Hi Everyone,

In Part 3 of my five part series which investigates the operation of the Steem ecosystem, I will be exploring applications and services on Steem. Before I get into this post, I will provide a brief overview of the series.

In this series, I will be investigating some of the problems with the Steem ecosystem in terms of rewards aligning with desired behaviour. The five parts to this series are as follows:

- Part 1 – Witnesses (complete)

- Part 2 – Content creators and curators (complete)

- Part 3 – Applications and services

- Part 4 – Passive income

- Part 5 – Combinations of solutions

This series of posts has been inspired by recent discussions regarding proposed solutions to some of the problems relating to the economic equilibrium in the Steem ecosystem. The views of the top ranked witnesses, in regards to proposed solutions, are briefly summarised in the post ‘Witness consensus status to fix the actual steem’s economic flows (ENG)’.

In this series, I will be investigating, identifying and articulating many of the problems with the distribution of rewards in the current Steem ecosystem.

There are several ways of earning rewards on Steem. I will simplify these into five categories. Content creation, content curation, applications and services, witnesses, and passive income. All of these categories obtain rewards from the increase in supply of Steem also known as the rewards pool. The right incentives need to be in place for the right balance of activity. All five areas are important for different reasons.

Applications and services

Applications and services are occupying a larger role on Steem. There are 11 applications and 15 vote selling bots that have more than 500,000 Steem Power (effective). The total effective Steem Power for these 26 accounts is approximately 38 Million; this is almost 20% of all Steem Power.

Applications

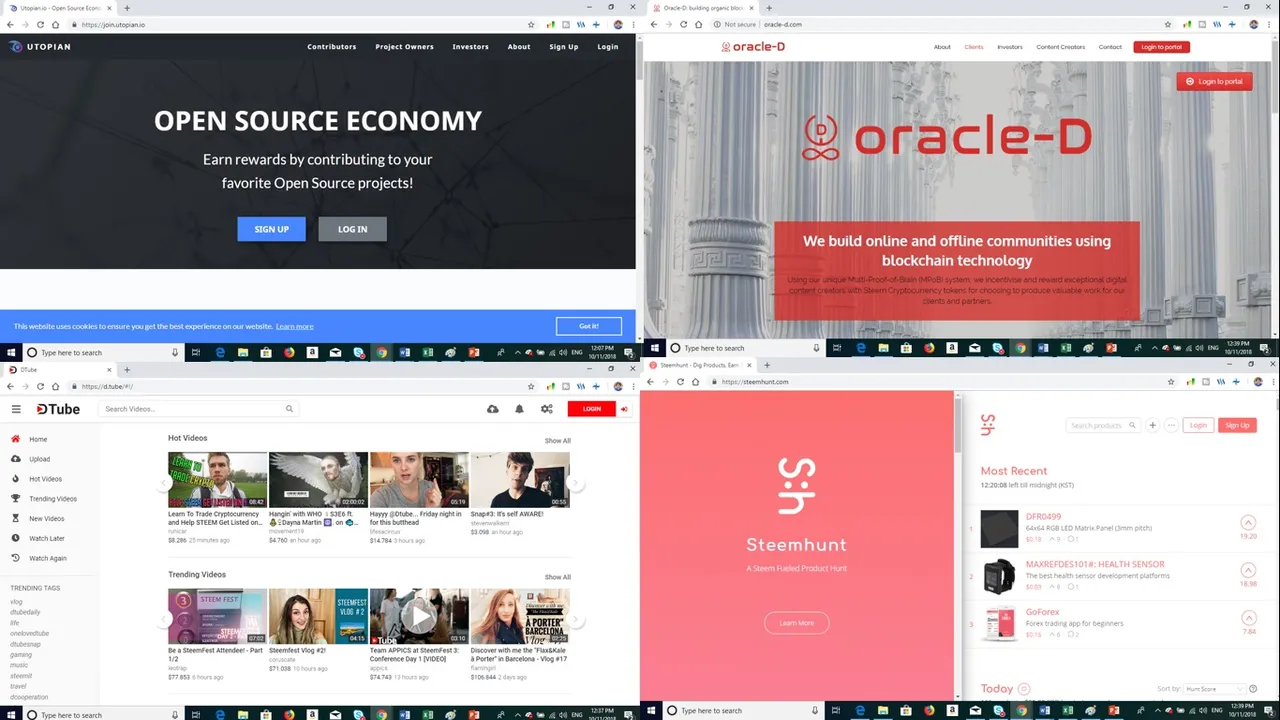

Utopian, Dtube, Oracle-D, and Steemhunt

Tasteem, Musing, Steempress, and DSound

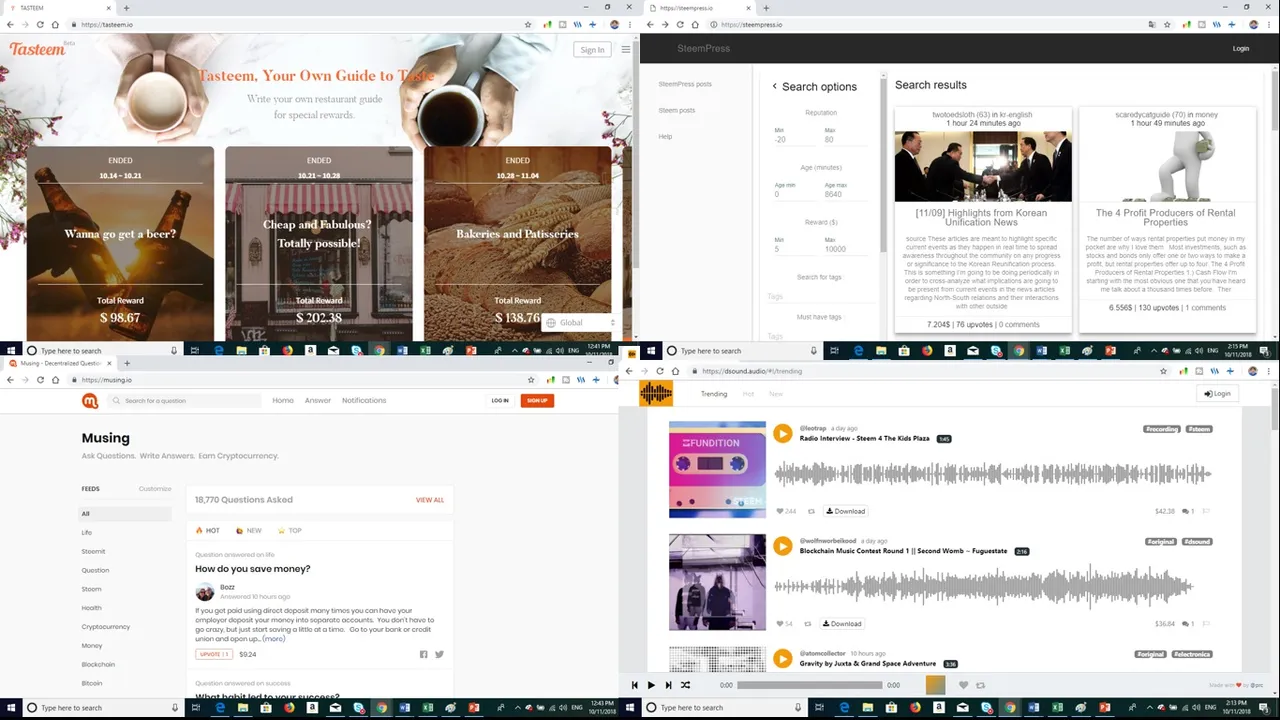

Fundition, Esteem, Busy, and SteemitWorldMap

Applications add value to the platform in many ways. Below is a list of just a few of the many applications operating on the Steem Blockchain.

- Dtube (video sharing)

- Partiko (mobile phone Steem interface)

- Steemhunt (product hunt)

- Dsound (music)

- Dmania (memes)

- Utopian-io (open source projects)

- Tasteem (restaurant reviews)

- Musing (ask questions, give answers, and earn money)

- Steempress.io (connecting blogs to the Steem platform)

- Steemitworldmap (travel presented in a map)

- Esteem (downloable Steem interface for devices)

- 1ramp (creative developments)

- Steemstem (facts and knowledge sharing)

How can applications earn/raise funds to operate?

Applications require funding to operate, develop, and maintain. Some applications require more funds than others. For example, any application that requires the storage of large files such as videos will require more money than applications that store predominantly text.

Some of the methods that applications can use to raise money are as follows:

- curating content

- witnesses

- beneficiary rewards

- donations

- smart media tokens

- advertising

Curating content

Those running the applications can curate content created on their applications. Curation rewards are related to the amount of effective Steem Power (owned Steem Power and delegated Steem Power). Application owners can provide their own Steem Power but that would tie up a lot of investment that could be put straight into their applications. The other option is to obtain delegated Steem Power. The @misterdelegation account controlled by Steemit Inc appears to have been created almost solely for delegating to applications and abuse fighting accounts such as @spaminator and @steemcleaners. Table 1 contains the applications with the most effective Steem Power.

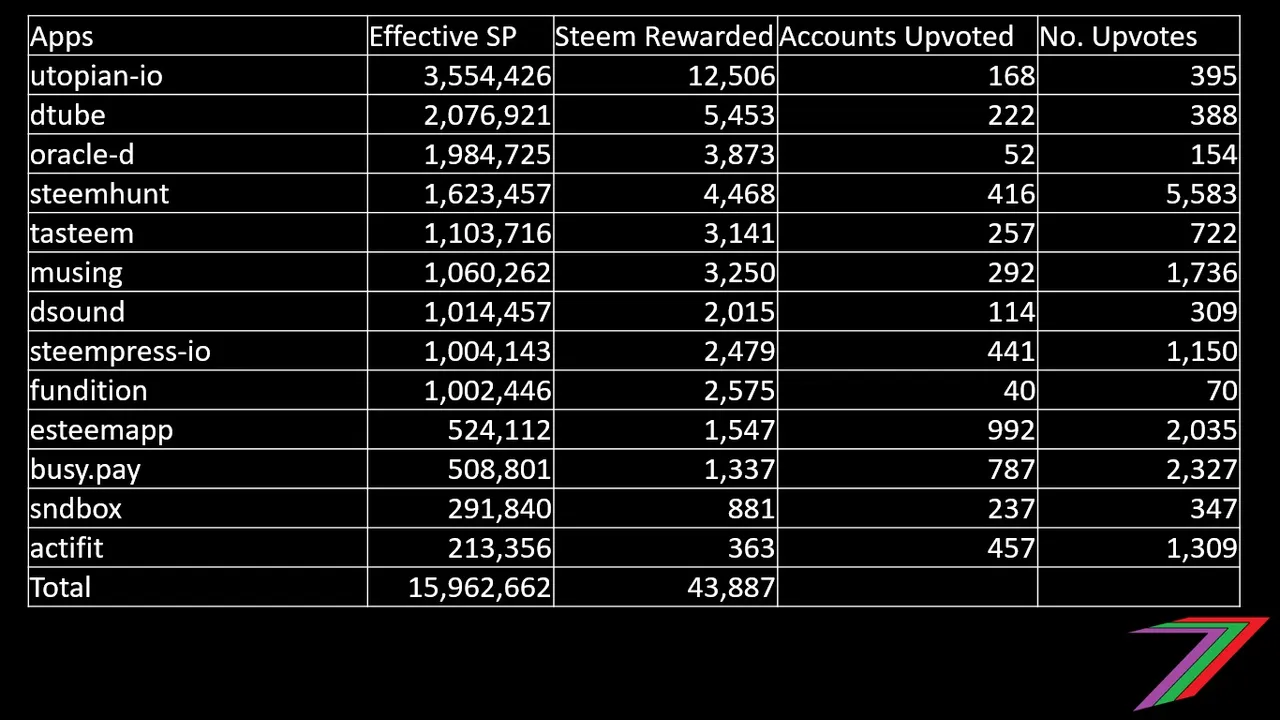

Table 1: Applications with the highest Effective Steem Power

Data collected from steemocean.com for dates 26/10/2018 to 31/10/2018 (6 days, rewards were provided in SBD but have been converted to Steem using a ratio of 0.8 SBD equals 1 Steem) and steemfriends.org on 09/11/2018

Table 1 contains the effective Steem Power for the application as well as the approximate value in Steem for rewards given out, the number of upvotes and the number of accounts upvoted. Different accounts have different models for rewarding content or work. Fundition rewards team members with upvotes in comments. Utopian rewards content that meets their criteria for rewards. Esteem and Busy prefer to spread their votes around to many users.

There is a potential risk that those delegating could remove their Steem Power. Steem Power acquired from Steemit Inc would have a lower risk compared to Steem Power acquired from other stakeholders who might be more focussed on obtaining direct returns from investment. Having multiple delegators could decrease the risk of losing all delegated Steem Power but this could cause the amount of Steem Power to fluctuate, which could hinder planning and development.

Witness Income

Another great method of raising money for an application is from witness income. Witnesses have responsibilities relating to the blockchain as explained in ‘steemd.com’. However, witnesses can use money used from producing blocks to support their applications. They can also use their applications to obtain a higher witness position to obtain more funds. @good-karma (esteemapp) and @utopian-io (utopian) are amongst the top witnesses for Steem.

Beneficiary Rewards

Some applications require content creators to contribute to funding of the application through beneficiary rewards. Applications such as Dtube, Dsound, Dmania, Esteem, Uptopian.io and Steepshot use beneficiary rewards to raise funds. The beneficiary rewards range from 5% to 25%. Beneficiary rewards are taken from the content creator’s portion of the rewards. For example, if a post has a pending payout of 16 SBD, if 25% goes to curation rewards. The post is left with 12 SBD (16×0.75). If another 25% goes to the application, the payout to the content creator will be 9 SBD (12×0.75).

The value of beneficiary rewards depend on the number of posts and value of upvotes received for content posted using the application. In the current ecosystem, this can be problematic. Accounts using bots to promote their content could lose money by posting using an application if the application is taking a percentage of the value of the post payout. If the post, explained in the previous example, received an upvote of 12 SBD from a 10 SBD bid to a bot, the content creator would lose 1 SBD (9-10) from posting on the application. The risk of losing money from using bots together with the application decreases the attractiveness of using the application.

There is also a lack of transparency regarding the beneficiary rewards for many applications. The application should make it very clear to users before they post that they will be taking X% of the post rewards. This is important because many users might feel cheated when they see that the post payouts are less than expected. Steempeak.com includes the beneficiaries and percentage of the post payout to be rewarded to beneficiaries when a user mouses over the post’s pending payout.

Donations

Applications can earn money from donations. Donations could be direct transfers to the applications’ account or pay account or donations could come in the form of upvotes of posts. Some applications reward direct donations by offering upvotes to content. @steem-plus have adopted the strategy of selling Steem Plus Points (SPP). Buying SPP rewards buyers with upvotes. The more SPP an account has, the higher the value of upvote provided by @steem-plus. @steem-plus also provides the option of donating through beneficiary rewards. Paying through beneficiary rewards also accumulates SPP.

Smart Media Tokens (SMT)

Smart Media Tokens (SMT) offer the potential to raise money for applications through initial coin offerings (ICO). There have been some very successful ICOs, some of them have raised over hundreds of millions of dollars. Raising hundreds of millions dollars is probably very unlikely for any of the SMTs but it is possible some of them could get a good haul. Potential investors need to be impressed by the prospects of the application as well as the future of the SMT.

In my opinion, there are many unknowns in regards to SMTs and its co-existence with existing methods of funding such as curation rewards from delegated Steem Power. Would Steemit Inc or another investor buy the SMT and then delegate the bought SMT to the application so that they can support their content? Would the SMT hold sufficient value for that not to be necessary?

Advertising

Advertising is traditionally one of the largest contributors to revenue for many social media websites. To the best of my knowledge, none of the applications are utilising advertising to fund their activities. Advertising revenue is generally dependent on exposure. This exposure could include the number of views, duration of views, numbers watching/reading/listening, etc. View counters provide essential information to advertisers. Many of the applications do not display the number of views for their content.

There several ways advertising could be applied to an application. Advertisements could be included in the post. They could be added to the video, which is similar to how advertising is applied to YouTube. They could be added to the application’s user interface with banners. If any application is going to be successful in the long-run, advertising will need to be incorporated into the application eventually.

Services

Several accounts offer various services on Steem. These services include resteems, vote selling, auto-voting, Steem statistics and analysis, and transaction services. These services receive funding through various methods. Resteems are paid for directly, vote selling earns through direct payments and curation rewards, external websites are often funded through donations and witness rewards.

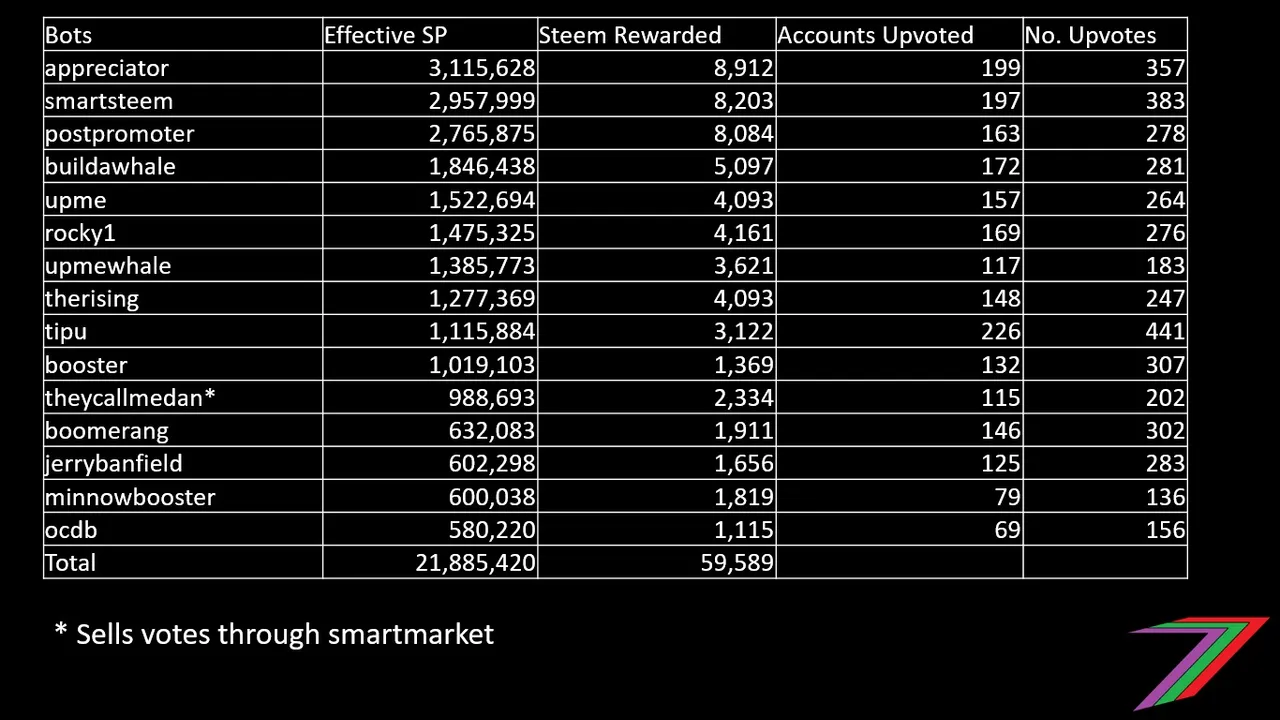

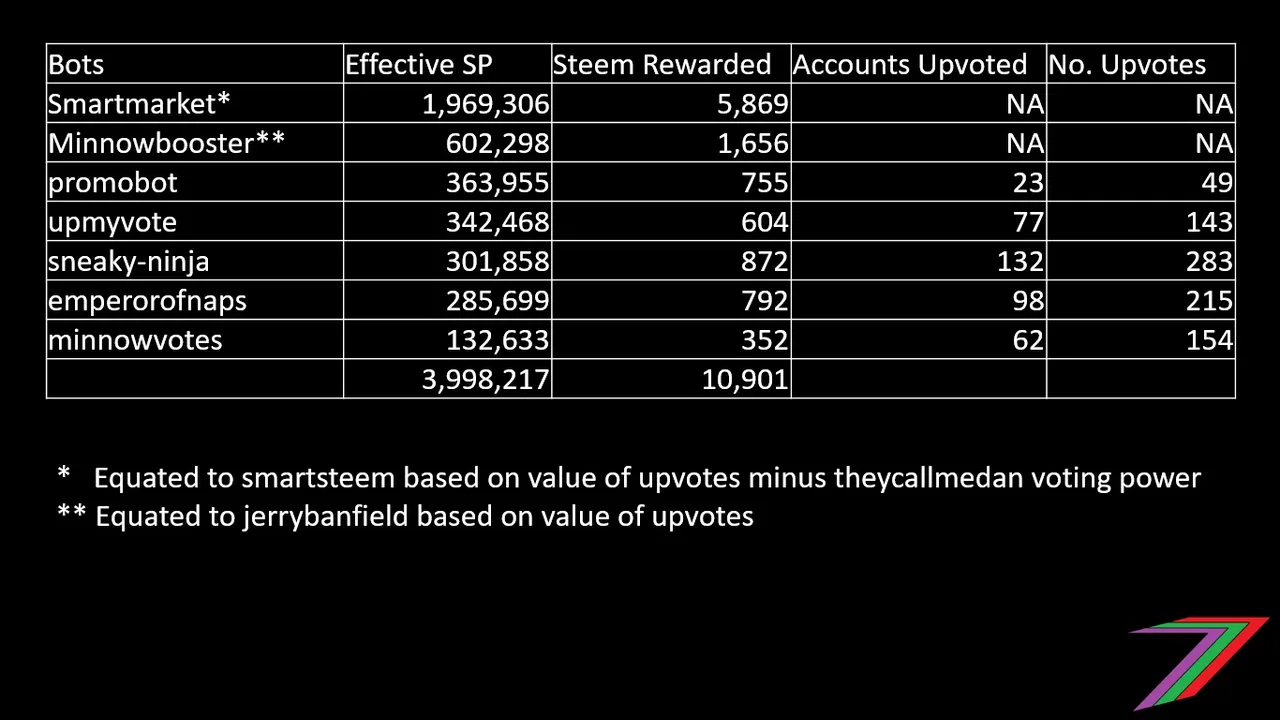

Vote selling through bid-bots is the most heavily funded service offered on Steem. At least 25 million effective Steem Power supports vote selling and bid-bots. Tables 2 and 3 contain the effective Steem Power of the largest bot services and vote selling services as well as the rewards distributed, number of upvotes and accounts upvoted by these bots (6 day sample).

Table 2: Bots and vote sellers with over 500,000 SP (effective)

Table 3: Other bots and vote selling services with high SP (effective)

Data collected from steemocean.com for dates 26/10/2018 to 31/10/2018 (6 days, rewards were provided in SBD but have been converted to Steem using a ratio of 0.8 SBD equals 1 Steem) and steemfriends.org on 09/11/2018

The profitability of bots is directly related to their effective Steem Power. More Steem Power equates to higher value upvotes, which equates to higher curation rewards. Bids received from bots are paid to the accounts delegating to the bots. Who pays for the bot upvotes? The account bidding, initially pays for upvotes. The account is compensated for the bids on payout of the post. If the post is not downvoted and the price of SBD remains close to constant, the visibility bought using the bots is free for that account. So who ultimately pays for the vote? The votes are paid for from the rewards pool. The community are indirectly paying for the promotion of these posts.

Voting cycles of bots also play a part in their profitability. Bots typically vote 10 times a day every 2 hours 24 minutes. This is how long it takes to regenerate voting mana to 100% after one full upvote. A shorter voting cycle would provide a greater opportunity for a bot’s vote to front-run (upvote before a large account such as whale or bot when upvotes can be predicted) other large bot votes. Many bots are reducing their voting cycle because they are not receiving sufficient bids to vote at 100%. Many of the bots vote at a maximum of 10% to 20% return on investment (ROI) to bidders. If total bids do not reach the target that would produce a ROI of less or equal to the maximum ROI, the total value of upvotes in a cycle will be less than 100%. If less than a full upvote is given at the end of the voting cycle, the time taken to regenerate voting mana to 100% is less; therefore, the next voting cycle is shorter.

Opportunities for other services such as developments on external websites can gain funding from witness rewards (if the developer is a top witness). Alternatively, these websites can funded through donations or upvotes to posts or comments by the developer.

Additional funding

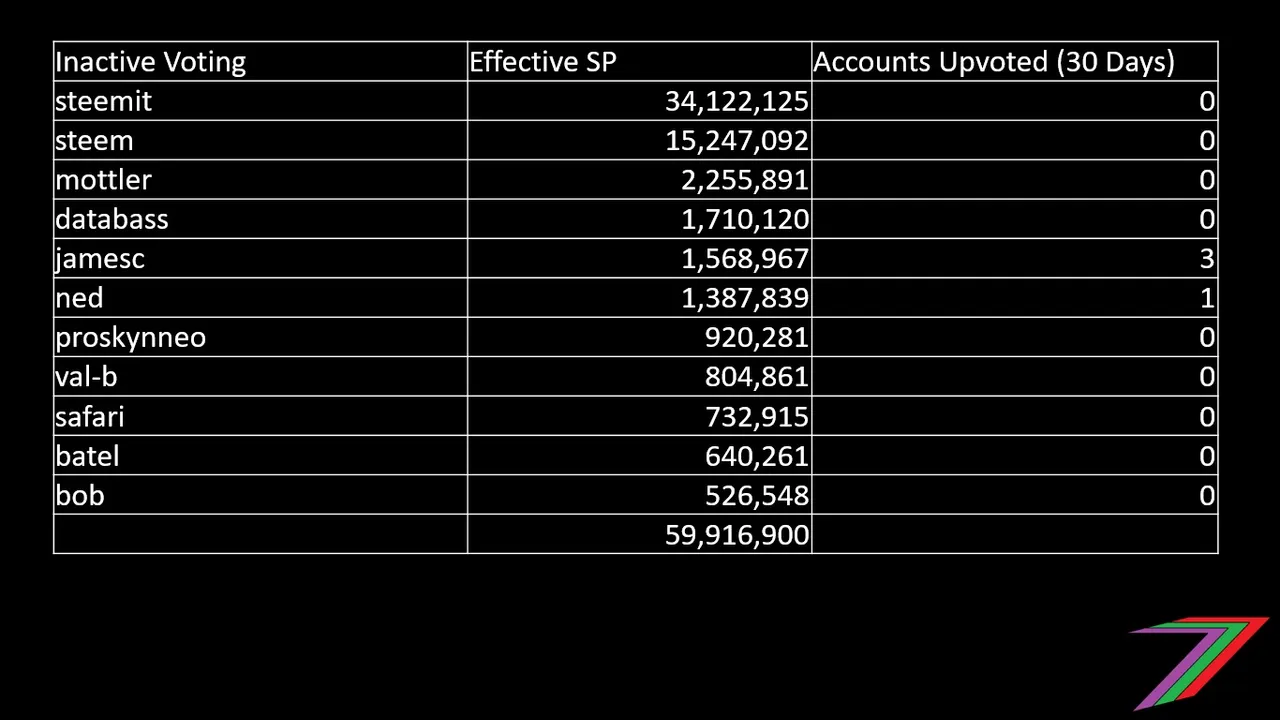

Applications and bots have a large share of effective Steem Power. There are 26 application and bots with the effective Steem Power of whales. However, there is still a considerable amount of inactive Steem Power. When data was collected for this post, there were eleven whale accounts that did not actively participate with their Voting Power. Table 4 contains the effective Voting Power of some of the largest (vote) inactive accounts on Steem.

Table 4: Effective Voting Power of inactive whale accounts

Data collected from steemreports.com for dates 14/10/2018 to 12/11/2018 (30 days) and steemfriends.org on 09/11/2018

These accounts could delegate their Voting Power to new applications on Steem. It is quite possible that these accounts are waiting for the right application to support. The inactivity of these accounts is also good for all accounts that are active as votes have a higher value.

There are also the spam and abuse fighting accounts such as @spaminator and @steemcleaners. These accounts do not actively upvote content either. These two accounts have a combined effective Steem Power of over 4.2 Million.

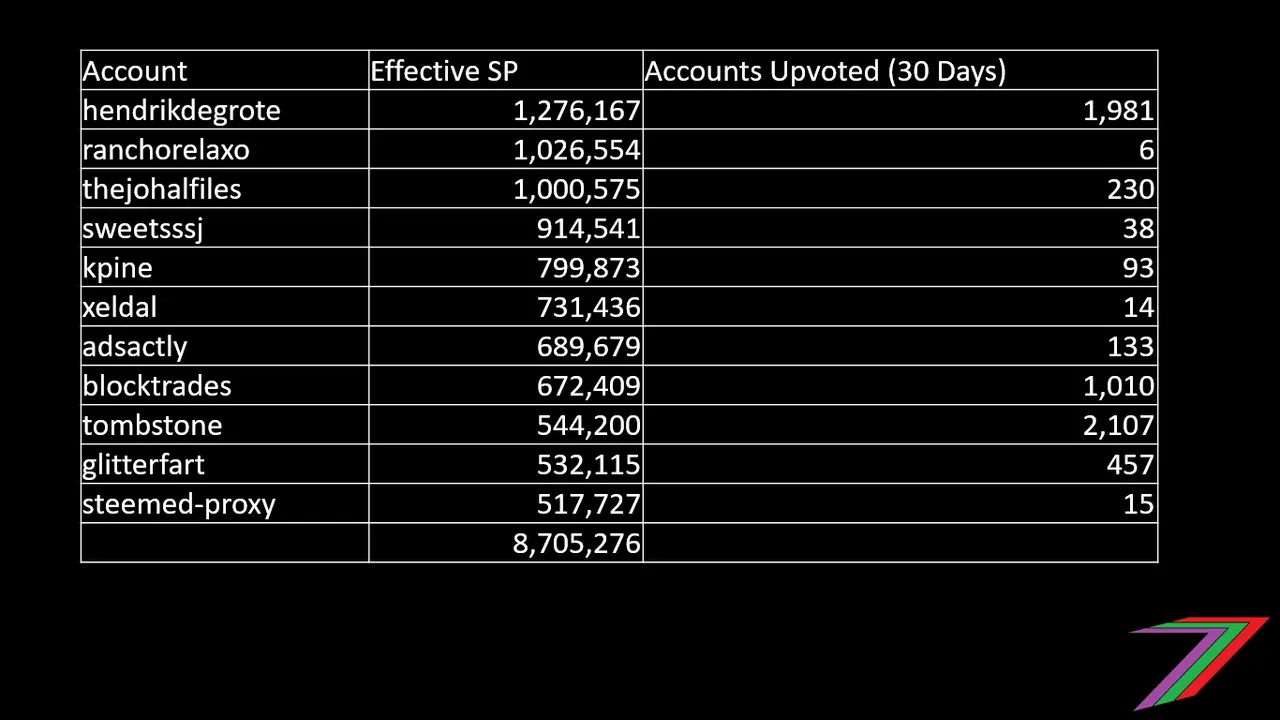

Active Steem Power not used by bots and applications (Slightly off-topic but relevant to Part 2 of the series)

Most of the (effective Steem Power) Whale accounts are bots, applications, or (vote) inactive. There are a few other accounts that do not fit into those categories and appear to be actively curating. Table 5 contains accounts with over 500,000 Steem Power (effective) and the number of accounts they voted for over a 30-day period.

Table 5: Effective Voting Power of active whale accounts

Data collected from steemreports.com for dates 14/10/2018 to 12/11/2018 (30 days) and steemfriends.org on 09/11/2018

Less than 8% of the Steem Power from Whale accounts (effective) is being used for manual curation of content that is not using applications or meeting the application's requirements for upvote. This an indication of the lack of attractiveness of curating content in the current Steem environment. It is also worth noting that most of these accounts did not upvote many users, 5 of the 11 accounts upvoted less than 100 other accounts over the duration of the 30 days of data collected. Manually curating takes time and effort, therefore a low number of upvotes can be expected. It would be logical to distribute Steem Power for curation purposes over more accounts. This would reduce the burden on just a few users and provide a broader distribution of votes.

Defining the problems of reward distribution to applications and services

Applications have many avenues for collecting revenue to support the growth of their operations. In my opinion, the best approach for funding and building a user base for an application is from delegated Steem Power. The application can upvote its users to build its user base as well as earn curation rewards to fund operations and developments. The biggest problem is obtaining delegated Steem Power to begin with. Many good applications have very little Steem Power to help them grow. There is also the concern regarding the reliability of the delegation, delegators could remove their delegation at any time.

Smart Media Tokens (SMT) could potentially offer a great stream of funding but there is considerable uncertainty of the extent of this funding. We will have a much better idea of the effectiveness of SMTs to obtain funding to applications in 2019.

Services such as vote selling are gaining a very large proportion of the current rewards pool. It would be difficult to improve the profitable of these services. I strongly believe these services are obtaining a disproportionately large share of the rewards. If changes are to be made to the rewards system on Steem, these changes should work against vote selling and bid-bot profitability.

Possible solutions

I will keep this section short as I have discussed several solutions in parts one and two of this series. I will revisit changes to curation rewards as discussed in my post ’content creators and curators’ but in the context of applications. I will briefly discuss improving the interaction between Steem frontend user interfaces such as Steemit and Steampeak. I will also explain how delegation contracts could be used to improve current delegation arrangements between delegators and delegatees.

Increasing curation rewards

Increasing curation rewards as discussed in previous posts, increases the incentive to curate. Therefore, should increase activity and curation on the platform. The curation rewards need to be sufficiently large to attract users away from vote selling but not so large that content creators are not attracted to Steem or existing users decide to leave.

Increasing the curation rewards would greatly benefit applications, as they will be able to fund their activities with a higher curation reward. The higher curation rewards could be sufficient for applications to remove their beneficiary rewards. Beneficiary rewards hinder the growth of some applications such as DTube. Users can create their videos on YouTube and share on Steemit without needing to pay beneficiary rewards. The beneficiary rewards requirement puts DTube at a disadvantage.

Improving the interaction between Steem frontends and applications

For an application to be successful, it needs to get as much visibility and user interaction as possible. Many of the Steem applications have close to zero visibility on the frontends of Steem. I did not realise that Steem had so many applications until I did some digging. The Steem frontends can solve this problem by providing an application webpage or even a dropdown menu for all applications on the Steem blockchain. Mouseover features could be provided to offer a brief description of the application.

Delegation contracts

I am not sure if contracts exist regarding delegating Steem Power between accounts but if not, I strongly believe they should. Contracts could be used to state the duration of the delegation as well as the terms of the delegation. Criteria for the use of Steem Power could be stated as potential targets for the delegatee to achieve to be granted an extension to the delegation period.

Contracts can benefit both the delegator as well as the delegatee. The delegator can feel more comfortable about how his/her delegation is being used. The delegatee can feel more comfortable about the security of the delegation and not need to be worried that it could be taken away on a whim.

Should such contracts be made public on the blockchain or remain private between account holders? There are advantages to both approaches. If contracts are made public, there is greater transparency to other users in regards to how the Steem Power is being used. This also creates greater likelihood of witching hunting over issues that could be perceived as violations of the contract. The delegator could determine if the contract is to be public or private before Steem Power is agreed to be delegated.

Conclusion

The applications on Steem have many opportunities and avenues to earn rewards to fund their operations and projects. The arrival of SMTs will provide even more methods to obtain funds for applications. With so many opportunities to acquire funds, the onus is on those running the application to make the most of these opportunities. The applications need to show signs of improving and developing. These improvements need to be visible to those delegating Steem Power. I would expect to see increasing usage, improving interfaces, as well as positive feedback as indicators of the success of the application.

Thank you for taking the time to read my post. I would be grateful for any feedback or suggestions that you might have regarding rewards distribution to applications and services. I do not run an application himself, the comments I have made are based on my own observations and information I have collected.

I still have another two more parts in this series. The next part will be focusing on passive income.