Eight days ago, a wrote an article about money. One of the comments I received was:

Some very wise advice. Restrict debt and always invest and save. There are lots of ways to make money (and lose it if you aren't careful...) You have to start young, the older you get the harder it is!

Especially if you don't come from a wealthy background, accumulating wealth quickly can seem impossible. But, you may greatly increase your odds by making wise judgments. A little planning, discipline, and risk-taking will do.

Investing is the best strategy to increase money. So invest and invest more! Set aside a certain amount of your salary each year for investments, and then raise that amount by 1%.

We frequently think that wealthy individuals are able to make large sums of money because they have access to covert investments. Now that I have access to such investments, I can tell you that, on average, they don't perform any better than an S&P index fund.

Finding a better paying job or negotiating your current one will always pay off in the long run. The key is to get paid what you're worth. Your income is the basis for generating wealth, and a bigger wage increases it instantly. Your total financial growth is accelerated since it enables you to save and invest more money. A better salary should always be negotiated.

Finance experts advise not to concentrate just on the dollar amount when negotiating a higher wage. Non-cash advantages like additional vacation days, flexible work schedules, or chances for professional growth are provided by many businesses.

These benefits may have a big financial effect. For example, taking more time off can help you save money on personal expenses, while furthering your career can help you land better jobs later on.

Unknown tactics for boosting your total wealth include negotiating for a full benefits package that includes non-cash rewards.

If you have a pile of bad debt, you can have a good income and still be in the same place. Your financial objectives will gradually be jeopardized by high-interest credit card debt.

Try employing the debt avalanche or snowball payback strategies to stay out of this trap.

As it's simpler to develop wealth when you're not burdened by high interest rates, paying off debt frees up more of your income for saving and investing, which lowers financial stress and increases your chances of success in the future. Control your debt.

If you don't cut your expenditures, you can have a six-figure salary and yet be living paycheck to paycheck. Living a more frugal lifestyle can lower financial risks and lessen your exposure to unanticipated occurrences such as job loss, market swings, or other calamities. Limit your spending.

Budgeting is only one aspect of managing spending. Examine all of your regular expenses and monthly subscriptions in detail. Unknowingly, a lot of people pay for streaming services, magazine subscriptions, and gym memberships that they never use. A self-audit such as this may release more money for you to use for wealth-building activities.

Allocating your money wisely is just as important as earning more of it. You are not the only one who does not "accidentally" succeed in anything! Making plans is essential if you want to accumulate riches. And a budget is precisely that! All it is, is a documented financial strategy. Every dollar needs to have a task assigned to it at the beginning of each month, and it needs to be followed.

😍#ilikeitalot!😍

Gold and Silver Stacking is not for everyone. Do your own research!

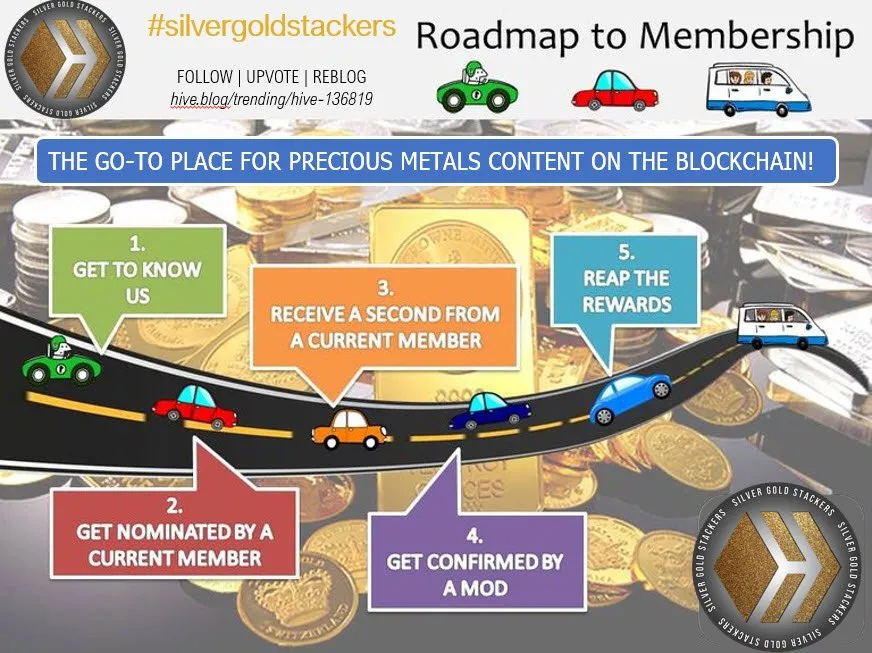

If you want to learn more, we are here at the Silver Gold Stackers Community. Come join us!

Thank you for stopping by to view this article. I hope to see you again soon!

I hope to see you again soon!

Hugs and Kisses 🥰🌺🤙!!!!

I post an article daily. I feature precious metals every other day, and on other days I post articles of general interest. Follow me on my journey to save in silver and gold.