The vast portion of mining power is sourced from China.

The recent slump in coin prices has led to concerns over the feasibility of mining operations. However, mining operations are still profitable in some parts of the world; the lower Bitcoin price is making way for diversification in the mining industry by enabling the growth of farms in countries with electricity prices that are lower than the energy costs in China.

Opportunity for Newer, Better Services

Only a few months ago, BTC prices allowed a handful of mining facilities to control a vast portion of the network’s hash rate. Even if competing mining pools offered lower fees and better returns, the established mining pools out-marketed new entrants; moreover, the established pools had the cash flow to constantly grow their hash rate, thereby intimidating new entrants.

Now, hash rate isn’t rising; it’s depreciating.

Given that the market leaders are no longer growing the size of their mining farms, new market participants are confidently entering the market, knowing that their share of the hash rate won’t fall any time soon. Now, new mining farms that are launching operations in countries with low electricity costs are able to easily take on the goliaths of the mining industry.

Newer mining farms are pursuing disruptive business models as they intend to charge low fees, provide better service, and pass all transaction revenue to users.

Cryptonoras, a relatively new mining operation, aims to lead the shift to a more globalized presence in mining farms. The mine is located in Norway, enabling its users to benefit from a unique set of benefits.

The Status Quo of the Mining Industry

Established mining pools have enjoyed the benefit of limited competition. This has allowed them to charge high fees, consume a hefty percent of the mine’s block rewards, and even hold transaction fees from block rewards.

AntPool

AntPool has long asserted its dominance over the market by rallying rig after rig to keep competition at bay. This gave them the ability to not only keep 2.5% of block rewards, but also keep transaction fees.BTC.com

This mining pool tussles with AntPool by not charging a 2.5% on block rewards. However, its other fees, adding up to 4%, are even more than what AntPool takes.F2Pool

Unlike what the name may hint, being a part of this pool is far from free as it claims 3% of block rewards and still keeps transaction fees.Additionally, AntPool and F2Pool have neglected users’ returns in more ways than one. One event that serves as a testament to this is that these farms’ operations on Bitcoin Core 0.9.5 caused them to miss out of tens of thousands of dollars during the fork that took place on July 4, 2015. Those funds were the due gains of not the farm, but their users; negligence on behalf of the pools led to a loss to pools’ users.

Time for Change

New market participants, like Cryptonoras, are keen to boost their service quality to acquire increased market share. Thus, they keep their mining operations up-to-date with the most recent Bitcoin Core updates.

More importantly, they’re ensuring the hash rate is not concentrated in just one country. This allows them to focus on opportunities available across the globe.

For example, Cryptonoras, takes advantage of the incredibly low energy costs in Norway. While energy costs are at $0.08 kWh in most regions in China, Norway’s low energy costs, $0.04 kWh, gives miners the opportunity to gain incredibly low operating costs. In Cryptonoras's case, operations remain profitable even if the current low Bitcoin price, forces some large, established miners to barely break-even.

Additionally, the Chinese government has an increasingly negative stand against cryptocurrencies and Crypto-related operations. Scandinavian and North European governments are leading the way in the positive approach. This allows mining facilities there, like Cryptonoras, to gain access to insurance services. Thus, the assets mined by Cryptonoras will be insured, giving users increased peace of mind.

On a valuable note, the decentralization and increased spread of mining rate has accompanied another benefit. Mining services like Cryptonoras only charge an initial contract fee; after that, there are no cuts in users’ block rewards or transaction fee earnings.

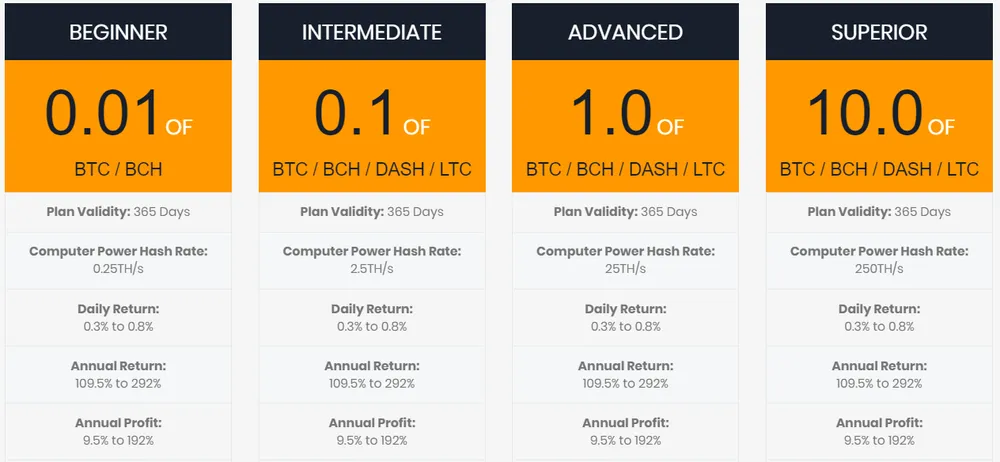

The Plans

Cryptonoras aims to make access to a stake in mining operations accessible to the masses. This allows the farm’s output—block reward earning—to be distributed among the masses. Thus, its plans start from prices as low as 0.01 BTC.

Given that the farm’s operating costs, primarily associated to its electricity bill, are well below the operating costs of most farms across the world, Cryptonoras is able to churn out cryptocurrency at a positive cash flow.

Connect with me:

Crypto News Crypto Airdrops ICO List Blockchain Lawyers