SUMMARY

On BitcoinLive; daily Crypto updates are made available while also, on demand analysis requests are fast filled. Join us as we have now opened up monthly and quarterly subscriptions. Use this link: https://bitcoin.live?aid=110. Below is an excerpt of a recent essay written on Cryptosphere.

It's quite interesting to see how "use" cases are highlighted as a fundamental feature to rank order the many crypto coins. I've heard that a coin's utility is the key driver for adoption and hence, impacts it's face value the most. Some have given association to the recent ETF news as the "trigger" that could drive BTC to $40k to $65k by Q1 of 2019. And on and on and on....

I rarely hear that Cryptosphere is driven only by sentiment. I've written before that price is the most direct reflection of sentiment and fundamentals are more downstream or not as immediate reflections. I've also explained my unique rationale of how price is twice removed from "reality" because it's a symbol of symbols. Yes, I borrowed it from Plato who stated: "What are words but symbols of symbols; hence twice removed from reality". Price is a reflection of sentiment which is itself a reflection of thought; hence projections using price must be probability outcome based and not certainty.

If sentiment drives price; then there is also a uniformity of sentiment and that phenotype is seen in every market; whether it be the equities, commodities or currencies. Cryptos are no exceptions. Sentiment becomes uniform largely because of "group think" or herding which can become interlaced but never interlocked because change in sentiment is the only constant.

If you juxtapose the charts of the DOW and S&P; very little difference will be observed. Such is an example of the "All the Same Market" phenomena. If you then include the charts of global markets; you'll see the same high similarity index.

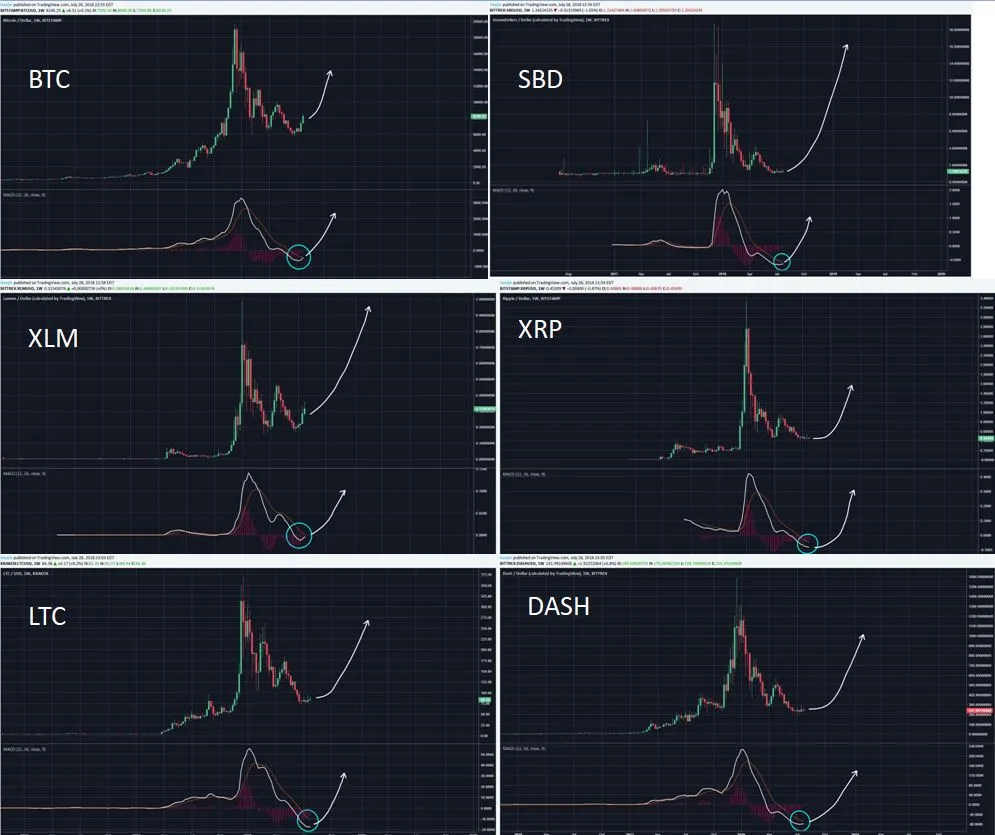

The below are six charts of crypto coins. They look near identical. Why and how? First, there are dominant charts; just as there are dominant cycles in a given range of time frames. For Cryptos, that dominant entity is Bitcoin (BTC) which is the moon that moves the tides of the Cryptosphere ocean and all Altcoins swim in it. In other words, many Altcoin holders also hold BTC; but BTC is held far more extensively. Second, distribution of coin holdings reflects the sentiment distribution or segmentation. Within each sentiment segmentation, nuances will be discernible just as differences can be shown between the charts of multiple altcoins. Such nuances never mask the dominant features. The high similarity index of the below six coins' charts reflects a dominant, uniform sentiment of Bitcoin. Not too long from today, most holders of equities and commodities will likely own Cryptos. While BTC currently remains uncorrelated; sentiment between the markets is expected to blend and perhaps inversely because BTC could be the new safe haven "Gold".

I believe that sentiment is about to once again turn positive for Bitcoin (BTC) and therefore the Cryptosphere. Another way of saying the same is that the the correction is at its terminal phase and not the beginning or the middle. All Altcoins are following Bitcoin's lead; just not exactly in lock step; but uniformly.

In my 20+ years of self taught analysis and trading experience, the most ideal times to buy have been at the terminal ends of major corrections. The Cryptosphere is at that stage. I've already shared in real time my buy ladder I had cast a week or so ago. The rungs on the buy ladder have been getting filled and that's most favorable to position my portfolio for the coming MASSIVE profits. One can choose to jump in and out; out and in through frequent trades; but I buy with discipline for that coming Cycle degree of trend Wave 3 which is known to move most violently amongst the actionary waves by making jaw dropping orgasmic price lunges upwards. Ladies and Gents, what we saw last Fall was just the foreplay!

Legal Disclaimer: I am not a financial advisor nor is any content in this article presented as financial advice. The information provided in this blog post and any other posts that I make and any accompanying material is for informational purposes only. It should not be considered financial or investment advice of any kind. One should consult with a financial or investment professional to determine what may be best for your individual needs. Plain English: This is only my opinion, make of it what you wish. What does this mean? It means it's not advice nor recommendation to either buy or sell anything! It's only meant for use as informative or entertainment purposes.