Hello Hivers , hope you are doing great today. In the world of ours there are three sectors likely to change in the coming future. They are finance, internet system and technology.

Under finance, I will like to share some statistical based test which can be applied to derive meaning from crypto currency prices.

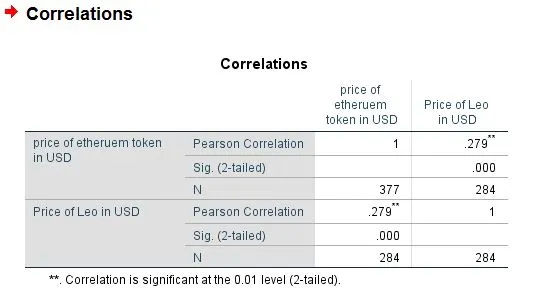

Correlation based test

Correlation test is a test that determines if there is a relationship between two or more crypto asset. It simply indicates that increase in price of an asset positively or negatively influence the price of the paired asset.

Correlation test was invented by a statistician named Karl Pearson, he used the coefficient of correlation to measure the strength of relationship between two or more variable. A variable could be the price of the asset in question.

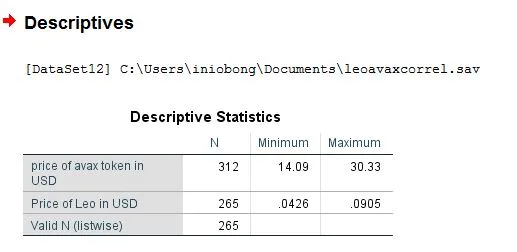

Other Descriptive Test

Some descriptive test are very vital for crypto currency analysis as it helps to describe the property of an asset to one who may have little or no knowledge about it. Examples of some descriptive test are:

Maximum and minimum

This indicates a value for maximum and minimum price of an asset.

Mean price

This indicates a value for the average price of an asset over a period of time.

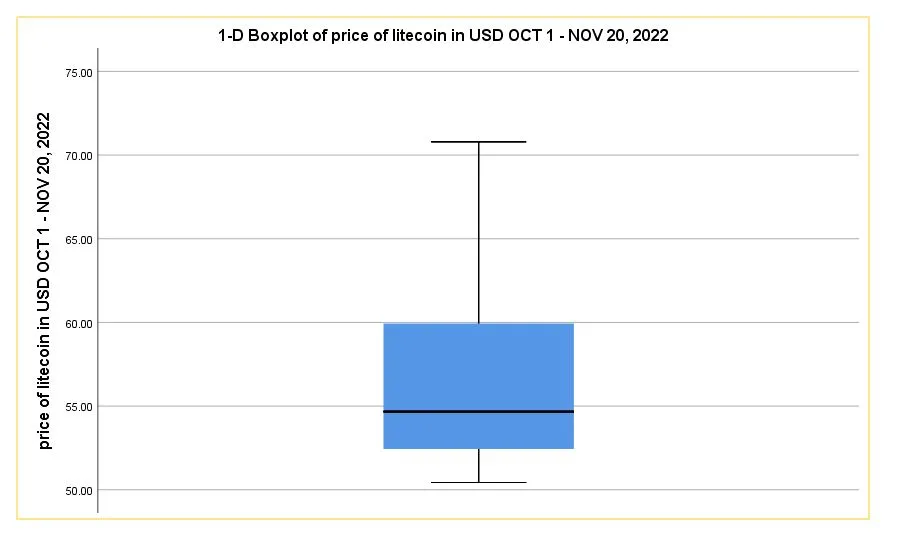

Boxplot

The boxplot indicates the range of price from maximum to minimum also presenting the median.

In the box plot, if the median line leaves a space longer than the other simply means either low or high price was discovered most. It depends on which side is longer. If the top is longer then it had higher price more than the lower price during the period of entry.

Scatterdot

The scatter dot diagram indicates if there is a relationship which could be useful in prediction between two assets. It works in hand with correlation test.

Test of prediction

Test of prediction is also referred to as regression analysis. It test what will be the future values of a particular asset having considered some properties of the other assets in question. This is useful in predicting for future trend an asset may attain.

There are different types of regression which are linear regression: prediction using a single variable with another (two variables).

Multiple linear regression: prediction using multiple variables or factors for a single variable. Others which may not be applied to crypto are logistic regression and multinomial regression.

Test of differences

This is another useful test which can be applied to a single crypto asset. It is possible to combine price of crypto asset for a given interval in period of time to test is there is a significant difference in the asset price.

For instance an asset could range in price from $10 - $20. Then after sometime, may increase to $50 probably in another month. You can carry out test of difference to find out if there has recently been a significant (observable) change in price using test of difference.

In summary

This article has been able to put together useful test as regards crypto assets.

Thanks for reading