but why was the Winklevoss ETF denied and what chance do the remaining ETF applications have?

The Winklevoss twins were once again denied their application to list and trade shares of “The Winklevoss Bitcoin Trust” ETF on the Bats BZX Exchange by the SEC in a 3-1 decision, despite the twins making a number of changes to this most recent proposal based on the SEC’s previous reasons for refusal.

However, it is the very nature of the global underlying market conditions of the cryptocurrency market that appears to have given the SEC concerns regarding market volatility, fraud and investor protection, in relation to insider trading, malicious software and hacked exchanges, many of which are outside the US and this being inconsistent with the Securities Exchange Act of 1934, section 6b. We've all seen how the market suffers, when hackers attempt to exploit Binance's hot wallets.

But, SEC Commissioner, Hester Pierce, who has previously made a number of positive, crypto-friendly comments, has declared her dissent with the decision;

Pierce argues that the SEC should permit BZX to list and trade the Winklevoss ETF, because it satisfies the statutory standard of the said act and also states that approval would actually have been beneficial to investor protection;

Commissioner Pierce’s reason for disagreeing with the SEC is that the Exchange Act “says nothing about looking at underlying markets, as the Commission often has done in its orders" and that the proposed BZX listing and trading should have been decided upon according to its own merits; “Winklevoss Bitcoin Trust (“Trust”) would trade under BZX Rule 14.11(e)(4), which governs the listing and trading of Commodity-Based Trust Shares. This rule would require the ETP shares to meet initial and continued listing standards.”

The SEC decision is in line with a staff letter published in January this year;

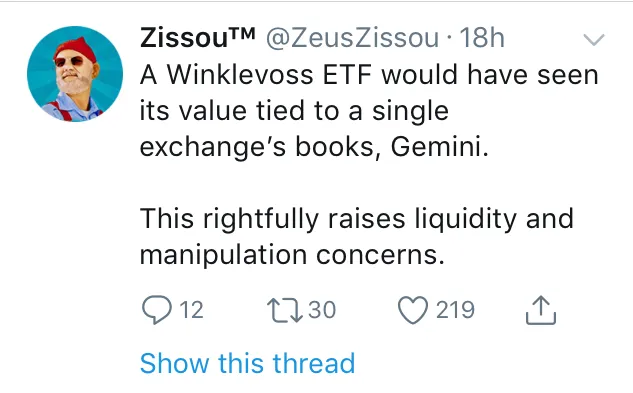

But perhaps the SEC is right to have its stated concerns in relation to the Winklevoss ETF;

Now that the Winklevoss twins have fallen out of the race, the frontrunners in the ETF race are Direxion, Bitwise and SolidX.

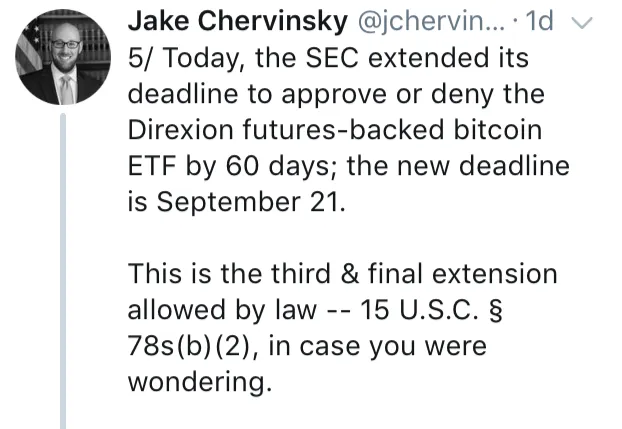

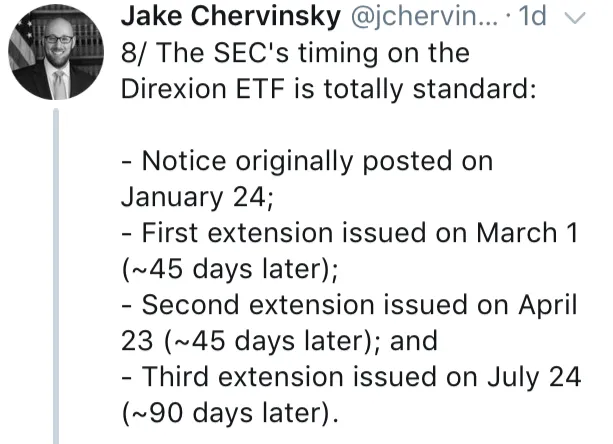

The SEC already announced this week a delay, until September, of their decision on whether or not to approve five Bitcoin ETF applications filed by Direxion; Direxion Daily Bitcoin Bear 1X Shares, Direxion Daily Bitcoin 1.25X Bull Shares, Direxion Daily Bitcoin 1.5X Bull Shares, Direxion Daily Bitcoin 2X Bull Shares, and Direxion Daily Bitcoin 2X Bear Shares.

The NYSE Arca exchange is seeking to list and trade the Direxion ETFs and in January they submitted a filing for a proposed rule change under the NYSE Arca Rule 8.200-E, to bring the proposed applications in line with the very same Section 6(b)(5) of the SEC Act, dealing with the protection of investors from fraudulent and manipulative trading practices. The SEC has now decided to designate a 60-day extension to consider the rule change and its final decision;

The SEC is likely to have misgivings about the leveraged, higher risk nature of Direxion’s Bitcoin ETF proposal, compared to traditional ETFs and it may ultimately prove to be too exotic for the SEC’s liking.

It’s not just a Bitcoin ETF that is now waiting for approval after an ETF application was submitted by Bitwise called the “Hold 10 Cryptocurrency Index Fund,” which, as the name suggests, will consist of the top 10 cryptocurrencies, such as Ethereum, Ripple, EOS, Cardano, Tron, Bitcoin Cash, IOTA and Stellar Lumens and it will be weighted by market cap.

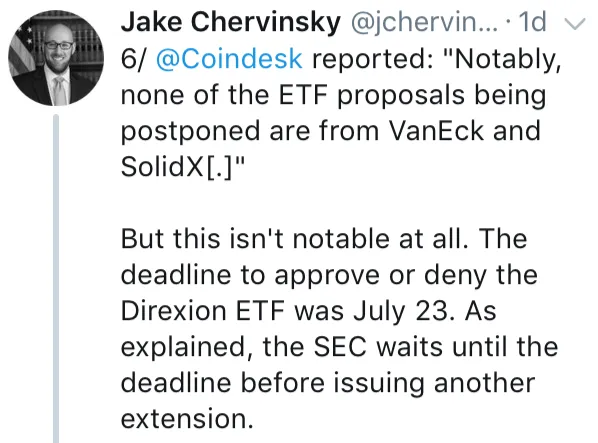

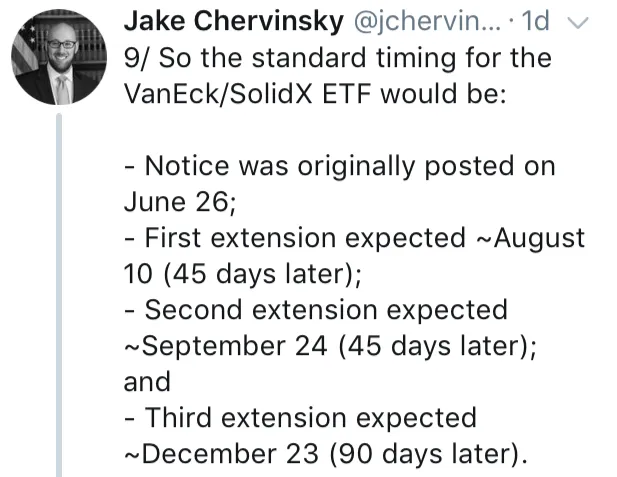

The SEC has not so far delayed the VanEck & SolidX ETF application, which Cboe Global Markets is seeking permission from the SEC to list and trade and a decision from the SEC is scheduled for August 10th. The SEC called for public comments on the SolidX proposal, which so far seem to be mostly positive.

Daniel H. Gallancy, CEO of SolidX Partners Inc, has been quoted as saying;

Indeed, the SolidX proposal will clearly be focused on institutional investors, as reflected in the minimum entry point of one SolidX share, this being 25 BTC—which is roughly $200,000, as of 28th July, 2018, thus creating a substantial influx of institutional capital waiting on the sidelines and is the most likely ETF proposal to be approved and if we take any notice of rumours, the SEC is set to approve SolidX at some point this year.

SolidX Inc has been lobbying the SEC for approval of its ETF and like Commissioner Pierce, VanEck argues that a Bitcoin ETF would be beneficial to investor protection in that would combat price manipulation;

The SolidX proposal may be looked upon more favourably by the SEC, although it may not answer the concerns of the SEC in relation to the global nature of the cryptocurrency market and it lying beyond the control of the SEC to intervene in order to protect investors from market manipulation such as wash-trading and spoofing;

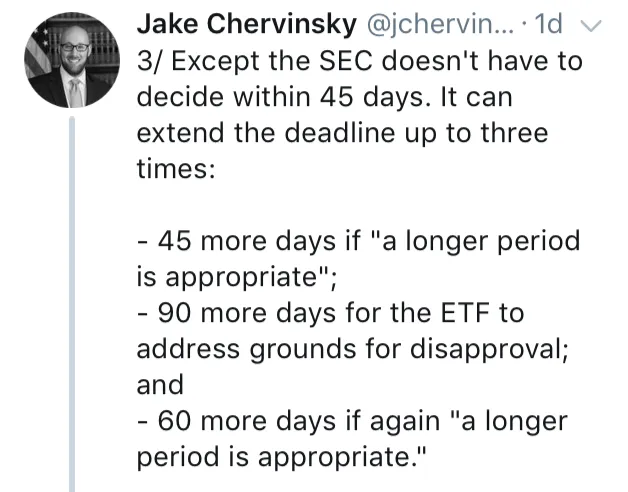

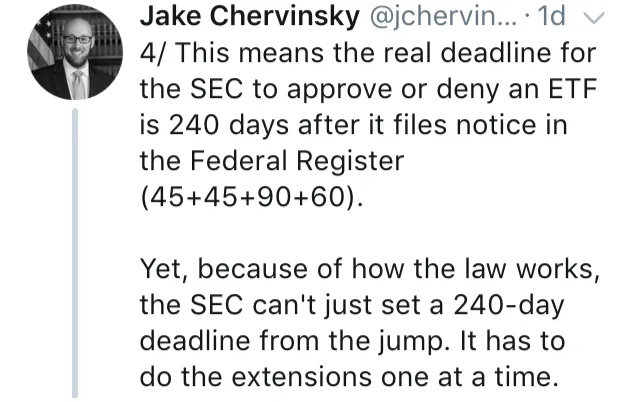

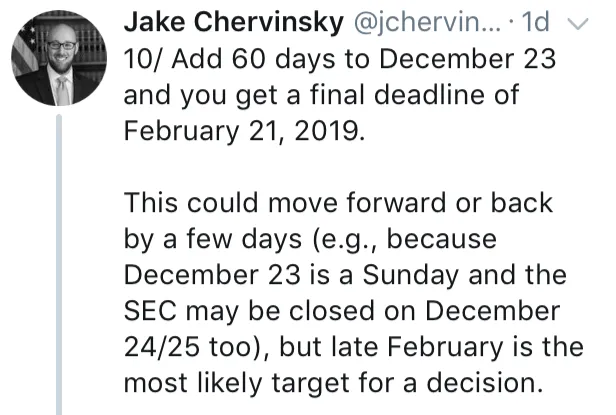

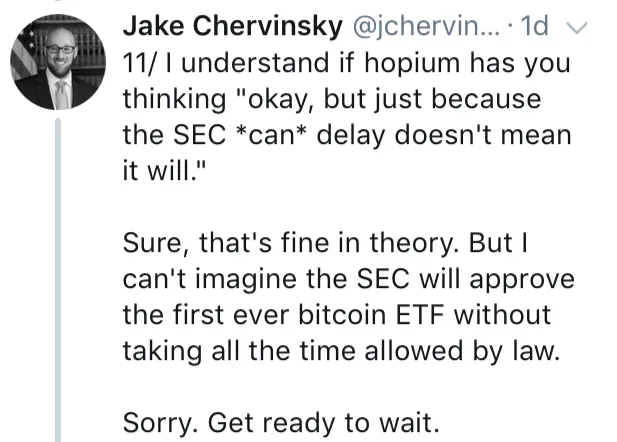

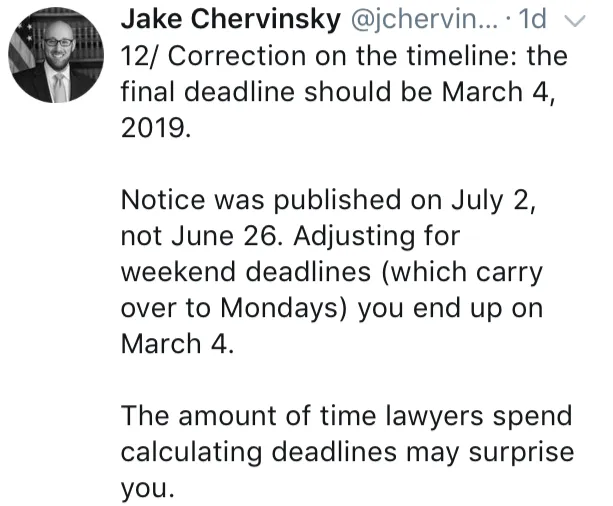

Whatever transpires, the following series of tweets by a lawyer, Jake Chervinsky, sheds light on the decision-making process of the SEC, so don’t be surprised, if we see an announcement in August that the decision on whether or not to approve the SolidX ETF proposal has been delayed. It may ultimately be delayed until March 2019.

Although the SEC is clearly wrestling with the approval of the first Bitcoin ETF, it has also stated for the public record that;

And it has been reported that internal sources within the SEC and more particularly the CTFC are saying a Bitcoin ETF is very close to being approved and I merely report this, without wishing to suggest that it should be relied upon.

Commissioner Pierce also alluded to the need of the US to send a “strong signal” that its markets are at the forefront of innovation and consider the need to prevent innovation and capital flight to other markets. The continued procrastinating of the SEC will strengthen Japan’s position in the FinTech race and the first ETF may well come from Canada, which has a history of approving groundbreaking ETFs before the US and the Winklevoss decision has gifted Canada more time to consider and approve a Bitcoin ETF, as Commissioner Pierce fears. The Evolve Bitcoin ETF (BITS), filed three months ago, is awaiting approval in Canada and it would track Bitcoin futures.

Some may consider the argument of Commissioner Pierce and VanEck that a Bitcoin ETF will combat price manipulation to be rather back to front and that the need for a regulatory framework to be in place before an ETF approval is the first and most important step to aiding ETF approval. The long waited for regulatory framework is almost upon us and it is reported to be positive, in order to prevent the fears of capital and innovation flight from the US.

https://bitcoinmagazine.com/articles/winklevoss-bitcoin-etf-proposal-denied-us-sec/

https://unhashed.com/cryptocurrency-news/race-bitcoin-etfs-winklevoss-twins-denied-sec/

https://www.sec.gov/news/public-statement/peirce-dissent-34-83723

https://theicojournal.com/source-bitcoin-etf-nearly-certain-to-win-approval-later-this-year/

https://www.ccn.com/sec-delays-ruling-on-five-bitcoin-etf-applications/

https://www.chepicap.com/en/news/2433/fud-sec-delays-ruling-on-bitcoin-etf-applications-until-september.html

https://blokt.com/news/bitwise-looking-into-launching-a-crypto-etf

https://ethereumworldnews.com/here-is-what-recent-bitcoin-btc-etf-applications-to-the-sec-mean-for-the-crypto-markets/

https://www.bloomberg.com/professional/blog/u-s-bitcoin-etf-launch-2018-good-luck-one/